download pdf - Fund Evaluation Group, LLC

download pdf - Fund Evaluation Group, LLC

download pdf - Fund Evaluation Group, LLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PRIVATE EQUITY: SECONDARY MARKETS<br />

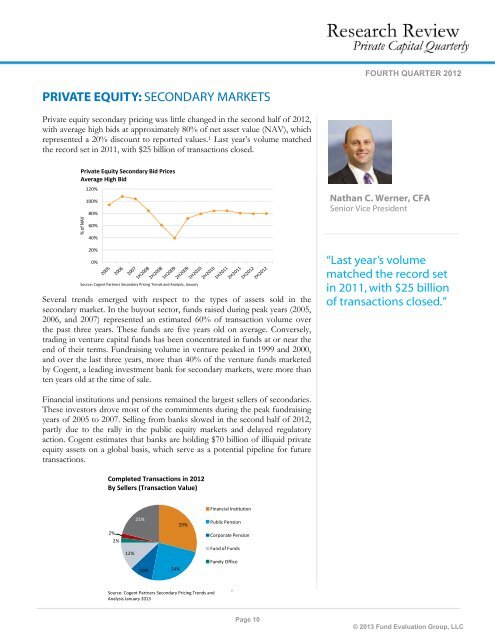

Private equity secondary pricing was little changed in the second half of 2012,<br />

with average high bids at approximately 80% of net asset value (NAV), which<br />

represented a 20% discount to reported values. 1 Last year’s volume matched<br />

the record set in 2011, with $25 billion of transactions closed.<br />

Private Equity Secondary Bid Prices<br />

Average High Bid<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

% of NAV Private Equity Secondary Bid Prices<br />

20%<br />

0%<br />

Source: Cogent Partners Secondary Pricing Trends and Analysis, January 2013<br />

Source: Cogent Partners Secondary Pricing Trends and Analysis, January<br />

Several trends emerged with respect to the types of assets sold in the<br />

secondary market. In the buyout sector, funds raised during peak years (2005,<br />

2006, and 2007) represented an estimated 60% of transaction volume over<br />

the past three years. These funds are five years old on average. Conversely,<br />

trading in venture capital funds has been concentrated in funds at or near the<br />

end of their terms. <strong>Fund</strong>raising volume in venture peaked in 1999 and 2000,<br />

and over the last three years, more than 40% of the venture funds marketed<br />

by Cogent, a leading investment bank for secondary markets, were more than<br />

ten years old at the time of sale.<br />

Financial institutions and pensions remained the largest sellers of secondaries.<br />

These investors drove most of the commitments during the peak fundraising<br />

years of 2005 to 2007. Selling from banks slowed in the second half of 2012,<br />

partly due to the rally in the public equity markets and delayed regulatory<br />

action. Cogent estimates that banks are holding $70 billion of illiquid private<br />

equity assets on a global basis, which serve as a potential pipeline for future<br />

transactions.<br />

Completed Completed Transactions in 2012<br />

By Sellers (Transaction Value)<br />

2%<br />

2%<br />

12%<br />

21%<br />

10%<br />

24%<br />

29%<br />

Financial Institution<br />

Public Pension<br />

Corporate Pension<br />

<strong>Fund</strong> of <strong>Fund</strong>s<br />

Family Office<br />

Source: Cogent Partners Secondary Pricing Trends and Analysis,<br />

Source: Cogent Partners Secondary Pricing Trends and<br />

January 2013<br />

Analysis January 2013<br />

Page 10<br />

FOURTH QUARTER 2012<br />

Nathan C. Werner, CFA<br />

Senior Vice President<br />

“Last year’s volume<br />

matched the record set<br />

in 2011, with $25 billion<br />

of transactions closed.”<br />

© 2013 <strong>Fund</strong> <strong>Evaluation</strong> <strong>Group</strong>, <strong>LLC</strong>