download pdf - Fund Evaluation Group, LLC

download pdf - Fund Evaluation Group, LLC

download pdf - Fund Evaluation Group, LLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PRIVATE EQUITY: BUYOUTS<br />

Another year of modest fundraising allowed global buyout funds to work off<br />

another $150 billion of the global capital overhang over the past year.<br />

<strong>Fund</strong>raising for global buyouts increased year-over-year, while the pace of<br />

investing was relatively flat. Global exit activity also was essentially unchanged<br />

as measured by number of transactions, but modestly higher in terms of<br />

value. Dividend recaps picked up in the fourth quarter and set a new record<br />

for the year. 1 Robust credit markets facilitated these partial liquidity events<br />

and the attractive credit terms are likely to continue into 2013.<br />

Buyout <strong>Fund</strong>raising and Investing<br />

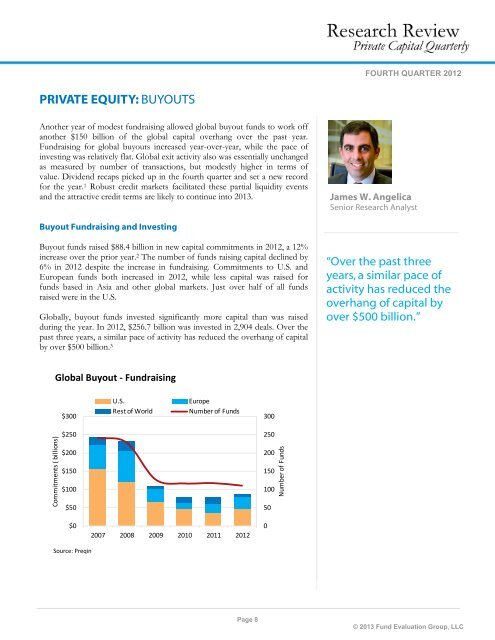

Buyout funds raised $88.4 billion in new capital commitments in 2012, a 12%<br />

increase over the prior year. 2 The number of funds raising capital declined by<br />

6% in 2012 despite the increase in fundraising. Commitments to U.S. and<br />

European funds both increased in 2012, while less capital was raised for<br />

funds based in Asia and other global markets. Just over half of all funds<br />

raised were in the U.S.<br />

Globally, buyout funds invested significantly more capital than was raised<br />

during the year. In 2012, $256.7 billion was invested in 2,904 deals. Over the<br />

past three years, a similar pace of activity has reduced the overhang of capital<br />

by over $500 billion. 3<br />

Global Buyout - <strong>Fund</strong>raising<br />

$300<br />

$250<br />

$200<br />

$150<br />

$100<br />

$50<br />

Commitments ( billions) Global Buyout - <strong>Fund</strong>raising<br />

$0<br />

Source: Preqin<br />

U.S. Europe<br />

Rest of World Number of <strong>Fund</strong>s<br />

2007 2008 2009 2010 2011 2012<br />

Page 8<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Number of <strong>Fund</strong>s<br />

FOURTH QUARTER 2012<br />

James W. Angelica<br />

Senior Research Analyst<br />

“Over the past three<br />

years, a similar pace of<br />

activity has reduced the<br />

overhang of capital by<br />

over $500 billion.”<br />

© 2013 <strong>Fund</strong> <strong>Evaluation</strong> <strong>Group</strong>, <strong>LLC</strong>