download pdf - Fund Evaluation Group, LLC

download pdf - Fund Evaluation Group, LLC

download pdf - Fund Evaluation Group, LLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page 4<br />

FOURTH QUARTER 2012<br />

way. Private debt in the form of mezzanine lending to middle market credits remains reasonably attractive, although total<br />

return expectations may trend lower.<br />

Real Assets Outlook<br />

Real assets strategies performed well in 2012 and appear poised to continue this trend. Investors added inflation<br />

protection strategies in many forms to their portfolios. Looking forward, inflation hedging strategies remain attractive in<br />

the face of loose monetary policy around the globe.<br />

Real estate continued to rebound in 2012, posting returns in public and private markets. Stabilized properties in core<br />

markets are now priced near prior peaks. Opportunities remain in stressed, messy, small- to medium-sized properties,<br />

those generally located in less-than-glamorous locations, and in some niche markets.<br />

Within the energy sector, oil prices reacted to<br />

economic and political activity during the<br />

year. Crude oil prices ranged from over $100<br />

per barrel early in the year, into the $80s midyear,<br />

to ending the year at $92. 14 Natural gas<br />

prices were driven by domestic production<br />

and demand. Prices appear to have bottomed<br />

mid-year before trending up to a five-year<br />

high of $3.35/mmbtu at year-end. 15 Ongoing<br />

development of the North American energy<br />

industry offers a range of investment<br />

opportunities in public and private strategies.<br />

We continue to purse investments in direct<br />

ownership of producing assets, energy<br />

buyouts, and publicly traded master limited<br />

partnerships (MLPs).<br />

In other real assets strategies, timber<br />

produced a 7.8% return in 2012, trending up<br />

from five years of lackluster returns and<br />

activity. 16 We remain unenthusiastic about<br />

timber, choosing higher-returning strategies<br />

for locked-up capital, but expect timber to<br />

continue to benefit from the rebound in housing. Similar to timber, agriculture and other commodities can also provide<br />

diversification and modest returns to a globally diversified portfolio.<br />

In Summary<br />

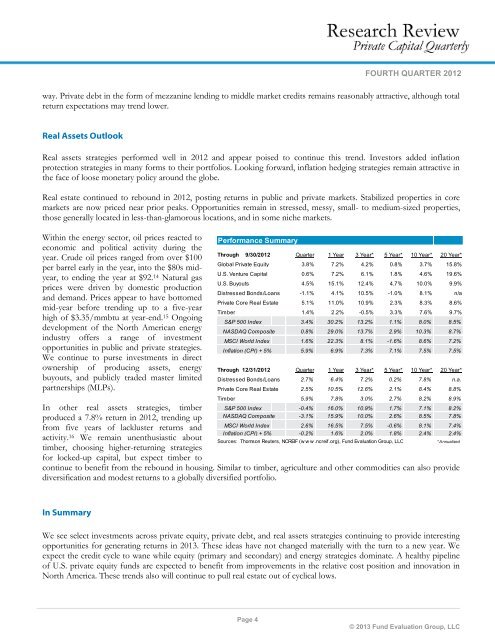

Performance Summary<br />

Through 9/30/2012 Quarter 1 Year 3 Year* 5 Year* 10 Year* 20 Year*<br />

Global Private Equity 3.8% 7.2% 4.2% 0.8% 3.7% 15.8%<br />

U.S. Venture Capital 0.6% 7.2% 6.1% 1.8% 4.6% 19.6%<br />

U.S. Buyouts 4.5% 15.1% 12.4% 4.7% 10.0% 9.9%<br />

Distressed Bonds/Loans -1.1% 4.1% 10.5% -1.0% 8.1% n/a<br />

Private Core Real Estate 5.1% 11.0% 10.9% 2.3% 8.3% 8.6%<br />

Timber 1.4% 2.2% -0.5% 3.3% 7.6% 9.7%<br />

S&P 500 Index 3.4% 30.2% 13.2% 1.1% 8.0% 8.5%<br />

NASDAQ Composite 0.8% 29.0% 13.7% 2.9% 10.3% 8.7%<br />

MSCI World Index 1.6% 22.3% 8.1% -1.6% 8.6% 7.2%<br />

Inflation (CPI) + 5% 5.9% 6.9% 7.3% 7.1% 7.5% 7.5%<br />

Through 12/31/2012 Quarter 1 Year 3 Year* 5 Year* 10 Year* 20 Year*<br />

Distressed Bonds/Loans 2.7% 6.4% 7.2% 0.2% 7.8% n.a.<br />

Private Core Real Estate 2.5% 10.5% 12.6% 2.1% 8.4% 8.8%<br />

Timber 5.9% 7.8% 3.0% 2.7% 8.2% 8.9%<br />

S&P 500 Index -0.4% 16.0% 10.9% 1.7% 7.1% 8.2%<br />

NASDAQ Composite -3.1% 15.9% 10.0% 2.6% 8.5% 7.8%<br />

MSCI World Index 2.6% 16.5% 7.5% -0.6% 8.1% 7.4%<br />

Inflation (CPI) + 5% -0.2% 1.6% 2.0% 1.8% 2.4% 2.4%<br />

Sources: Thomson Reuters, NCREIF (w w w .ncreif.org), <strong>Fund</strong> <strong>Evaluation</strong> <strong>Group</strong>, <strong>LLC</strong> * Annualized<br />

We see select investments across private equity, private debt, and real assets strategies continuing to provide interesting<br />

opportunities for generating returns in 2013. These ideas have not changed materially with the turn to a new year. We<br />

expect the credit cycle to wane while equity (primary and secondary) and energy strategies dominate. A healthy pipeline<br />

of U.S. private equity funds are expected to benefit from improvements in the relative cost position and innovation in<br />

North America. These trends also will continue to pull real estate out of cyclical lows.<br />

© 2013 <strong>Fund</strong> <strong>Evaluation</strong> <strong>Group</strong>, <strong>LLC</strong>