Registration - GAMS

Registration - GAMS

Registration - GAMS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

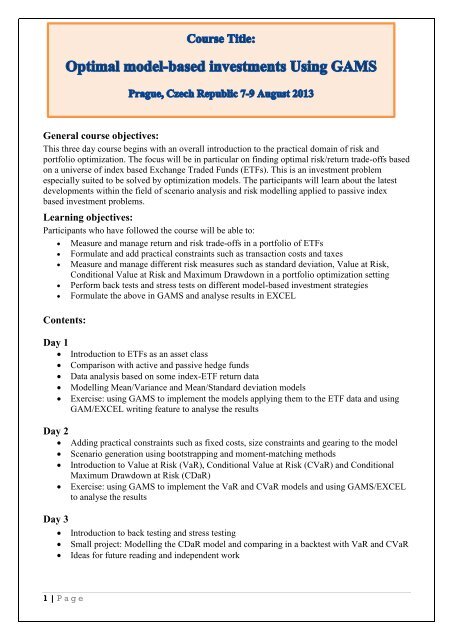

General course objectives:<br />

This three day course begins with an overall introduction to the practical domain of risk and<br />

portfolio optimization. The focus will be in particular on finding optimal risk/return trade-offs based<br />

on a universe of index based Exchange Traded Funds (ETFs). This is an investment problem<br />

especially suited to be solved by optimization models. The participants will learn about the latest<br />

developments within the field of scenario analysis and risk modelling applied to passive index<br />

based investment problems.<br />

Learning objectives:<br />

Participants who have followed the course will be able to:<br />

Measure and manage return and risk trade-offs in a portfolio of ETFs<br />

Formulate and add practical constraints such as transaction costs and taxes<br />

Measure and manage different risk measures such as standard deviation, Value at Risk,<br />

Conditional Value at Risk and Maximum Drawdown in a portfolio optimization setting<br />

Perform back tests and stress tests on different model-based investment strategies<br />

Formulate the above in <strong>GAMS</strong> and analyse results in EXCEL<br />

Contents:<br />

Day 1<br />

Introduction to ETFs as an asset class<br />

Comparison with active and passive hedge funds<br />

Data analysis based on some index-ETF return data<br />

Modelling Mean/Variance and Mean/Standard deviation models<br />

Exercise: using <strong>GAMS</strong> to implement the models applying them to the ETF data and using<br />

GAM/EXCEL writing feature to analyse the results<br />

Day 2<br />

Adding practical constraints such as fixed costs, size constraints and gearing to the model<br />

Scenario generation using bootstrapping and moment-matching methods<br />

Introduction to Value at Risk (VaR), Conditional Value at Risk (CVaR) and Conditional<br />

Maximum Drawdown at Risk (CDaR)<br />

Exercise: using <strong>GAMS</strong> to implement the VaR and CVaR models and using <strong>GAMS</strong>/EXCEL<br />

to analyse the results<br />

Day 3<br />

Introduction to back testing and stress testing<br />

Small project: Modelling the CDaR model and comparing in a backtest with VaR and CVaR<br />

Ideas for future reading and independent work<br />

1 | P a g e

Prerequisites :<br />

The course is aimed for practitioners in the field of portfolio or risk management or students of a<br />

finance program.<br />

No knowledge of <strong>GAMS</strong> is required, but to prepare for the course it is recommended to download<br />

the current version of <strong>GAMS</strong> (http://gams.com/download/) on your laptop computers (windows<br />

machines in order to use the <strong>GAMS</strong>/EXCEL link as well) and go through the short <strong>GAMS</strong> tutorial<br />

(http://www.gams.com/dd/docs/gams/Tutorial.pdf).<br />

Participants will also receive course material (lecture notes, slides and the book “Practical Financial<br />

Optimization, Decision Making for Financial Engineers” by Stavros Zenios) at the first day of the<br />

course. Upon request lecture notes and slides will be sent to the participants after registration.<br />

The venue :<br />

The course is held at the Andel’s hotel in Prague (http://www.vi-hotels.com/en/andels-prague/). The<br />

hotel is located near Pragues historical centre with easy access to trams, metro, shopping centres,<br />

fitness, theatre, several good restaurants, parks, the brewery Staropramen …<br />

<strong>Registration</strong>:<br />

Fax or e-mail the fulfilled and signed registration form (last page of this document) to <strong>GAMS</strong><br />

GmbH.<br />

Lecturer: Kourosh Marjani Rasmussen, Email: kmra@dtu.dk<br />

Kourosh has a PhD in Financial Optimization and is an associate professor at the Technical<br />

University of Denmark, where he teaches and conducts research within financial optimization.<br />

Kourosh has combined work in the industry with academia. From 2006-2010 he worked as a<br />

financial engineer with product and system development at Nykredit (the biggest Danish<br />

mortgage bank) and since 2010 he has worked as a consultant to the financial institutions.<br />

As part of his consultancy work he has developed a new advisory system for mortgage backed<br />

loans, an optimization model for life cycle wealth management of private household in<br />

sdfsfsfsfsfds Denmark and worked extensively with scenario generation and asset allocation problems<br />

especially index based strategic investments.<br />

Kourosh has been teaching the course “Optimization in Finance” at the technical university of<br />

Denmark since 2005, and is the founder of the master program “Financial Engineering” at the<br />

same university.<br />

2 | P a g e

1. Personal Data<br />

3 | P a g e<br />

<strong>Registration</strong> Form for the Course<br />

“Optimal Model-Based Investments Using <strong>GAMS</strong>”<br />

Andel’s Hotel Prague 7-9 August 2013<br />

Name ______________________________________________<br />

Company ______________________________________________<br />

Address ______________________________________________<br />

Phone ______________________________________________<br />

Email ______________________________________________<br />

2. Workshop Fee, including course material and meals (cross where fits)<br />

€ 640 Academic participants (early registration) € 800 Academic participants<br />

€ 760 Other participants (early registration) € 950 Other participants<br />

3. Accommodation if needed (Superior double rooms, breakfast, free internet and fitness)<br />

Check in date _____________________ Check out date _____________________<br />

Number of extra person in the room (if children mentions age) _____________________<br />

NB: Rooms are available for a discounted rate of € 85 per night in the period 7 th - 12 th of August 2013.<br />

Surcharge for extra occupancy in one room per night is € 10. Payments are made directly to the hotel.<br />

Terms and Conditions<br />

After the registration form is received by <strong>GAMS</strong> GmbH, an invoice with payment instructions will be sent to<br />

the participant. Academic participants need to send a letter signed by their university explaining the nature of<br />

their affiliation with the university. The fee should be transferred by the latest by the 2 nd of August 2013. For<br />

early registration, however, participants need to pay by 20 th of June 2013. Payment information is:<br />

Recipient: <strong>GAMS</strong> GmbH, Account No.: 3533320, Bank Code: 37070024<br />

IBAN: DE87 3707 0024 0353 3320 00, BIC (SWIFT Code): DEUT DEDBKOE<br />

Reason for payment: Course “Optimal Model-Based Investments Using <strong>GAMS</strong>” Prague 7-9 August 2013<br />

With my signature below I agree to the Terms and Conditions.<br />

_________________________________ ____________________________________<br />

Place, Date Signature<br />

Please send your registration to info@gams.de or fax the form to: +49 2219499171