Chairman's - FMC Corporation

Chairman's - FMC Corporation

Chairman's - FMC Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

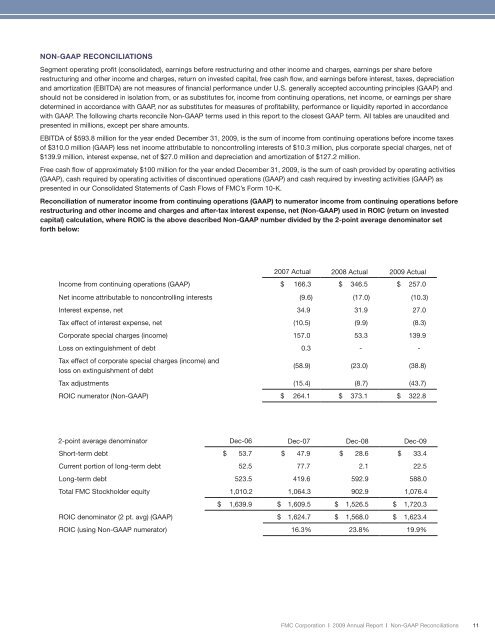

NON-GAAP RECONCILIATIONS<br />

Segment operating proft (consolidated), earnings before restructuring and other income and charges, earnings per share before<br />

restructuring and other income and charges, return on invested capital, free cash fow, and earnings before interest, taxes, depreciation<br />

and amortization (EBITDA) are not measures of fnancial performance under U.S. generally accepted accounting principles (GAAP) and<br />

should not be considered in isolation from, or as substitutes for, income from continuing operations, net income, or earnings per share<br />

determined in accordance with GAAP, nor as substitutes for measures of proftability, performance or liquidity reported in accordance<br />

with GAAP. The following charts reconcile Non-GAAP terms used in this report to the closest GAAP term. All tables are unaudited and<br />

presented in millions, except per share amounts.<br />

EBITDA of $593.8 million for the year ended December 31, 2009, is the sum of income from continuing operations before income taxes<br />

of $310.0 million (GAAP) less net income attributable to noncontrolling interests of $10.3 million, plus corporate special charges, net of<br />

$139.9 million, interest expense, net of $27.0 million and depreciation and amortization of $127.2 million.<br />

Free cash fow of approximately $100 million for the year ended December 31, 2009, is the sum of cash provided by operating activities<br />

(GAAP), cash required by operating activities of discontinued operations (GAAP) and cash required by investing activities (GAAP) as<br />

presented in our Consolidated Statements of Cash Flows of <strong>FMC</strong>’s Form 10-K.<br />

Reconciliation of numerator income from continuing operations (GAAP) to numerator income from continuing operations before<br />

restructuring and other income and charges and after-tax interest expense, net (Non-GAAP) used in ROIC (return on invested<br />

capital) calculation, where ROIC is the above described Non-GAAP number divided by the 2-point average denominator set<br />

forth below:<br />

2007 Actual 2008 Actual 2009 Actual<br />

Income from continuing operations (GAAP) $ 166.3 $ 346.5 $ 257.0<br />

Net income attributable to noncontrolling interests (9.6) (17.0) (10.3)<br />

Interest expense, net 34.9 31.9 27.0<br />

Tax effect of interest expense, net (10.5) (9.9) (8.3)<br />

Corporate special charges (income) 157.0 53.3 139.9<br />

Loss on extinguishment of debt 0.3 - -<br />

Tax effect of corporate special charges (income) and<br />

loss on extinguishment of debt<br />

(58.9) (23.0) (38.8)<br />

Tax adjustments (15.4) (8.7) (43.7)<br />

ROIC numerator (Non-GAAP) $ 264.1 $ 373.1 $ 322.8<br />

2-point average denominator Dec-06 Dec-07 Dec-08 Dec-09<br />

Short-term debt $ 53.7 $ 47.9 $ 28.6 $ 33.4<br />

Current portion of long-term debt 52.5 77.7 2.1 22.5<br />

Long-term debt 523.5 419.6 592.9 588.0<br />

Total <strong>FMC</strong> Stockholder equity 1,010.2 1,064.3 902.9 1,076.4<br />

$ 1,639.9 $ 1,609.5 $ 1,526.5 $ 1,720.3<br />

ROIC denominator (2 pt. avg) (GAAP) $ 1,624.7 $ 1,568.0 $ 1,623.4<br />

ROIC (using Non-GAAP numerator) 16.3% 23.8% 19.9%<br />

<strong>FMC</strong> <strong>Corporation</strong> | 2009 Annual Report | Non-GAAP Reconciliations 11<br />

11