Chairman's - FMC Corporation

Chairman's - FMC Corporation

Chairman's - FMC Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

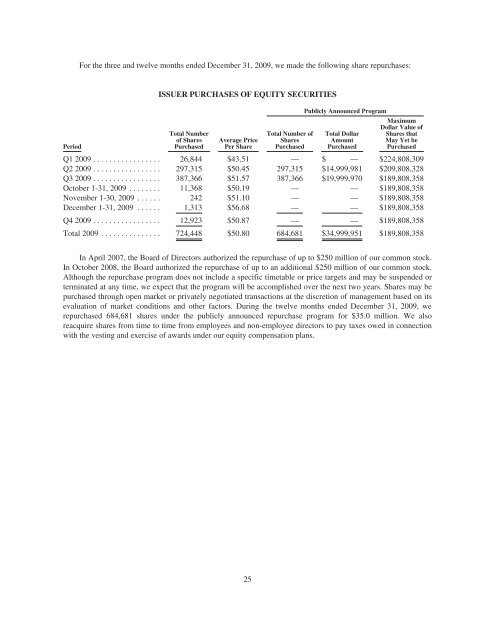

For the three and twelve months ended December 31, 2009, we made the following share repurchases:<br />

ISSUER PURCHASES OF EQUITY SECURITIES<br />

Publicly Announced Program<br />

Maximum<br />

Dollar Value of<br />

Total Number Total Number of Total Dollar Shares that<br />

of Shares Average Price Shares Amount May Yet be<br />

Period Purchased Per Share Purchased Purchased Purchased<br />

Q12009................. 26,844 $43.51 — $ — $224,808,309<br />

Q2 2009................. 297,315 $50.45 297,315 $14,999,981 $209,808,328<br />

Q3 2009................. 387,366 $51.57 387,366 $19,999,970 $189,808,358<br />

October 1-31, 2009 ........ 11,368 $50.19 — — $189,808,358<br />

November 1-30, 2009 ...... 242 $51.10 — — $189,808,358<br />

December 1-31, 2009 ...... 1,313 $56.68 — — $189,808,358<br />

Q42009................. 12,923 $50.87 — — $189,808,358<br />

Total 2009 . .............. 724,448 $50.80 684,681 $34,999,951 $189,808,358<br />

In April 2007, the Board of Directors authorized the repurchase of up to $250 million of our common stock.<br />

In October 2008, the Board authorized the repurchase of up to an additional $250 million of our common stock.<br />

Although the repurchase program does not include a specific timetable or price targets and may be suspended or<br />

terminated at any time, we expect that the program will be accomplished over the next two years. Shares may be<br />

purchased through open market or privately negotiated transactions at the discretion of management based on its<br />

evaluation of market conditions and other factors. During the twelve months ended December 31, 2009, we<br />

repurchased 684,681 shares under the publicly announced repurchase program for $35.0 million. We also<br />

reacquire shares from time to time from employees and non-employee directors to pay taxes owed in connection<br />

with the vesting and exercise of awards under our equity compensation plans.<br />

25