summit partners GRI Summit 2003 - Global Real Estate Institute

summit partners GRI Summit 2003 - Global Real Estate Institute

summit partners GRI Summit 2003 - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

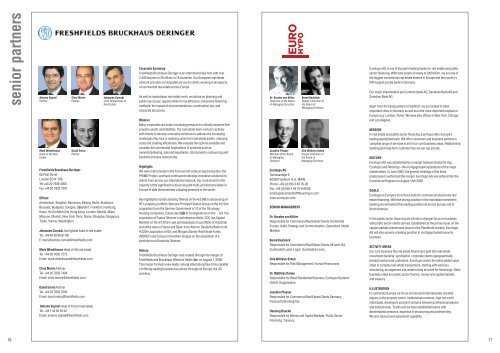

senior <strong>partners</strong><br />

Antoine Vignial<br />

Partner<br />

Mark Wheelhouse<br />

Head of UK <strong>Real</strong><br />

<strong>Estate</strong><br />

Chris Morris<br />

Partner<br />

David Ereira<br />

Partner<br />

Freshfields Bruckhaus Deringer<br />

65 Fleet Street<br />

London EC4Y 1HS<br />

Tel:+44 20 7936 4000<br />

Fax:+44 20 7832 7001<br />

Offices<br />

Amsterdam, Bangkok, Barcelona, Beijing, Berlin, Bratislava,<br />

Brussels, Budapest, Cologne, Düsseldorf, Frankfurt, Hamburg,<br />

Hanoi, Ho Chi Minh City, Hong Kong, London, Madrid, Milan,<br />

Moscow, Munich, New York, Paris, Rome, Shanghai, Singapore,<br />

Toyko, Vienna, Washington<br />

Johannes Conradi Joint global head of real estate<br />

Tel: +49 40 36 90 61 68<br />

E-mail:johannes.conradi@freshfields.com<br />

Mark Wheelhouse Head of UK real estate<br />

Tel: +44 20 7832 7272<br />

Email: mark.wheelhouse@freshfields.com<br />

Chris Morris Partner<br />

Tel: +44 20 7832 7494<br />

Email: chris.morris@freshfields.com<br />

David Ereira Partner<br />

Tel: +44 20 7832 7003<br />

Email: david.ereira@freshfields.com<br />

Antoine Vignial Head of French real estate<br />

Tel: +33 1 44 56 55 52<br />

Email: antoine.vignial@freshfields.com<br />

Johannes Conradi<br />

Joint <strong>Global</strong> Head of<br />

<strong>Real</strong> <strong>Estate</strong><br />

Corporate Summary<br />

Freshfields Bruckhaus Deringer is an international law firm with over<br />

2,400 lawyers in 28 offices in 18 countries. Our European real estate<br />

network provides an integrated service to clients working in all aspects<br />

of commercial real estate across Europe.<br />

As well as mainstream real estate work, we advise on planning and<br />

public law issues; opportunities for tax efficiency; innovative financing<br />

methods; the impact of environmental law; construction law; and<br />

corporate structures.<br />

Mission<br />

Many corporates are under increasing pressure to critically examine their<br />

property assets and liabilities. Our real estate team work pro-actively<br />

with clients to develop innovative solutions to address the increasing<br />

challenges they face in realising value from real estate assets, reducing<br />

costs and creating efficiencies. We evaluate the options available and<br />

consider the commercial implications of products such as<br />

ownership/leasing, sale and leasebacks, total property outsourcing and<br />

business process outsourcing.<br />

Highlights<br />

We were instrumental in the first ever UK outsourcing transaction, the<br />

PRIME Project, and have continued to develop innovative solutions for<br />

clients from across our international network. Our involvement in the<br />

majority of the significant outsourcing and multi-jurisdictional deals in<br />

Europe to date demonstrates a leading presence in the sector.<br />

Key highlights include advising Telereal on the €3.86bn outsourcing of<br />

BT’s property portfolio; Nomura Principal Finance Group on the €2.5bn<br />

acquisition from the German Government of 10 of the 18 railway<br />

housing companies; Caisse des Dépôts et Consignations on the €3.1bn<br />

acquisition of France Telecom's real estate portfolio; CDC Ixis Capital<br />

Markets on the €120.5m sale and leaseback of a portfolio of industrial<br />

and office sites in France and Spain from Alstom; Deutsche Bank on its<br />

€220m acquisition of GA; and Morgan Stanley <strong>Real</strong> <strong>Estate</strong> Funds<br />

(MSREF) and Corpus Immobilien-Gruppe on the acquisition of a<br />

portfolio from Deutsche Telekom.<br />

History<br />

Freshfields Bruckhaus Deringer was created through the merger of<br />

Freshfields and Bruckhaus Westrick Heller Löber on August 1, 2000.<br />

The merger formed a new leader among international law firms capable<br />

of offering leading business law advice throughout Europe, the US<br />

and Asia.<br />

Dr. Karsten von Köller<br />

Chairman of the Board<br />

of Managing Directors<br />

Joachim Plesser<br />

Member of the Board<br />

of Managing<br />

Directors<br />

Eurohypo AG<br />

Taunusanlage 9<br />

60329 Frankfurt A.m. MAIN<br />

Phone: +49 (0)180-3 49 76-00<br />

Fax: +49 (0)180-3 49 76-8 88 88<br />

email:gisela.brandhoff@eurohypo.com<br />

www.eurohypo.com<br />

SENIOR MANAGEMENT<br />

Bernd Knobloch<br />

Deputy Chairman of<br />

the Board of<br />

Managing Directors<br />

Dirk Wilhelm Schuh<br />

Deputy Chairman of<br />

the Board of<br />

Managing Directors<br />

Dr. Karsten von Köller<br />

Responsible for Commercial <strong>Real</strong> <strong>Estate</strong> Clients Continental<br />

Europe, Audit, Strategy and Communication, Operations <strong>Global</strong><br />

Markets<br />

Bernd Knobloch<br />

Responsible for Commercial <strong>Real</strong> <strong>Estate</strong> Clients UK and USA,<br />

Syndicated Loans, Legal , Syndicated Loans<br />

Dirk Wilhelm Schuh<br />

Responsible for Risk Management, Human Ressources<br />

Dr. Matthias Danne<br />

Responsible for Retail Residential Business, Eurohypo Systems<br />

GmbH, Organisation<br />

Joachim Plesser<br />

Responsible for Commercial <strong>Real</strong> <strong>Estate</strong> Clients Germany,<br />

Finance/Controlling/Tax<br />

Henning Rasche<br />

Responsible for Money and Capital Markets, Public Sector<br />

Financing, Treasury.<br />

Eurohypo AG is one of Europe’s leading banks for real estate and public<br />

sector financing. With total assets of nearly € 240 billion, we are one of<br />

the biggest commercial real estate lenders in Europe and the country’s<br />

fifth-largest private bank in Germany.<br />

Our major shareholders are Commerzbank AG, Deutsche Bank AG and<br />

Dresdner Bank AG.<br />

Apart from the headquarters in Frankfurt, we are located in other<br />

important cities in Germany as well as in the most important capitals in<br />

Europe (e.g. London, Paris). We have also offices in New York, Chicago<br />

and Los Angeles.<br />

MISSION<br />

In real estate and public sector financing, Eurohypo AG is Europe’s<br />

leading specialized bank. We offer customers and business <strong>partners</strong> a<br />

complete range of services in all of our core business areas. Relationship<br />

banking and long-term customer ties are our top priority.<br />

HISTORY<br />

Eurohypo AG was established by a merger between Deutsche Hyp,<br />

Eurohypo and Rheinhyp –the mortgage bank subsidaries of the major<br />

shareholders. In June 2002, the general meetings of the three<br />

predecessors authorized the merger. Eurohypo AG was entered into the<br />

Commercial Register on August 13th 2002.<br />

GOALS<br />

Eurohypo is Europe’s first choice both for commercial and private real<br />

estate financing. With the strong position in the real estate investment<br />

banking we will extend this leading position all across Europe and to<br />

North America.<br />

In the public sector financing we will see a stronger focus on business<br />

with public sector clients abroad. Established as the prime issuer on the<br />

capital markets (benchmark issuer in the Pfandbrief market), Eurohypo<br />

AG will also assume a leading position in mortgage backed security<br />

business.<br />

ACTIVITY AREAS<br />

Our core business the real estate financing is split into real estate<br />

investment banking, syndication, corporate clients (geographically<br />

divided) and private customers. Eurohypo covers the entire added value<br />

chain in complex real estate transactions, starting with advisory,<br />

structuring, arrangement and underwriting services for financings. Other<br />

business areas are public sector finance, money and capital markets<br />

and treasury.<br />

ILLUSTRATION<br />

In continental Europe we focus on local and internationally oriented<br />

players in the property sector, institutional investors, high net worth<br />

individuals, developers and joint ventures between professional players<br />

and institutionals. To this end we have established teams with<br />

decentralized presence, expertise in structuring and underwriting.<br />

We also have proven placement capability.<br />

16 17