Open print version - Hapag-Lloyd

Open print version - Hapag-Lloyd

Open print version - Hapag-Lloyd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

interim group management report I hapag-lloyd interim group report 9M · 2012<br />

Group financial and net asset position<br />

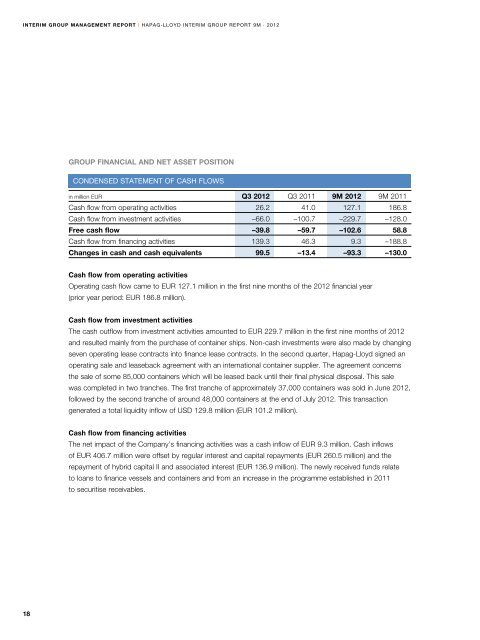

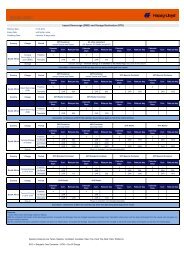

condensed statement of cash flows<br />

in million EUR Q3 2012 Q3 2011 9M 2012 9M 2011<br />

Cash flow from operating activities 26.2 41.0 127.1 186.8<br />

Cash flow from investment activities –66.0 –100.7 –229.7 –128.0<br />

Free cash flow –39.8 –59.7 –102.6 58.8<br />

Cash flow from financing activities 139.3 46.3 9.3 –188.8<br />

Changes in cash and cash equivalents 99.5 –13.4 –93.3 –130.0<br />

Cash flow from operating activities<br />

Operating cash flow came to EUR 127.1 million in the first nine months of the 2012 financial year<br />

(prior year period: EUR 186.8 million).<br />

Cash flow from investment activities<br />

The cash outflow from investment activities amounted to EUR 229.7 million in the first nine months of 2012<br />

and resulted mainly from the purchase of container ships. Non-cash investments were also made by changing<br />

seven operating lease contracts into finance lease contracts. In the second quarter, <strong>Hapag</strong>-<strong>Lloyd</strong> signed an<br />

operating sale and leaseback agreement with an international container supplier. The agreement concerns<br />

the sale of some 85,000 containers which will be leased back until their final physical disposal. This sale<br />

was completed in two tranches. The first tranche of approximately 37,000 containers was sold in June 2012,<br />

followed by the second tranche of around 48,000 containers at the end of July 2012. This transaction<br />

generated a total liquidity inflow of USD 129.8 million (EUR 101.2 million).<br />

Cash flow from financing activities<br />

The net impact of the Company’s financing activities was a cash inflow of EUR 9.3 million. Cash inflows<br />

of EUR 406.7 million were offset by regular interest and capital repayments (EUR 260.5 million) and the<br />

repayment of hybrid capital II and associated interest (EUR 136.9 million). The newly received funds relate<br />

to loans to finance vessels and containers and from an increase in the programme established in 2011<br />

to securitise receivables.<br />

18