Annual Report 2011 - Hongkong Land

Annual Report 2011 - Hongkong Land

Annual Report 2011 - Hongkong Land

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 Financial Risk Management continued<br />

Financial risk factors continued<br />

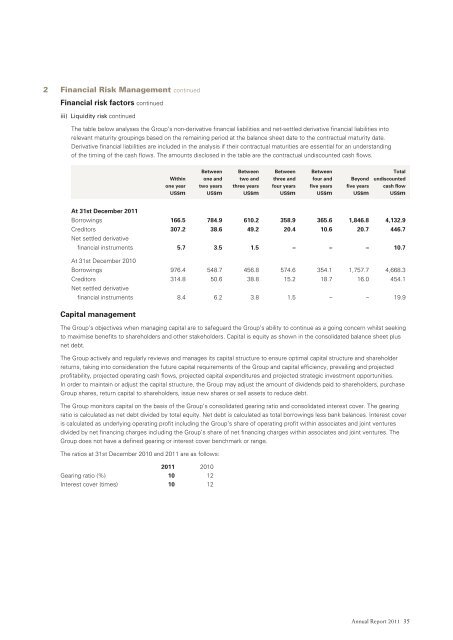

iii) Liquidity risk continued<br />

The table below analyses the Group’s non-derivative financial liabilities and net-settled derivative financial liabilities into<br />

relevant maturity groupings based on the remaining period at the balance sheet date to the contractual maturity date.<br />

Derivative financial liabilities are included in the analysis if their contractual maturities are essential for an understanding<br />

of the timing of the cash flows. The amounts disclosed in the table are the contractual undiscounted cash flows.<br />

Between Between Between Between Total<br />

Within one and two and three and four and Beyond undiscounted<br />

one year two years three years four years five years five years cash flow<br />

US$m US$m US$m US$m US$m US$m US$m<br />

At 31st December <strong>2011</strong><br />

Borrowings 166.5 784.9 610.2 358.9 365.6 1,846.8 4,132.9<br />

Creditors 307.2 38.6 49.2 20.4 10.6 20.7 446.7<br />

Net settled derivative<br />

financial instruments 5.7 3.5 1.5 – – – 10.7<br />

At 31st December 2010<br />

Borrowings 976.4 548.7 456.8 574.6 354.1 1,757.7 4,668.3<br />

Creditors 314.8 50.6 38.8 15.2 18.7 16.0 454.1<br />

Net settled derivative<br />

financial instruments 8.4 6.2 3.8 1.5 – – 19.9<br />

Capital management<br />

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern whilst seeking<br />

to maximise benefits to shareholders and other stakeholders. Capital is equity as shown in the consolidated balance sheet plus<br />

net debt.<br />

The Group actively and regularly reviews and manages its capital structure to ensure optimal capital structure and shareholder<br />

returns, taking into consideration the future capital requirements of the Group and capital efficiency, prevailing and projected<br />

profitability, projected operating cash flows, projected capital expenditures and projected strategic investment opportunities.<br />

In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders, purchase<br />

Group shares, return capital to shareholders, issue new shares or sell assets to reduce debt.<br />

The Group monitors capital on the basis of the Group’s consolidated gearing ratio and consolidated interest cover. The gearing<br />

ratio is calculated as net debt divided by total equity. Net debt is calculated as total borrowings less bank balances. Interest cover<br />

is calculated as underlying operating profit including the Group’s share of operating profit within associates and joint ventures<br />

divided by net financing charges including the Group’s share of net financing charges within associates and joint ventures. The<br />

Group does not have a defined gearing or interest cover benchmark or range.<br />

The ratios at 31st December 2010 and <strong>2011</strong> are as follows:<br />

<strong>2011</strong> 2010<br />

Gearing ratio (%) 10 12<br />

Interest cover (times) 10 12<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 35