Annual Report 2011 - Hongkong Land

Annual Report 2011 - Hongkong Land

Annual Report 2011 - Hongkong Land

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

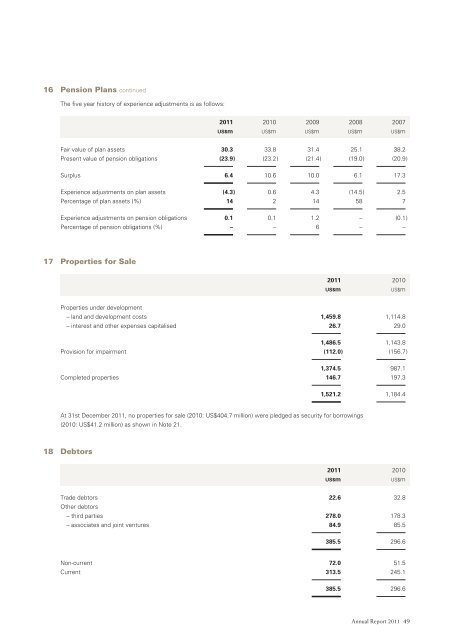

16 Pension Plans continued<br />

The five year history of experience adjustments is as follows:<br />

<strong>2011</strong> 2010 2009 2008 2007<br />

US$m US$m US$m US$m US$m<br />

Fair value of plan assets 30.3 33.8 31.4 25.1 38.2<br />

Present value of pension obligations (23.9 ) (23.2 ) (21.4 ) (19.0 ) (20.9 )<br />

Surplus 6.4 10.6 10.0 6.1 17.3<br />

Experience adjustments on plan assets (4.3 ) 0.6 4.3 (14.5 ) 2.5<br />

Percentage of plan assets (%) 14 2 14 58 7<br />

Experience adjustments on pension obligations 0.1 0.1 1.2 – (0.1 )<br />

Percentage of pension obligations (%) – – 6 – –<br />

17 Properties for Sale<br />

<strong>2011</strong> 2010<br />

US$m<br />

US$m<br />

Properties under development<br />

– land and development costs 1,459.8 1,114.8<br />

– interest and other expenses capitalised 26.7 29.0<br />

1,486.5 1,143.8<br />

Provision for impairment (112.0 ) (156.7 )<br />

1,374.5 987.1<br />

Completed properties 146.7 197.3<br />

1,521.2 1,184.4<br />

At 31st December <strong>2011</strong>, no properties for sale (2010: US$404.7 million) were pledged as security for borrowings<br />

(2010: US$41.2 million) as shown in Note 21.<br />

18 Debtors<br />

<strong>2011</strong> 2010<br />

US$m<br />

US$m<br />

Trade debtors 22.6 32.8<br />

Other debtors<br />

– third parties 278.0 178.3<br />

– associates and joint ventures 84.9 85.5<br />

385.5 296.6<br />

Non-current 72.0 51.5<br />

Current 313.5 245.1<br />

385.5 296.6<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 49