Annual Report 2011 - Hongkong Land

Annual Report 2011 - Hongkong Land

Annual Report 2011 - Hongkong Land

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

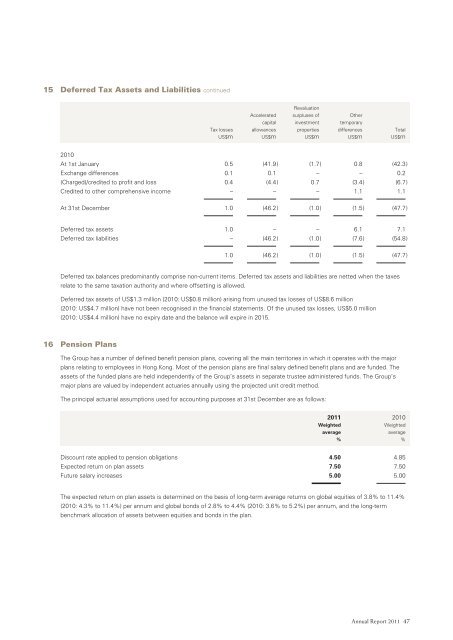

15 Deferred Tax Assets and Liabilities continued<br />

Revaluation<br />

Accelerated surpluses of Other<br />

capital investment temporary<br />

Tax losses allowances properties differences Total<br />

US$m US$m US$m US$m US$m<br />

2010<br />

At 1st January 0.5 (41.9) (1.7) 0.8 (42.3)<br />

Exchange differences 0.1 0.1 – – 0.2<br />

(Charged)/credited to profit and loss 0.4 (4.4) 0.7 (3.4) (6.7)<br />

Credited to other comprehensive income – – – 1.1 1.1<br />

At 31st December 1.0 (46.2 ) (1.0 ) (1.5 ) (47.7 )<br />

Deferred tax assets 1.0 – – 6.1 7.1<br />

Deferred tax liabilities – (46.2) (1.0) (7.6) (54.8)<br />

1.0 (46.2 ) (1.0 ) (1.5 ) (47.7 )<br />

Deferred tax balances predominantly comprise non-current items. Deferred tax assets and liabilities are netted when the taxes<br />

relate to the same taxation authority and where offsetting is allowed.<br />

Deferred tax assets of US$1.3 million (2010: US$0.8 million) arising from unused tax losses of US$8.6 million<br />

(2010: US$4.7 million) have not been recognised in the financial statements. Of the unused tax losses, US$5.0 million<br />

(2010: US$4.4 million) have no expiry date and the balance will expire in 2015.<br />

16 Pension Plans<br />

The Group has a number of defined benefit pension plans, covering all the main territories in which it operates with the major<br />

plans relating to employees in Hong Kong. Most of the pension plans are final salary defined benefit plans and are funded. The<br />

assets of the funded plans are held independently of the Group’s assets in separate trustee administered funds. The Group’s<br />

major plans are valued by independent actuaries annually using the projected unit credit method.<br />

The principal actuarial assumptions used for accounting purposes at 31st December are as follows:<br />

<strong>2011</strong> 2010<br />

Weighted<br />

Weighted<br />

average<br />

average<br />

% %<br />

Discount rate applied to pension obligations 4.50 4.85<br />

Expected return on plan assets 7.50 7.50<br />

Future salary increases 5.00 5.00<br />

The expected return on plan assets is determined on the basis of long-term average returns on global equities of 3.8% to 11.4%<br />

(2010: 4.3% to 11.4%) per annum and global bonds of 2.8% to 4.4% (2010: 3.6% to 5.2%) per annum, and the long-term<br />

benchmark allocation of assets between equities and bonds in the plan.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 47