Annual Report and Financial Statements 2010/11 - Hanover

Annual Report and Financial Statements 2010/11 - Hanover

Annual Report and Financial Statements 2010/11 - Hanover

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

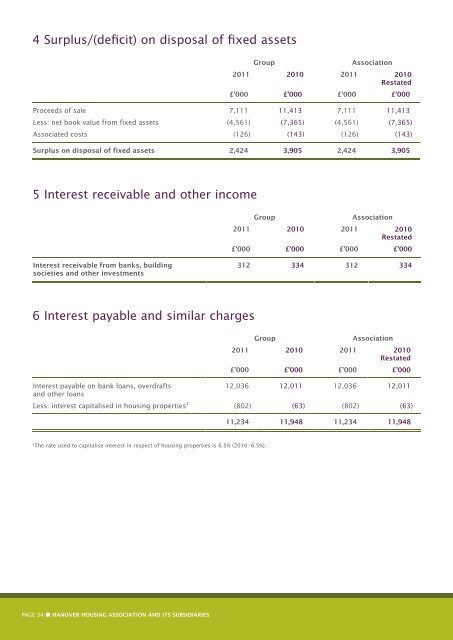

4 Surplus/(deficit) on disposal of fixed assets<br />

Group<br />

Association<br />

20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong><br />

Restated<br />

£’000 £’000 £’000 £’000<br />

Proceeds of sale 7,<strong>11</strong>1 <strong>11</strong>,413 7,<strong>11</strong>1 <strong>11</strong>,413<br />

Less: net book value from fixed assets (4,561) (7,365) (4,561) (7,365)<br />

Associated costs (126) (143) (126) (143)<br />

Surplus on disposal of fixed assets 2,424 3,905 2,424 3,905<br />

5 Interest receivable <strong>and</strong> other income<br />

Group<br />

Association<br />

20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong><br />

Restated<br />

£’000 £’000 £’000 £’000<br />

Interest receivable from banks, building<br />

societies <strong>and</strong> other investments<br />

312 334 312 334<br />

6 Interest payable <strong>and</strong> similar charges<br />

Interest payable on bank loans, overdrafts<br />

<strong>and</strong> other loans<br />

Group<br />

Association<br />

20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong><br />

Restated<br />

£’000 £’000 £’000 £’000<br />

12,036 12,0<strong>11</strong> 12,036 12,0<strong>11</strong><br />

Less: interest capitalised in housing properties 1 (802) (63) (802) (63)<br />

<strong>11</strong>,234 <strong>11</strong>,948 <strong>11</strong>,234 <strong>11</strong>,948<br />

1<br />

The rate used to capitalise interest in respect of housing properties is 6.5% (<strong>2010</strong>: 6.5%).<br />

PAGE 34 • HANOVER HOUSING ASSOCIATION AND ITS SUBSIDIARIES