Forma # 1.ai - ICAB

Forma # 1.ai - ICAB

Forma # 1.ai - ICAB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

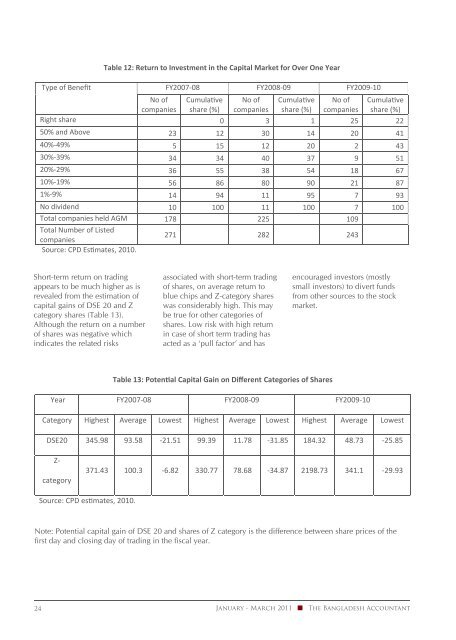

Table 12: Return to Investment in the Capital Market for Over One Year<br />

Type of Benefit FY2007 08 FY2008 09 FY2009 10<br />

No of<br />

companies<br />

Cumulave<br />

share (%)<br />

No of<br />

companies<br />

Cumulave<br />

share (%)<br />

No of<br />

companies<br />

Cumulave<br />

share (%)<br />

Right share 0 3 1 25 22<br />

50% and Above 23 12 30 14 20 41<br />

40% 49% 5 15 12 20 2 43<br />

30% 39% 34 34 40 37 9 51<br />

20% 29% 36 55 38 54 18 67<br />

10% 19% 56 86 80 90 21 87<br />

1% 9% 14 94 11 95 7 93<br />

No dividend 10 100 11 100 7 100<br />

Total companies held AGM 178 225 109<br />

Total Number of Listed<br />

companies<br />

271 282 243<br />

Source: CPD Esmates, 2010.<br />

Short‐term return on trading<br />

appears to be much higher as is<br />

revealed from the estimation of<br />

capital gains of DSE 20 and Z<br />

category shares (Table 13).<br />

Although the return on a number<br />

of shares was negative which<br />

indicates the related risks<br />

associated with short‐term trading<br />

of shares, on average return to<br />

blue chips and Z‐category shares<br />

was considerably high. This may<br />

be true for other categories of<br />

shares. Low risk with high return<br />

in case of short term trading has<br />

acted as a ‘pull factor’ and has<br />

encouraged investors (mostly<br />

small investors) to divert funds<br />

from other sources to the stock<br />

market.<br />

Table 13: Potenal Capital Gain on Different Categories of Shares<br />

Year FY2007 08 FY2008 09 FY2009 10<br />

Category Highest Average Lowest Highest Average Lowest Highest Average Lowest<br />

DSE20 345.98 93.58 21.51 99.39 11.78 31.85 184.32 48.73 25.85<br />

Z<br />

category<br />

371.43 100.3 6.82 330.77 78.68 34.87 2198.73 341.1 29.93<br />

Source: CPD esmates, 2010.<br />

Note: Potential capital gain of DSE 20 and shares of Z category is the difference between share prices of the<br />

first day and closing day of trading in the fiscal year.<br />

24<br />

January - March 2011<br />

The Bangladesh Accountant