Forma # 1.ai - ICAB

Forma # 1.ai - ICAB

Forma # 1.ai - ICAB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IPO in a year, a number of these<br />

banks were unable to comply with<br />

this target.90 This would indicate<br />

that the number of merchant<br />

banks in operation is large<br />

compared to what the market<br />

could sustain.91 Where the<br />

operation of the merchant banks<br />

should have been confined to<br />

portfolio management, often these<br />

banks are alleged to act as<br />

‘brokerage houses’.<br />

Lack of coordination among<br />

various financial markets<br />

including debt market, equity<br />

market and bond market is<br />

considered to be a major<br />

weakness for sustainable growth<br />

of the capital market. Decisions<br />

(or indecisions) of different market<br />

regulatory bodies taken at various<br />

points of time, have often<br />

contributed towards significant<br />

volatility in the market. For<br />

example, possible diversion of<br />

industrial credit to the capital<br />

market was anticipated by the<br />

Bangladesh Bank in its Monetary<br />

Policy Statement for<br />

July‐December 2010, but the<br />

required surveillance came only at<br />

a much later stage. Further, the<br />

margin rule instrument available<br />

to the SEC appears to have been<br />

applied without proper assessment<br />

of the overall money supply and<br />

demand situation prevailing in<br />

different sectors. Moreover,<br />

notwithstanding their mandated<br />

responsibilities, most market<br />

agents, such as brokerage houses,<br />

merchant banks, investment<br />

banks, institutional investors,<br />

members of DSE, are involved in<br />

short term ‘trading’. Overall, lack<br />

of proper coordination between<br />

two leading regulatory bodies of<br />

the financial sector, namely the<br />

Bangladesh Bank and SEC is said<br />

to have contributed to the current<br />

volatile behaviour that is observed<br />

in the country’s capital market .<br />

Prospect of smooth landing<br />

of the market?<br />

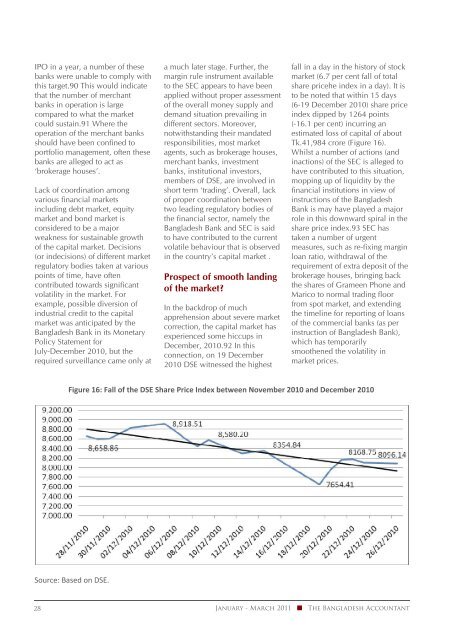

In the backdrop of much<br />

apprehension about severe market<br />

correction, the capital market has<br />

experienced some hiccups in<br />

December, 2010.92 In this<br />

connection, on 19 December<br />

2010 DSE witnessed the highest<br />

fall in a day in the history of stock<br />

market (6.7 per cent fall of total<br />

share pricehe index in a day). It is<br />

to be noted that within 15 days<br />

(6‐19 December 2010) share price<br />

index dipped by 1264 points<br />

(‐16.1 per cent) incurring an<br />

estimated loss of capital of about<br />

Tk.41,984 crore (Figure 16).<br />

Whilst a number of actions (and<br />

inactions) of the SEC is alleged to<br />

have contributed to this situation,<br />

mopping up of liquidity by the<br />

financial institutions in view of<br />

instructions of the Bangladesh<br />

Bank is may have played a major<br />

role in this downward spiral in the<br />

share price index.93 SEC has<br />

taken a number of urgent<br />

measures, such as re‐fixing margin<br />

loan ratio, withdrawal of the<br />

requirement of extra deposit of the<br />

brokerage houses, bringing back<br />

the shares of Grameen Phone and<br />

Marico to normal trading floor<br />

from spot market, and extending<br />

the timeline for reporting of loans<br />

of the commercial banks (as per<br />

instruction of Bangladesh Bank),<br />

which has temporarily<br />

smoothened the volatility in<br />

market prices.<br />

Figure 16: Fall of the DSE Share Price Index between November 2010 and December 2010<br />

Source: Based on DSE.<br />

28<br />

January - March 2011<br />

The Bangladesh Accountant