Chapter 13 Income Taxes

Chapter 13 Income Taxes

Chapter 13 Income Taxes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

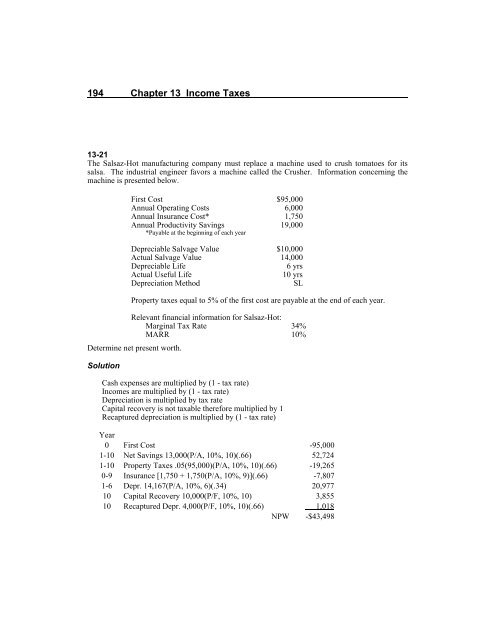

194 <strong>Chapter</strong> <strong>13</strong> <strong>Income</strong> <strong>Taxes</strong><br />

<strong>13</strong>-21<br />

The Salsaz-Hot manufacturing company must replace a machine used to crush tomatoes for its<br />

salsa. The industrial engineer favors a machine called the Crusher. Information concerning the<br />

machine is presented below.<br />

First Cost $95,000<br />

Annual Operating Costs 6,000<br />

Annual Insurance Cost* 1,750<br />

Annual Productivity Savings 19,000<br />

*Payable at the beginning of each year<br />

Depreciable Salvage Value $10,000<br />

Actual Salvage Value 14,000<br />

Depreciable Life<br />

6 yrs<br />

Actual Useful Life<br />

10 yrs<br />

Depreciation Method<br />

SL<br />

Property taxes equal to 5% of the first cost are payable at the end of each year.<br />

Relevant financial information for Salsaz-Hot:<br />

Marginal Tax Rate 34%<br />

MARR 10%<br />

Determine net present worth.<br />

Solution<br />

Cash expenses are multiplied by (1 - tax rate)<br />

<strong>Income</strong>s are multiplied by (1 - tax rate)<br />

Depreciation is multiplied by tax rate<br />

Capital recovery is not taxable therefore multiplied by 1<br />

Recaptured depreciation is multiplied by (1 - tax rate)<br />

Year<br />

0 First Cost -95,000<br />

1-10 Net Savings <strong>13</strong>,000(P/A, 10%, 10)(.66) 52,724<br />

1-10 Property <strong>Taxes</strong> .05(95,000)(P/A, 10%, 10)(.66) -19,265<br />

0-9 Insurance [1,750 + 1,750(P/A, 10%, 9)](.66) -7,807<br />

1-6 Depr. 14,167(P/A, 10%, 6)(.34) 20,977<br />

10 Capital Recovery 10,000(P/F, 10%, 10) 3,855<br />

10 Recaptured Depr. 4,000(P/F, 10%, 10)(.66) 1,018<br />

NPW -$43,498