Chapter 13 Income Taxes

Chapter 13 Income Taxes

Chapter 13 Income Taxes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

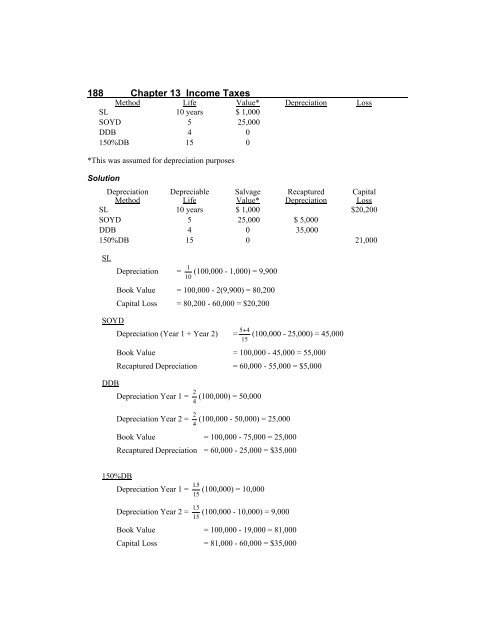

188 <strong>Chapter</strong> <strong>13</strong> <strong>Income</strong> <strong>Taxes</strong><br />

Method Life Value* Depreciation Loss<br />

SL 10 years $ 1,000<br />

SOYD 5 25,000<br />

DDB 4 0<br />

150%DB 15 0<br />

*This was assumed for depreciation purposes<br />

Solution<br />

Depreciation Depreciable Salvage Recaptured Capital<br />

Method Life Value* Depreciation Loss<br />

SL 10 years $ 1,000 $20,200<br />

SOYD 5 25,000 $ 5,000<br />

DDB 4 0 35,000<br />

150%DB 15 0 21,000<br />

SL<br />

Depreciation = (100,000 - 1,000) = 9,900<br />

Book Value = 100,000 - 2(9,900) = 80,200<br />

Capital Loss = 80,200 - 60,000 = $20,200<br />

SOYD<br />

Depreciation (Year 1 + Year 2) = (100,000 - 25,000) = 45,000<br />

Book Value = 100,000 - 45,000 = 55,000<br />

Recaptured Depreciation = 60,000 - 55,000 = $5,000<br />

DDB<br />

Depreciation Year 1 = (100,000) = 50,000<br />

Depreciation Year 2 = (100,000 - 50,000) = 25,000<br />

Book Value = 100,000 - 75,000 = 25,000<br />

Recaptured Depreciation = 60,000 - 25,000 = $35,000<br />

150%DB<br />

Depreciation Year 1 = (100,000) = 10,000<br />

Depreciation Year 2 = (100,000 - 10,000) = 9,000<br />

Book Value = 100,000 - 19,000 = 81,000<br />

Capital Loss = 81,000 - 60,000 = $35,000