Chapter 13 Income Taxes

Chapter 13 Income Taxes

Chapter 13 Income Taxes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

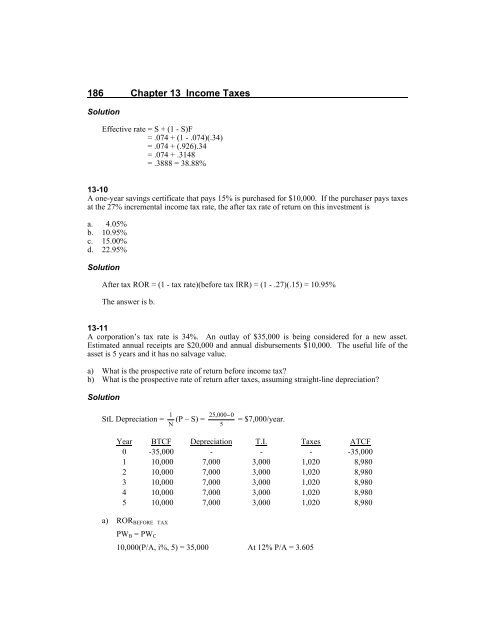

186 <strong>Chapter</strong> <strong>13</strong> <strong>Income</strong> <strong>Taxes</strong><br />

Solution<br />

Effective rate = S + (1 - S)F<br />

= .074 + (1 - .074)(.34)<br />

= .074 + (.926).34<br />

= .074 + .3148<br />

= .3888 = 38.88%<br />

<strong>13</strong>-10<br />

A one-year savings certificate that pays 15% is purchased for $10,000. If the purchaser pays taxes<br />

at the 27% incremental income tax rate, the after tax rate of return on this investment is<br />

a. 4.05%<br />

b. 10.95%<br />

c. 15.00%<br />

d. 22.95%<br />

Solution<br />

After tax ROR = (1 - tax rate)(before tax IRR) = (1 - .27)(.15) = 10.95%<br />

The answer is b.<br />

<strong>13</strong>-11<br />

A corporation’s tax rate is 34%. An outlay of $35,000 is being considered for a new asset.<br />

Estimated annual receipts are $20,000 and annual disbursements $10,000. The useful life of the<br />

asset is 5 years and it has no salvage value.<br />

a) What is the prospective rate of return before income tax?<br />

b) What is the prospective rate of return after taxes, assuming straight-line depreciation?<br />

Solution<br />

StL Depreciation = (P – S) = = $7,000/year.<br />

Year BTCF Depreciation T.I. <strong>Taxes</strong> ATCF<br />

0 -35,000 - - - -35,000<br />

1 10,000 7,000 3,000 1,020 8,980<br />

2 10,000 7,000 3,000 1,020 8,980<br />

3 10,000 7,000 3,000 1,020 8,980<br />

4 10,000 7,000 3,000 1,020 8,980<br />

5 10,000 7,000 3,000 1,020 8,980<br />

a) ROR BEFORE TAX<br />

PW B = PW C<br />

10,000(P/A, i%, 5) = 35,000 At 12% P/A = 3.605