Chapter 13 Income Taxes

Chapter 13 Income Taxes

Chapter 13 Income Taxes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Chapter</strong> <strong>13</strong> <strong>Income</strong> <strong>Taxes</strong> 185<br />

6 14,000 - 10,000 4,200 9,800<br />

$4,000 capital recovery in year 6 is not taxable.<br />

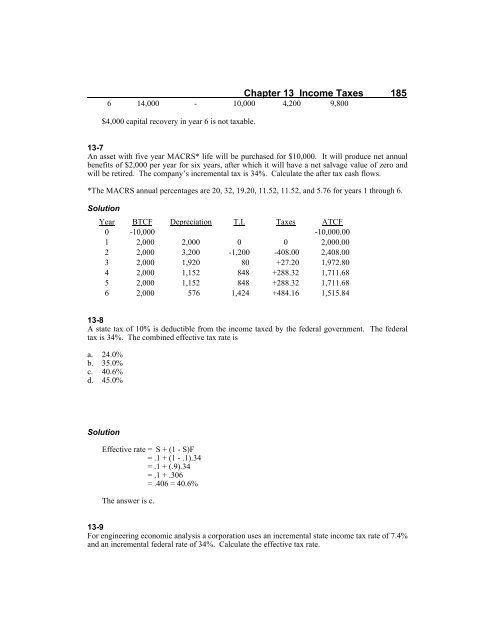

<strong>13</strong>-7<br />

An asset with five year MACRS* life will be purchased for $10,000. It will produce net annual<br />

benefits of $2,000 per year for six years, after which it will have a net salvage value of zero and<br />

will be retired. The company’s incremental tax is 34%. Calculate the after tax cash flows.<br />

*The MACRS annual percentages are 20, 32, 19.20, 11.52, 11.52, and 5.76 for years 1 through 6.<br />

Solution<br />

Year BTCF Depreciation T.I. <strong>Taxes</strong> ATCF<br />

0 -10,000 -10,000.00<br />

1 2,000 2,000 0 0 2,000.00<br />

2 2,000 3,200 -1,200 -408.00 2,408.00<br />

3 2,000 1,920 80 +27.20 1,972.80<br />

4 2,000 1,152 848 +288.32 1,711.68<br />

5 2,000 1,152 848 +288.32 1,711.68<br />

6 2,000 576 1,424 +484.16 1,515.84<br />

<strong>13</strong>-8<br />

A state tax of 10% is deductible from the income taxed by the federal government. The federal<br />

tax is 34%. The combined effective tax rate is<br />

a. 24.0%<br />

b. 35.0%<br />

c. 40.6%<br />

d. 45.0%<br />

Solution<br />

Effective rate = S + (1 - S)F<br />

= .1 + (1 - .1).34<br />

= .1 + (.9).34<br />

= .1 + .306<br />

= .406 = 40.6%<br />

The answer is c.<br />

<strong>13</strong>-9<br />

For engineering economic analysis a corporation uses an incremental state income tax rate of 7.4%<br />

and an incremental federal rate of 34%. Calculate the effective tax rate.