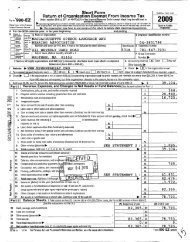

. . . . . O - Charity Blossom

. . . . . O - Charity Blossom

. . . . . O - Charity Blossom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<br />

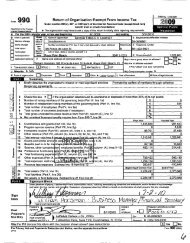

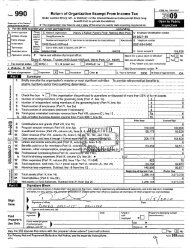

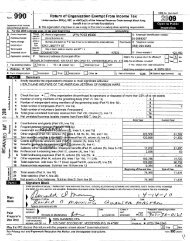

Form 990 (2009) The ChJ.1dren"s Cooperative, Inc. 04-2506891 Page5<br />

Yes MI<br />

1a Enter the number reported in Box 3 of Form 1096, Annual Summary and Transmittal of<br />

*if - .. 2 ,, f<br />

.T 7, J . .-. :V A<br />

US Information Returns Enter -0- if not applicable - - - - - - - - - - - - - - - ... -....13<br />

6 15* if 5..<br />

b Enter the number of Forms W-2G included in line 1a Enter -0- if not applicable - - . - - --un<br />

i<br />

0 -5* KVM.<br />

c<br />

- J ff<br />

Did the organization comply with backup withholding rules for reportable payments to vendors and reportable<br />

-3 " Q5, .T , L 1<br />

gaming (gambling) winnings to prize winners? - - - - - - - - - - - -- - - - - - -----1.--an ..--. .....1g,<br />

2a Enter the number of employees reported on Fom1 W-3, Transmittal of Wage and Tax<br />

* Statements-Regarding Other IRS Filings and Tax Compliance<br />

b<br />

3a<br />

b<br />

4a<br />

b<br />

5a<br />

b<br />

c<br />

6a<br />

b<br />

7<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

9<br />

h<br />

Statements, filed forthe calendar year ending with or within the year covered by this return - - - - - Za t<br />

lf at least one is reported on line 2a, did the organization file all required<br />

,<br />

federal<br />

th<br />

employment tax returns? <br />

Note. lf the sum of lines 1a and 2a is greater than 250, you may be required to e-file this return (see<br />

instructions)<br />

Did the organization have unrelated business gross income of $1 OOO or more during e year covered by<br />

thIsreturn7-..--.. . . . --.s.ss...-.se..---.--..-...-.--..--.- as --<br />

lf "Yes," has it filed a Fonn 990-T for this year? lf "No," provide an explanation in Schedule O - - <br />

At any time during the calendar year, did the organization have an interest in, or a signature or other authority<br />

over, a financial account in a foreign country (such as a bank account, securities account, or other financial<br />

acc0unt)7-.............-.-..........-......---<br />

lf "Yes enter the name of the foreign country P<br />

See the instructions for exceptions and tiling requirements for Form TD F 90-22 1, Report of Foreign Bank<br />

and Financial Accounts<br />

Was the organization a party to a prohibited tax shelter transaction at any time during th<br />

Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction?<br />

If "Yes," to line 5a or 5b, did the organization tile Form 8886-T, Disclosure by Tax-Exempt Entity Regarding<br />

Prohibited Tax Shelter Transaction? - - - - - - - - - - - - - - - - - - - - - - <br />

Does the organization have annual gross receipts that are nonnally greater than $100,000, and did the<br />

organization solicit any contributions that were not tax deductible? - - - - - - - <br />

lf "Yes," did the organization include with every solicitation an express statement that such contributions or<br />

glftswefen0(taXdeducUble7 . . . . . . . . . .. . . . . - - . . . . - . . - . <br />

..3a<br />

ui. .Y<br />

, Y -1t<br />

tv 5<br />

..4a - .<br />

A-f<br />

6b<br />

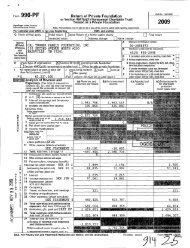

Organizations that may receive deductible contributions under section 170(c).<br />

Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods<br />

,.1 L-,Lf-, -alyef--1<br />

andservicesprovidedtothepayor? - - - - - - - - - - - - - - - - - - - - - - 7a X<br />

If "Yes," did the organization notify the donor of the value of the goods or services provided? - - <br />

-7b<br />

Did the organization sell, exchange, or otherwise dispose of tangible personal property for which it was<br />

requ"-edtofjIeFQrm82827 ........--..--.---.--.-..-.<br />

7c<br />

lf"Yes." indicate the number of Forms 8282 filed during the year - - - - - - - - - <br />

Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal<br />

benefifconffacf).-.---.-.....--.-.......--....-- ........... 19 u r<br />

-n-er-s. DL*-.L.<br />

Did the organization, during the year, pay premiums, directly or indirectly, on a personal<br />

benefit contract? . .. .. 7f<br />

For all contributions of qualified intellectual property, did the organization tile Form 8899 as required? - - .. ........ 7g<br />

For contnbutions of cars, boats, airplanes, and other vehicles, did the organization file a Form 1098-C as<br />

fequlred?.-...-......-....--..-...............<br />

etaxyealqasauoenan -.-.<br />

. . . . .......5b<br />

5 Wifi<br />

. . . . 2b X<br />

Sponsorlng organizations maintaining donor advised funds and section 509(a)(3) supporting<br />

organizations. Did the supporting organization, or a donor advised fund maintained byasponsoring ,,151 -gg .", -Y: J, -ll. * .<br />

organization, have excess business holdings at any time during the year? - - - - <br />

9<br />

,- .,,., , Sponsoring organizations maintaining donor advised funds.<br />

.-.I-,.e:.,,.,<br />

a Did the organization make any taxable distributions under section 4966? - - - - - . . . . . ...... 93<br />

b Did the organization make a distribution to a donor, donor advisor, or related person?<br />

10 Section 501(c)(7) organizations. Enter<br />

a Initiation fees and capital contnbutions included on Part VIII, line 12 - - - - - - - . . . . . ....10a 4- 1<br />

b Gross receipts. included on Form 990, Part Vlll, line 12, for public use of club facilities<br />

3 A ,<br />

11 Section 501 (c)(12) organizations. Enter<br />

a Gross income from members or shareholders - - - - - - - - - - - - - - - - - - .-..-....11<br />

.1<br />

....11b<br />

I.1<br />

1041?Iizbl<br />

A<br />

b Gross income from other sources (Do not net amounts due or paid to other sources against<br />

amountsdueorreceivedfromthem) - - - - - - - - - - - - - - - - - - - - - - <br />

12a Section 4947(a)(1) non-exempt charitable trusts. ls the organization tiling Form 990 in lieu of Form .. . . . . ...12a DQS-S<br />

.<br />

b lf "Yes," enter the amount of tax-exempt interest received or accmed during the year<br />

f i<br />

i EEA Form 990 (2009)<br />

, t<br />

J-ee , ,<br />

I 4,: V-I i<br />

.fxarq<br />

Iifitw<br />

17""<br />

.. 5,:<br />

5,2 1 , .<br />

3b<br />

,X<br />

:<br />

. VF,<br />

st-x<br />

X<br />

s J i<br />

4 1(<br />

1*.-PL<br />

..*-JL<br />

-.i-X.<br />

-6a<br />

. .........7h