. . . . . O - Charity Blossom

. . . . . O - Charity Blossom

. . . . . O - Charity Blossom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1a 1b ".<br />

Form<br />

1<br />

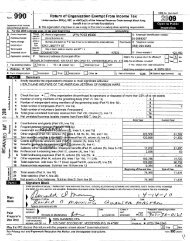

990 (2009) The Ch:i.1dren"s Cooparatlve, Inc. 04-2506891 Page9<br />

l-Bgftllll-ll Statement of Revenue<br />

9<br />

Total revenue Related or Unrelated Revenue<br />

* 1 exempt functi im (Bl ic) (Di<br />

business on revenue excluded under from sections tax<br />

revenue 512,<br />

I<br />

513,<br />

7<br />

or514<br />

.<br />

1c<br />

1d<br />

afnlh<br />

Progan<br />

Service<br />

Revdln<br />

1a Federated campaigns - <br />

b Membership dues - - - - -- - - <br />

c Fundraising events - - <br />

d Related organizations<br />

e Government grants (contributions) - 1ei 3,049<br />

.a i<br />

f All other contributions. gifts, grants,<br />

and similar amounts not included above 1f T<br />

9 Noncash contributions included in lines 1a-1f" $<br />

h Total. Add lines la-1f . . . . . . . . 3,04g<br />

23 Day care & education 624410<br />

170,342 79 73<br />

170,842-*MA 1-io,a42i<br />

J<br />

b<br />

C<br />

d<br />

e<br />

f All other program service revenueueeeuln<br />

- ,<br />

9 Total. Add lines 2a-2f <br />

Investment income (including dividends, interest, and<br />

other similar amounts) - <br />

* ,<br />

Income from investment of tax-exempt bond proceeds - - - P<br />

5 Royalties.......--.-.--..--..--..-.,<br />

(i) Real (ii) Personal ,<br />

6a Gross Rents - - - - -- <br />

,-<br />

.<br />

fi<br />

- ,--. 1<br />

.Lt,*<br />

"<br />

b Less rental expenses - - <br />

c Rental income or (loss) - <br />

d Net rental income or (loss)<br />

1a Gross amount from sales of<br />

(i)<br />

3,049<br />

Secunties<br />

-mi<br />

(ii)Other ",<br />

,X51<br />

1 - ,Lt I , L<br />

v. 4<br />

assets other than inventory<br />

b Less cost or other basis<br />

4<br />

and sales expenses - - <br />

iv" x r<br />

l<br />

1.<br />

c Gain or(loss) - - - - - <br />

d Net gain or (loss) - - - - . ..-..) MJ Y-*- Y I 4Y*<br />

Gross income from fundraising ,<br />

events (not including $<br />

of contributions<br />

ctivities ..-3b--?-<br />

fi.-in b<br />

reported<br />

Y K 4,<br />

on line<br />

3"* f<br />

1c)<br />

.3<br />

" j<br />

<br />

See Part IV, line1B - - - <br />

b Less direct expenses - <br />

c Net income or (loss) from fundraising events<br />

9a Gross income from gaming a<br />

.-......a See Part lV, line 19 - - - .. .<br />

. .<br />

P<br />

. ....b<br />

l<br />

.<br />

b Less direct expenses - - - - - - - - - - <br />

c Net income or (loss) from gaming activities <br />

10 Gross sales of inventory, less<br />

retums and allowances - <br />

b Less cost of goods sold <br />

c Net income or (loss) from salesofinventory - - - - - - - - - Miscellaneous Revenue msnw Code Y Y QI<br />

a<br />

b<br />

c<br />

d All other revenue - - - - <br />

e Total. Add lines 11a-11d<br />

12 Total revenue. See instructions . . . . ..<br />

EEA<br />

. . . . . ..<br />

Form<br />

. 5 173,969<br />

990<br />

170,942<br />

(2009)<br />

q -ia<br />

. I - ti,i