Trust account handbook - Department of Commerce - wa.gov.au

Trust account handbook - Department of Commerce - wa.gov.au

Trust account handbook - Department of Commerce - wa.gov.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

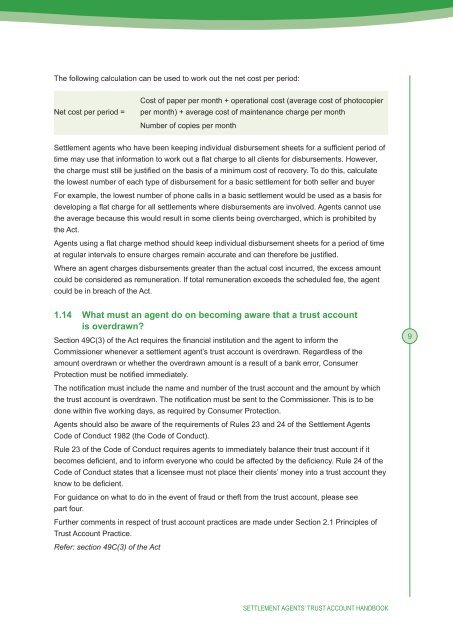

The following calculation can be used to work out the net cost per period:<br />

Net cost per period =<br />

Cost <strong>of</strong> paper per month + operational cost (average cost <strong>of</strong> photocopier<br />

per month) + average cost <strong>of</strong> maintenance charge per month<br />

Number <strong>of</strong> copies per month<br />

Settlement agents who have been keeping individual disbursement sheets for a sufficient period <strong>of</strong><br />

time may use that information to work out a flat charge to all clients for disbursements. However,<br />

the charge must still be justified on the basis <strong>of</strong> a minimum cost <strong>of</strong> recovery. To do this, calculate<br />

the lowest number <strong>of</strong> each type <strong>of</strong> disbursement for a basic settlement for both seller and buyer<br />

For example, the lowest number <strong>of</strong> phone calls in a basic settlement would be used as a basis for<br />

developing a flat charge for all settlements where disbursements are involved. Agents cannot use<br />

the average bec<strong>au</strong>se this would result in some clients being overcharged, which is prohibited by<br />

the Act.<br />

Agents using a flat charge method should keep individual disbursement sheets for a period <strong>of</strong> time<br />

at regular intervals to ensure charges remain accurate and can therefore be justified.<br />

Where an agent charges disbursements greater than the actual cost incurred, the excess amount<br />

could be considered as remuneration. If total remuneration exceeds the scheduled fee, the agent<br />

could be in breach <strong>of</strong> the Act.<br />

1.14 What must an agent do on becoming a<strong>wa</strong>re that a trust <strong>account</strong><br />

is overdrawn?<br />

Section 49C(3) <strong>of</strong> the Act requires the financial institution and the agent to inform the<br />

Commissioner whenever a settlement agent’s trust <strong>account</strong> is overdrawn. Regardless <strong>of</strong> the<br />

amount overdrawn or whether the overdrawn amount is a result <strong>of</strong> a bank error, Consumer<br />

Protection must be notified immediately.<br />

The notification must include the name and number <strong>of</strong> the trust <strong>account</strong> and the amount by which<br />

the trust <strong>account</strong> is overdrawn. The notification must be sent to the Commissioner. This is to be<br />

done within five working days, as required by Consumer Protection.<br />

Agents should also be a<strong>wa</strong>re <strong>of</strong> the requirements <strong>of</strong> Rules 23 and 24 <strong>of</strong> the Settlement Agents<br />

Code <strong>of</strong> Conduct 1982 (the Code <strong>of</strong> Conduct).<br />

Rule 23 <strong>of</strong> the Code <strong>of</strong> Conduct requires agents to immediately balance their trust <strong>account</strong> if it<br />

becomes deficient, and to inform everyone who could be affected by the deficiency. Rule 24 <strong>of</strong> the<br />

Code <strong>of</strong> Conduct states that a licensee must not place their clients’ money into a trust <strong>account</strong> they<br />

know to be deficient.<br />

For guidance on what to do in the event <strong>of</strong> fr<strong>au</strong>d or theft from the trust <strong>account</strong>, please see<br />

part four.<br />

Further comments in respect <strong>of</strong> trust <strong>account</strong> practices are made under Section 2.1 Principles <strong>of</strong><br />

<strong>Trust</strong> Account Practice.<br />

Refer: section 49C(3) <strong>of</strong> the Act<br />

9<br />

SETTLEMENT AGENTS’ TRUST ACCOUNT HANDBOOK