Trust account handbook - Department of Commerce - wa.gov.au

Trust account handbook - Department of Commerce - wa.gov.au

Trust account handbook - Department of Commerce - wa.gov.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

cross-referenced against the interim receipt in the computer system.<br />

When agents have issued interim receipts, they should review them on a weekly basis to ensure<br />

the formal trust receipt has been issued.<br />

2.4 <strong>Trust</strong> deposit forms<br />

Agents should make and retain a copy <strong>of</strong> every completed trust <strong>account</strong> deposit form.<br />

<strong>Trust</strong> <strong>account</strong> deposit forms should show:<br />

• the date <strong>of</strong> payment to the <strong>au</strong>thorised financial institution;<br />

• the name and number <strong>of</strong> the agent’s trust <strong>account</strong>; and<br />

• if the money is paid by cheque, the name <strong>of</strong> the drawer and the name and branch <strong>of</strong> the<br />

financial institution against which the cheque <strong>wa</strong>s drawn.<br />

Most standard bank deposit books issued by trading banks include this information.<br />

To assist in checking that all money paid into the trust bank <strong>account</strong> matches a trust <strong>account</strong><br />

receipt, it is useful for agencies with more than one branch to note the serial numbers <strong>of</strong> the<br />

receipts <strong>of</strong> the money banked on the copy <strong>of</strong> the bank deposit form. This practice assists in<br />

bookkeeping and will aid the <strong>au</strong>ditor when checking details <strong>of</strong> receipts against money banked.<br />

For example:<br />

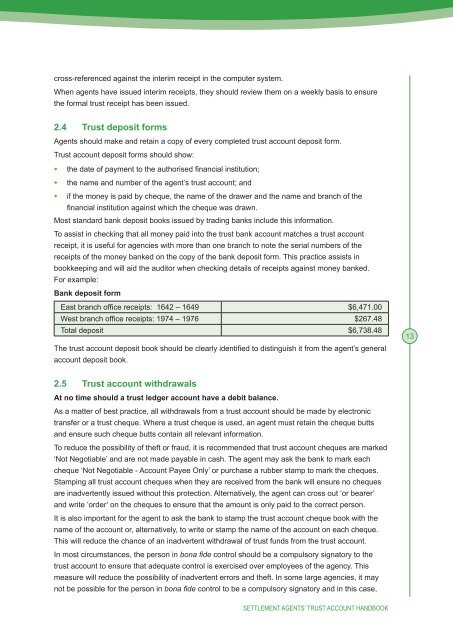

Bank deposit form<br />

East branch <strong>of</strong>fice receipts: 1642 – 1649 $6,471.00<br />

West branch <strong>of</strong>fice receipts: 1974 – 1976 $267.48<br />

Total deposit $6,738.48<br />

The trust <strong>account</strong> deposit book should be clearly identified to distinguish it from the agent’s general<br />

<strong>account</strong> deposit book.<br />

13<br />

2.5 <strong>Trust</strong> <strong>account</strong> withdra<strong>wa</strong>ls<br />

At no time should a trust ledger <strong>account</strong> have a debit balance.<br />

As a matter <strong>of</strong> best practice, all withdra<strong>wa</strong>ls from a trust <strong>account</strong> should be made by electronic<br />

transfer or a trust cheque. Where a trust cheque is used, an agent must retain the cheque butts<br />

and ensure such cheque butts contain all relevant information.<br />

To reduce the possibility <strong>of</strong> theft or fr<strong>au</strong>d, it is recommended that trust <strong>account</strong> cheques are marked<br />

‘Not Negotiable’ and are not made payable in cash. The agent may ask the bank to mark each<br />

cheque ‘Not Negotiable - Account Payee Only’ or purchase a rubber stamp to mark the cheques.<br />

Stamping all trust <strong>account</strong> cheques when they are received from the bank will ensure no cheques<br />

are inadvertently issued without this protection. Alternatively, the agent can cross out ‘or bearer’<br />

and write ‘order’ on the cheques to ensure that the amount is only paid to the correct person.<br />

It is also important for the agent to ask the bank to stamp the trust <strong>account</strong> cheque book with the<br />

name <strong>of</strong> the <strong>account</strong> or, alternatively, to write or stamp the name <strong>of</strong> the <strong>account</strong> on each cheque.<br />

This will reduce the chance <strong>of</strong> an inadvertent withdra<strong>wa</strong>l <strong>of</strong> trust funds from the trust <strong>account</strong>.<br />

In most circumstances, the person in bona fide control should be a compulsory signatory to the<br />

trust <strong>account</strong> to ensure that adequate control is exercised over employees <strong>of</strong> the agency. This<br />

measure will reduce the possibility <strong>of</strong> inadvertent errors and theft. In some large agencies, it may<br />

not be possible for the person in bona fide control to be a compulsory signatory and in this case,<br />

SETTLEMENT AGENTS’ TRUST ACCOUNT HANDBOOK