Trust account handbook - Department of Commerce - wa.gov.au

Trust account handbook - Department of Commerce - wa.gov.au

Trust account handbook - Department of Commerce - wa.gov.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

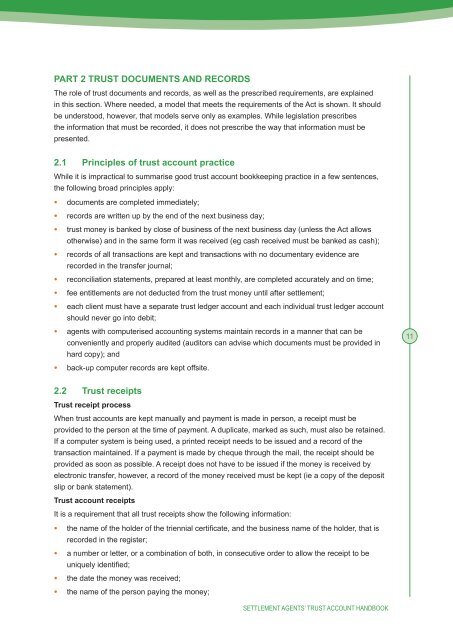

PART 2 TRUST DOCUMENTS AND RECORDS<br />

The role <strong>of</strong> trust documents and records, as well as the prescribed requirements, are explained<br />

in this section. Where needed, a model that meets the requirements <strong>of</strong> the Act is shown. It should<br />

be understood, however, that models serve only as examples. While legislation prescribes<br />

the information that must be recorded, it does not prescribe the <strong>wa</strong>y that information must be<br />

presented.<br />

2.1 Principles <strong>of</strong> trust <strong>account</strong> practice<br />

While it is impractical to summarise good trust <strong>account</strong> bookkeeping practice in a few sentences,<br />

the following broad principles apply:<br />

• documents are completed immediately;<br />

• records are written up by the end <strong>of</strong> the next business day;<br />

• trust money is banked by close <strong>of</strong> business <strong>of</strong> the next business day (unless the Act allows<br />

otherwise) and in the same form it <strong>wa</strong>s received (eg cash received must be banked as cash);<br />

• records <strong>of</strong> all transactions are kept and transactions with no documentary evidence are<br />

recorded in the transfer journal;<br />

• reconciliation statements, prepared at least monthly, are completed accurately and on time;<br />

• fee entitlements are not deducted from the trust money until after settlement;<br />

• each client must have a separate trust ledger <strong>account</strong> and each individual trust ledger <strong>account</strong><br />

should never go into debit;<br />

• agents with computerised <strong>account</strong>ing systems maintain records in a manner that can be<br />

conveniently and properly <strong>au</strong>dited (<strong>au</strong>ditors can advise which documents must be provided in<br />

hard copy); and<br />

• back-up computer records are kept <strong>of</strong>fsite.<br />

11<br />

2.2 <strong>Trust</strong> receipts<br />

<strong>Trust</strong> receipt process<br />

When trust <strong>account</strong>s are kept manually and payment is made in person, a receipt must be<br />

provided to the person at the time <strong>of</strong> payment. A duplicate, marked as such, must also be retained.<br />

If a computer system is being used, a printed receipt needs to be issued and a record <strong>of</strong> the<br />

transaction maintained. If a payment is made by cheque through the mail, the receipt should be<br />

provided as soon as possible. A receipt does not have to be issued if the money is received by<br />

electronic transfer, however, a record <strong>of</strong> the money received must be kept (ie a copy <strong>of</strong> the deposit<br />

slip or bank statement).<br />

<strong>Trust</strong> <strong>account</strong> receipts<br />

It is a requirement that all trust receipts show the following information:<br />

• the name <strong>of</strong> the holder <strong>of</strong> the triennial certificate, and the business name <strong>of</strong> the holder, that is<br />

recorded in the register;<br />

• a number or letter, or a combination <strong>of</strong> both, in consecutive order to allow the receipt to be<br />

uniquely identified;<br />

• the date the money <strong>wa</strong>s received;<br />

• the name <strong>of</strong> the person paying the money;<br />

SETTLEMENT AGENTS’ TRUST ACCOUNT HANDBOOK