Contents - Ashgate

Contents - Ashgate

Contents - Ashgate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

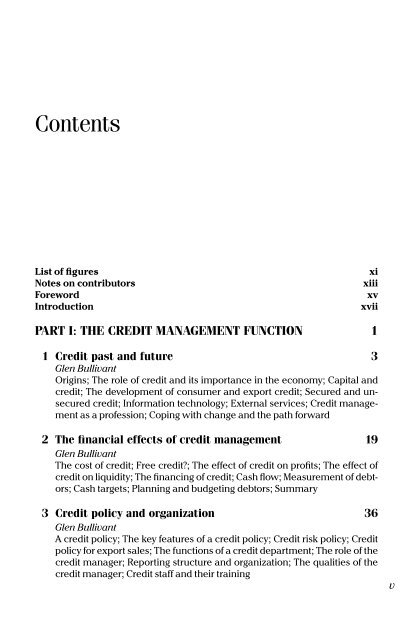

<strong>Contents</strong><br />

List of figures<br />

Notes on contributors<br />

Foreword<br />

Introduction<br />

xi<br />

xiii<br />

xv<br />

xvii<br />

PART I: THE CREDIT MANAGEMENT FUNCTION 1<br />

1 Credit past and future 3<br />

Glen Bullivant<br />

Origins; The role of credit and its importance in the economy; Capital and<br />

credit; The development of consumer and export credit; Secured and unsecured<br />

credit; Information technology; External services; Credit management<br />

as a profession; Coping with change and the path forward<br />

2 The financial effects of credit management 19<br />

Glen Bullivant<br />

The cost of credit; Free credit?; The effect of credit on profits; The effect of<br />

credit on liquidity; The financing of credit; Cash flow; Measurement of debtors;<br />

Cash targets; Planning and budgeting debtors; Summary<br />

3 Credit policy and organization 36<br />

Glen Bullivant<br />

A credit policy; The key features of a credit policy; Credit risk policy; Credit<br />

policy for export sales; The functions of a credit department; The role of the<br />

credit manager; Reporting structure and organization; The qualities of the<br />

credit manager; Credit staff and their training<br />

v

CREDIT MANAGEMENT HANDBOOK<br />

PART II: CREDIT TERMS AND CONDITIONS OF SALE 61<br />

4 Credit terms and conditions of sale 63<br />

Glen Bullivant<br />

Credit terms; The factors affecting credit terms; Conditions of sale; Types<br />

of credit terms; Cash discounts; Late payment interest; Progress payments,<br />

retentions and consignment accounts; Methods of payment<br />

PART III: ASSESSING CREDIT RISK 79<br />

5 Assessing risks in trade credit 81<br />

Glen Bullivant<br />

Credit assessment overview; Marketing and risk assessment; Customer<br />

identity – types of customer; Trade credit information and its sources; Financial<br />

statements; Interpretation of accounts; Summary<br />

6 Credit ratings and risk categories 121<br />

Glen Bullivant<br />

Why have credit ratings?; Calculating credit ratings; Risk categories; Identifying<br />

and dealing with high-risk accounts; Bad debt reserves; Effective<br />

credit management<br />

7 Predicting corporate insolvency by computer 140<br />

Glen Bullivant<br />

Background; Developing and using a solvency model; Credit management<br />

applications<br />

8 Insolvency warning signs 146<br />

Glen Bullivant<br />

Background; Attitude; The three phases of failure; Can it be avoided?; Conclusion<br />

PART IV: SALES LEDGER 159<br />

9 Sales ledger administration 161<br />

Glen Bullivant<br />

Administration and format; Statements; Disputes and queries; Cash matching;<br />

Collection aids; Controls<br />

10 Computer systems for credit management 175<br />

Glen Bullivant<br />

System requirements; The sales ledger and customer file<br />

vi

CONTENTS<br />

PART V: CASH COLLECTION 187<br />

11 Collecting trade debts 189<br />

Glen Bullivant<br />

The front end; Collection attitudes; Days sales outstanding (DSO) and cash<br />

targets; Incentives; Computer aids to collection; Methods; The future<br />

12 Telephone collection 226<br />

Glen Bullivant<br />

The telephone; Staff; Making the call; Customer excuses; Win-win; Conclusion<br />

13 Using collection agencies 246<br />

Glen Bullivant<br />

The collection agency; The right agency?; Choosing the agency; The CSA<br />

14 Planning, measuring and reporting debtors 251<br />

Burt Edwards<br />

The need to plan debtors and then to report the results; The powerful tool<br />

– the DSO ratio; Budgets and reports; Measurable items<br />

PART VI: CREDIT INSURANCE 275<br />

15 Home trade credit insurance 277<br />

T Glyndwr Powell<br />

Introduction; Features of credit insurance policies; When does cover commence?;<br />

Benefits of credit insurance; Importance of brokers; Captives and<br />

mutuals; Domestic credit insurers; Further reading; Useful addresses<br />

16 Export credit insurance 295<br />

T Glyndwr Powell<br />

Introduction; Differences between domestic and export credit insurance;<br />

Country (political) risks; Commercial (customer) risks; Pre-shipment<br />

cover: suitable for companies making specialist goods to order and not<br />

easily resold elsewhere; Level of indemnity; Credit insurance compared to<br />

confirmed letters of credit; Sources of export cover; The UK’s governmentsupported<br />

export credit agency – ECGD – and medium-term credit; Further<br />

reading; Useful addresses<br />

vii

CREDIT MANAGEMENT HANDBOOK<br />

PART VII: EXPORT CREDIT AND FINANCE 305<br />

17 Export credit and collections 307<br />

Burt Edwards<br />

Exporting is expensive – so manage the expense!; Time and cost in export<br />

payments; Effective conditions of sale; Agents, distributors and subsidiaries;<br />

Export documents; Payment terms; Countertrade; Tender and performance<br />

bonds; Getting funds transferred from abroad; Checking the risk of payment<br />

delays; Information on country (political) risks; Information on customer<br />

risks; Evaluating customer risks; Codifying information; Collecting overdues<br />

– an overview; A systematic approach; A word about foreign currency;<br />

Checklist: to speed export cash; The future for export collections; Think<br />

international<br />

18 Export finance 341<br />

Burt Edwards<br />

The need for special money for exports; Enhanced overdraft; Bill advances<br />

and negotiation; Export finance banks; Finance from letters of credit; ECGDbacked<br />

finance: medium-term credit; The international consensus<br />

19 Foreign exchange 350<br />

Burt Edwards<br />

The credit manager and foreign currency; The history of foreign exchange;<br />

Present day foreign exchange markets; Dealing operations; Press charts of<br />

foreign currency rates; Exchange risks and how to cover them; The European<br />

Monetary System and ECU, leading to the Euro; The UK and the Euro;<br />

Summary; Glossary of foreign exchange terms<br />

PART VIII: CONSUMER CREDIT 367<br />

20 Retail credit management 369<br />

Glen Bullivant<br />

Securing finance for the credit operation; Relationship with finance houses;<br />

Types of credit available; Credit policy; Controlling the risk; Collecting<br />

accounts; Collection letters by computer; Management information and<br />

reports<br />

21 Consumer credit law 396<br />

Peter C Coupe<br />

Introduction; Development of consumer credit law; The Consumer Credit<br />

Act; The Data Protection Act 1998; Other laws; Codes of practice; Conclusion<br />

and further reading<br />

viii

CONTENTS<br />

PART IX: COMMERCIAL CREDIT LAW 417<br />

22 Legal action for debt recovery 419<br />

Robert Addlestone and Gareth Allen<br />

Pre-action steps; Alternative dispute resolution (ADR); Information needed<br />

to commence proceedings; Issuing the claim form; Completing the form;<br />

Service of the claim form; The next stage; Defended actions; Enforcement<br />

23 Insolvency procedures 449<br />

Malcolm Cork<br />

Introduction; Personal insolvency; Partnerships; Corporate insolvency; Creditors’<br />

voluntary liquidation; Members’ voluntary liquidation; Receivership;<br />

Company voluntary arrangement; Administration order; Informal schemes<br />

PART X: CREDIT SERVICES 469<br />

24 Invoice financing 471<br />

Ted Ettershank<br />

What’s the difference between factoring and invoice discounting?; How<br />

does invoice financing work?; How does factoring work?; How does invoice<br />

discounting vary from factoring?; When to use factoring; Points to be aware<br />

of when considering invoice financing; Choosing a factor<br />

25 Credit cards 475<br />

Peter C Coupe<br />

Introduction; What are credit cards?; Early development in the USA; UK market<br />

development; Credit and debit card spending and borrowing; The cost<br />

of credit; The cost of payments; The cost of promoting cards; Fraud and bad<br />

debt; Chips and electronic purse<br />

26 Sales finance and leasing 492<br />

T Glyndwr Powell<br />

Introduction to sales finance; Benefits of sales finance to buyer and seller;<br />

Types of sales finance; Funding the credit advanced; Which product is best<br />

for what?; Summary; Sources of information; Further reading<br />

Appendix 515<br />

Glen Bullivant<br />

Membership organizations for credit management personnel; Training and<br />

consultancy services for credit management; Sources of credit information;<br />

Useful addresses; Useful credit publications; Query management systems;<br />

The better payment practice group; Credit policy and procedures; Suggested<br />

contents for a credit manual<br />

Index 541<br />

ix