ANNUAL REPORT 2006

ANNUAL REPORT 2006

ANNUAL REPORT 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

P L AT I N U M A U S T R A L I A A N N U A L R E P O R T 2 0 0 6<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE <strong>2006</strong><br />

NOTE 15: COMMITMENTS AND CONTINGENCIES (continued)<br />

Contingencies<br />

(a)<br />

Native Title Claims<br />

Legislative developments and judicial decisions (in particular the uncertainty created in the area of Native<br />

Title rights by the High Court’s decisions in the “Mabo”, “Wik” and “Miriuwung-Gajerrong” cases and native<br />

title legislation) may have an adverse impact on the Consolidated Entity’s exploration and production activities<br />

and its ability to fund those activities. It is impossible at this stage to quantify the impact (if any) which these<br />

developments may have on the Consolidated Entity’s operations.<br />

The Company is aware of native title claims in respect of areas in which the Consolidated Entity currently has<br />

an interest. It is possible that further claims could be made in the future. However, the Company cannot<br />

determine whether any current or future claims, if made, will succeed and if so, what the implications would<br />

be for the Consolidated Entity. In the case of the Panton project, however, as these leases were granted prior<br />

to January 1994 there are no native title implications.<br />

(b)<br />

(c)<br />

Performance Bonds<br />

As disclosed in Note 6(b)(i), the Consolidated Entity has provided performance bonds amounting to $116,500<br />

(2005: $106,500) to the Department of Industry and Resources in respect of compliance with environmental<br />

conditions in relation to certain tenements.<br />

South African Bank Guarantee<br />

As disclosed in Note 6(b)(ii), the Consolidated Entity has provided a bank guarantee amounting to<br />

ZAR12,047,500 to secure the acquisition of an interest in the Smokey Hills Project and is subject to the<br />

Government approval of the transfer of a new order right. Refer to Note 20(c) for details of a subsequent<br />

event in relation to this matter.<br />

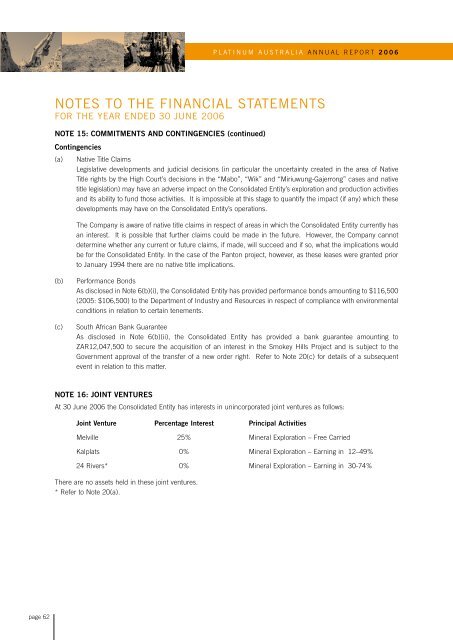

NOTE 16: JOINT VENTURES<br />

At 30 June <strong>2006</strong> the Consolidated Entity has interests in unincorporated joint ventures as follows:<br />

Joint Venture Percentage Interest Principal Activities<br />

Melville 25% Mineral Exploration – Free Carried<br />

Kalplats 0% Mineral Exploration – Earning in 12–49%<br />

24 Rivers* 0% Mineral Exploration – Earning in 30-74%<br />

There are no assets held in these joint ventures.<br />

* Refer to Note 20(a).<br />

page 62