ANNUAL REPORT 2006

ANNUAL REPORT 2006

ANNUAL REPORT 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

P L AT I N U M A U S T R A L I A A N N U A L R E P O R T 2 0 0 6<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE <strong>2006</strong><br />

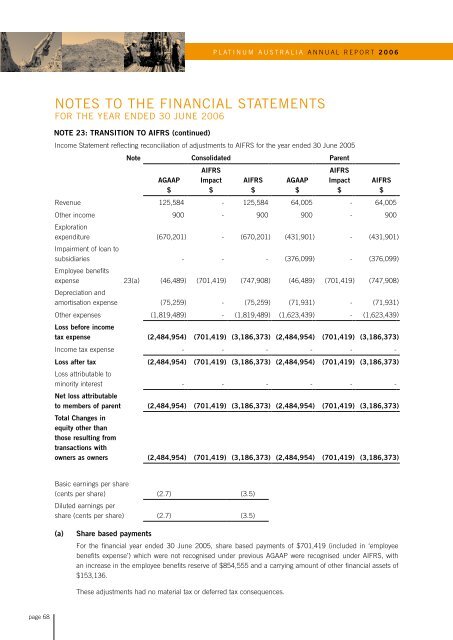

NOTE 23: TRANSITION TO AIFRS (continued)<br />

Income Statement reflecting reconciliation of adjustments to AIFRS for the year ended 30 June 2005<br />

Note Consolidated Parent<br />

AGAAP<br />

$<br />

AIFRS<br />

Impact<br />

$<br />

AIFRS<br />

$<br />

AGAAP<br />

$<br />

AIFRS<br />

Impact<br />

$<br />

AIFRS<br />

$<br />

Revenue 125,584 - 125,584 64,005 - 64,005<br />

Other income 900 - 900 900 - 900<br />

Exploration<br />

expenditure (670,201) - (670,201) (431,901) - (431,901)<br />

Impairment of loan to<br />

subsidiaries - - - (376,099) - (376,099)<br />

Employee benefits<br />

expense 23(a) (46,489) (701,419) (747,908) (46,489) (701,419) (747,908)<br />

Depreciation and<br />

amortisation expense (75,259) - (75,259) (71,931) - (71,931)<br />

Other expenses (1,819,489) - (1,819,489) (1,623,439) - (1,623,439)<br />

Loss before income<br />

tax expense (2,484,954) (701,419) (3,186,373) (2,484,954) (701,419) (3,186,373)<br />

Income tax expense - - - - - -<br />

Loss after tax (2,484,954) (701,419) (3,186,373) (2,484,954) (701,419) (3,186,373)<br />

Loss attributable to<br />

minority interest - - - - - -<br />

Net loss attributable<br />

to members of parent (2,484,954) (701,419) (3,186,373) (2,484,954) (701,419) (3,186,373)<br />

Total Changes in<br />

equity other than<br />

those resulting from<br />

transactions with<br />

owners as owners (2,484,954) (701,419) (3,186,373) (2,484,954) (701,419) (3,186,373)<br />

Basic earnings per share<br />

(cents per share) (2.7) (3.5)<br />

Diluted earnings per<br />

share (cents per share) (2.7) (3.5)<br />

(a)<br />

Share based payments<br />

For the financial year ended 30 June 2005, share based payments of $701,419 (included in ‘employee<br />

benefits expense’) which were not recognised under previous AGAAP were recognised under AIFRS, with<br />

an increase in the employee benefits reserve of $854,555 and a carrying amount of other financial assets of<br />

$153,136.<br />

These adjustments had no material tax or deferred tax consequences.<br />

page 68