2008 ANNUAL REPORT - Hakrinbank

2008 ANNUAL REPORT - Hakrinbank

2008 ANNUAL REPORT - Hakrinbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2008</strong> <strong>ANNUAL</strong> <strong>REPORT</strong>

MISSION<br />

<strong>Hakrinbank</strong> is a dynamic, innovative bank that provides its clients<br />

with a comprehensive range of high quality financial services.<br />

Our highly skilled employees collaborate together as a team<br />

to deliver customized services for optimal client satisfaction.<br />

VISION<br />

Our vision is to be Suriname’s preferred bank<br />

by providing high quality financial services.<br />

CORE VALUES<br />

<strong>Hakrinbank</strong> has defined four core values that provide guidance in<br />

realising its strategic objectives, the activities that support these<br />

and the translation to its organisational structure, systems and<br />

values, norms and behaviours within the organisation, namely:<br />

- Reliability<br />

- Service and customer focus<br />

- Teamwork<br />

- Quality<br />

These core values are anchored in <strong>Hakrinbank</strong>’s organisational<br />

structure and culture and form the guiding principles for all of its<br />

activities. They clearly delineate what the bank stands for and form<br />

a benchmark for all that the bank does.

THEME <strong>2008</strong><br />

SMALL AND<br />

MEDIUM ENTERPRISES<br />

In this annual report we focus on our country’s small and medium enterprise<br />

(SME) sector by highlighting a number of our SME clients. From an<br />

economic perspective the SME is of great importance to Suriname taking<br />

into account that by far the most enterprises belong to this segment.As a<br />

source of employment and productivity, the SME is of special importance<br />

and it is here where most of the technical and organizational innovations<br />

also take place.The potential of the SME sector is often underrated but<br />

fortunately this perception is changing.The <strong>Hakrinbank</strong> is a committed<br />

partner of the SME sector and has supported companies throughout their<br />

evolution: from startup to growth. And this will not change in the future!

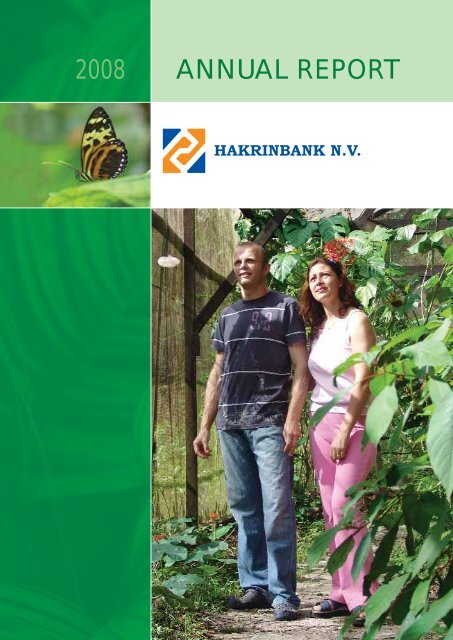

NEO<br />

TROPICAL<br />

INSECTS<br />

‘A hobby<br />

that<br />

became<br />

much<br />

more’<br />

This is how Ewout<br />

Eriks describes the<br />

company that he<br />

founded with his wife<br />

Amira Mendienta.<br />

As the only butterfly<br />

cultivator in the<br />

Caribbean, Neo<br />

Tropical Insects has<br />

grown to become a<br />

beautiful and unique<br />

Surinamese company<br />

that exports butterflies<br />

and butterfly<br />

poppies to Europe<br />

and North America.<br />

The company also<br />

offers tours to<br />

tourists and other<br />

visitors.

| 3 |<br />

CONTENTS<br />

Mission, Vision, Core Values 3<br />

Organisation Chart 4<br />

Division of Functions 5<br />

Five years of consolidated statements 6<br />

Report of the Supervisory Board 8<br />

Report of the Executive Board<br />

Introduction 12<br />

Economic developments in <strong>2008</strong><br />

Business of the bank<br />

Nationale Trust- en Financierings Maatschappij N.V.<br />

Financial developments of the bank<br />

Auditor’s Report<br />

Financial Statements <strong>2008</strong> (as of 31 December <strong>2008</strong>)<br />

Consolidated balance before earnings distribution<br />

Consolidated balance after earnings distribution<br />

Consolidated income statement<br />

Consolidated cash flow statement<br />

Company balance before earnings distribution<br />

Company balance after earnings distribution<br />

Consolidated income statement<br />

Notes to the financial statements<br />

Additional Information<br />

Resumes and details regarding ancillary positions of members<br />

of the Supervisory Board and Executive Board of <strong>Hakrinbank</strong><br />

Addresses<br />

Suriname: key macroeconomic indicators

| 4 |<br />

ORGANISATION CHART AS OF 31-12-<strong>2008</strong><br />

Chief Executive Officer<br />

Chief Operating Officer<br />

Chief Financial Officer<br />

Deputy Officer<br />

Operations<br />

Human Resources &<br />

General Affairs<br />

Information &<br />

Communication<br />

Technology<br />

Internal Audit<br />

Risk<br />

Management<br />

Insurance<br />

Domestic<br />

Credits<br />

Treasury &<br />

Securities<br />

Credit<br />

Administration<br />

Cash<br />

Nationale Trust- &<br />

Financierings<br />

Mij. N.V.<br />

Administration &<br />

Management<br />

Information<br />

(Financial<br />

Controlling)<br />

Foreign Transfers<br />

Affiliates<br />

(Operations)<br />

Affiliates (Credits)<br />

Administration &<br />

Management<br />

Information<br />

(Accounting)<br />

Compliance & Legal<br />

Maintenance<br />

& Technical<br />

Support<br />

Marketing & Public<br />

Relations

| 5 |<br />

ORGANISATION CHART AS OF 31-12-<strong>2008</strong><br />

SUPERVISORY BOARD<br />

Mr. A.K.R. Shyamnarain<br />

Drs. H.B. Abrahams<br />

Ir. R.A. Mac Donald<br />

G. Lie Sem-Nawikromo<br />

H.R. Ramdhani<br />

Drs. M.M. Sandvliet M.Sc.<br />

Drs. J.J.F. Tjang-A-Sjin<br />

- President<br />

- Vice President<br />

EXECUTIVE BOARD<br />

Drs. J.D. Bousaid<br />

Mr. M.M Tjon A Ten<br />

Drs. G.M. Raghoenathsingh MBA<br />

- Chief Executive Officer<br />

- Chief Operating Officer<br />

- Chief Financial Officer<br />

DEPUTY OFFICER<br />

H.S.K. Liu Hung Chung<br />

- Operations<br />

Mr. M.M. Tjon A Ten<br />

Human Resources &<br />

General Affairs<br />

Mr. M. Naarendorp, Head<br />

Drs. I. Lo Fo Sang<br />

Insurance<br />

R. Tjon A Kon, Head<br />

Credit Administration<br />

Drs. I. Loenersloot, Head<br />

Compliance & Legal<br />

Mr. M. Schaap<br />

Maintenance & Technical<br />

Support<br />

R. Tjokro, Head<br />

Foreign Transfers<br />

L. Karg, Interim Head<br />

Information & Communication<br />

Technolog y<br />

R. Tjong Akiet, Head<br />

Ing. R. Mahabier<br />

A. Semoedi<br />

Domestic<br />

M.Tjon, Head<br />

Cash<br />

M. van ‘t Kruys, B.Ec., Head<br />

Affiliates<br />

Branchmanagers<br />

- Tourtonne<br />

Drs. V. Ramtahalsing<br />

- Nieuwe Haven<br />

Drs. N. Elshot-Chelius<br />

- Latour<br />

R. Wimpel<br />

Drs. A. Lau<br />

- Flora<br />

Drs. R. Mohamatsaid<br />

Drs. J.D. Bousaid<br />

Credits<br />

Drs. S. Jadoenathmisier, Coördinator<br />

Account Managers:<br />

C. Halfhide-Chou<br />

Drs. S. Kisoensing-Jhauw<br />

Drs. T. Gonesh<br />

Ir.P.Quintius<br />

E. Frangie M.Sc.<br />

R. Soedamah, B.Ec.<br />

Nationale Trust- &<br />

Financierings Mij. N.V.<br />

H. Vijzelman, Head<br />

Drs. R. Sitaram, Deputy Head<br />

G. Jong M.Sc.<br />

Internal Audit<br />

B. Jewbali, Head<br />

Drs. R. van Trikt<br />

Marketing & Public Relations<br />

Drs. N. Elliot M.Sc.<br />

Affiliates<br />

Branchmanagers<br />

- Nickerie<br />

R. Mangala, Head<br />

A. Anandbahadoer, Deputy Head<br />

- Tamanredjo<br />

S. Resomardono<br />

Drs. G. M. Raghoenathsingh MBA<br />

Treasury & Securities<br />

Drs. P. Tjon Kiem Sang, Head<br />

Drs. R. Amirkhan<br />

Administration & Management<br />

R. Liesdek, Accounting<br />

Drs. R. Sheorajpanday, Fin. controlling<br />

Risk Management<br />

R. Vanenburg B.Ec.

| 6 |<br />

FIVE YEARS OF KEY CONSOLIDATED FIGURES<br />

(in thousands of SRD)<br />

<strong>2008</strong> 2007 2006 2005 2004<br />

Balance sheet<br />

Cash and cash equivalents 151,702.4 120,230.2 104,159.4 97,240.7 104,589.0<br />

Due from Clients 544,400.8 431,991.8 306,449.0 229,730.0 161,942.5<br />

Other assets 276,508.7 243,530.7 195,854.6 144,708.6 133,074.3<br />

Total assets 972,611.9 795,752.7 606,463.0 471,679.3 399,605.8<br />

Savings 435,833.9 328,758.9 238,981.7 185,265.1 121,691.3<br />

Other funds 482,307.0 423,688.4 334,243.6 265,183.5 262,371.4<br />

Shareholders’ equity 54,471.0 43,305.4 33,237.7 21,230.7 15,543.1<br />

Total Liabilities 972,611.9 795,752.7 606,463.0 471,679.3 399,605.8<br />

Income Statement<br />

Operating income 63,255.0 55,123.8 49,236.5 36,659.5 27,500.6<br />

Operating expenses 34,841.5 29,983.5 27,848.8 21,690.5 17,405.2<br />

Provision for credit risks 2,107.2 1,242.6 1,439.3 1,725.9 1,515.9<br />

Earnings before tax 26,306.3 23,897.7 19,948.4 13,243.1 8,579.5<br />

Taxes 9,470.3 8,603.2 7,181.4 4,767.5 3,088.5<br />

Net Income 16,836.0 15,294.5 12,767.0 8,475.6 5,491.0<br />

Cash Dividend 5,588.4 5,122.7 4,657.0 2,731.8 1,862.8<br />

Ratios (in %)<br />

Efficiency ratio 55 54 56 59 63<br />

Return on average equity 34.4 40.0 46.9 46.1 39.9<br />

Return on average assets 1.90 2.18 2.37 1.95 1.69<br />

Capital ratio 5.60 5.44 5.48 4.50 3.89<br />

BIS ratio 11.49 10.56 11.31 10.01 10.19<br />

Stock information *)<br />

Number of outstanding shares 465,696 465,696 465,696 465,696 465,696<br />

Net earnings per share 36.15 32.84 27.41 18.20 11.79<br />

Dividend per share 12.00 11.00 10.00 6.07 4.00<br />

Dividend (% of par) 8,000.00 7,333.33 6,666.67 3,910.67 2,666.68<br />

Payout ratio (%) 33.19 33.49 36.48 32.23 33.92<br />

Book value equity 116.97 92.99 71.37 45.59 33.38<br />

Market price per share 174.00 150.00 136.00 124.00 106.00<br />

Market capitalisation (x SRD 1,000) 81,031 69,854 63,335 57,746 49,364<br />

Number of employees 262 252 254 247 238<br />

Number of branches 7 7 7 7 7<br />

*) x SRD 1. The amounts have been adjusted for the purposes of comparison and are based on a par value of SRD 0.15 per share.

| 7 |<br />

YOUR<br />

SOLUTIONS<br />

“Let your challenges be<br />

our solutions.”<br />

Ruben Kort and Raoul Brahim offer various tailor-made<br />

ICT solutions.Among other services their company offers its<br />

clients strategic advice and programs to streamline their<br />

business processes in the area of ICT.

| 8 |<br />

<strong>REPORT</strong> OF THE SUPERVISORY BOARD<br />

To the shareholders<br />

In general<br />

It is our pleasure to present our activities for the book<br />

year <strong>2008</strong>, in which the activities of the Audit<br />

Committee and the Remuneration and Nomination<br />

Committee will also be discussed. We have also<br />

included our recommendation with regards to the<br />

financial statements for the book year and the<br />

proposed distribution of earnings.<br />

Activities of the Supervisory Board<br />

The Supervisory Board held eleven ordinary<br />

meetings and fifteen extraordinary meetings during<br />

<strong>2008</strong>. Ordinary meetings are held monthly with the<br />

Executive Board, while extraordinary meetings<br />

depend on the topics to be discussed and are normally<br />

attended only by members of the Supervisory<br />

Board. Our supervision focused primarily on the<br />

company’s results and strategy, and included regular<br />

discussions of results achieved to date as presented by<br />

the Executive Board, and approval of the 2009 Policy<br />

Memorandum, together with the accompanying<br />

Operational and Investment Budget for 2009. Other<br />

agenda items included corporate governance, risk<br />

management and a number of other items. Some of<br />

these are discussed in greater detail below.<br />

Corporate Governance<br />

The company continuously strives to inform its shareholders<br />

and other stakeholders on relevant developments<br />

regarding its activities. Publication in August<br />

<strong>2008</strong> of the midyear figures as audited by an external<br />

accountant, and the timely distribution to shareholders<br />

of notes of the annual General Shareholders’<br />

Meeting, are perfectly in line with this objective.<br />

The corporate governance code of the company is<br />

intended to act as an instrument for responsible<br />

management. Transparency, integrity and trust play<br />

an important part in achieving this. It is therefore<br />

necessary to regularly evaluate this code and modify<br />

accordingly in the case of changes to the bank’s<br />

operating environment. In this respect the Board has<br />

initiated an evaluation programme in which the<br />

current corporate governance code will also be<br />

subject to an audit by an external expert. In doing so<br />

the Board wishes to gain insight into the extent by<br />

which rules and procedures, as laid out in the bank’s<br />

Corporate Governance Codes, are still in tandem with<br />

actual international best practices - and hence indicate<br />

where modifications may be necessary. It is our intention<br />

to have such audits of the current corporate<br />

governance code carried out on a regular basis.<br />

In so far it has not been discussed elsewhere in this<br />

report, the activities of the Supervisory Board are in<br />

compliance with the policies as laid out in the<br />

Corporate Governance Code of the company.<br />

Activities relating to the Executive Board<br />

With the formal appointment of drs. G.M. Raghoenathsingh<br />

MBA as Financial Director (Chief Financial<br />

Officer) on 1 July <strong>2008</strong>, the Executive Board has now<br />

become complete. The Supervisory Board wishes<br />

Mr Raghoenathsingh the best of luck in carrying out<br />

his tasks and reiterates its full support in his execution<br />

of the Executive Board’s strategies.<br />

The Supervisory Board has again closely followed the<br />

international economic developments so as to, when<br />

necessary, be able to discuss with the Executive Board<br />

strategies to prevent or limit negative effects on the<br />

bank’s operations. The Supervisory Board has in<br />

collaboration with the Executive Board decided to<br />

intensify discussions that are related to these developments.<br />

Activities of the Audit Committee<br />

The Audit Committee has focussed in this book year<br />

on financial developments within the bank, as laid out<br />

in the Operational and Investment Budget <strong>2008</strong>, the<br />

monthly realized figures as received by the Executive<br />

Board, the reports from the Administration &<br />

Management Information (AMI) department, and<br />

the internal and external accountant. The Committee<br />

has made suggestions in the areas of cost containment<br />

and efficiency improvements that have been adopted<br />

by a multi-disciplinary working group within the<br />

bank. In light of the optimisation of the risk management<br />

of that department, the Committee has, in<br />

collaboration with an external accountant, carefully<br />

scrutinized policies and procedures of the department<br />

of Foreign Transfers. This has resulted in<br />

proposals aimed at controlling specific risks. The<br />

Committee has already reported its activities and<br />

findings during the ordinary meetings of the<br />

Supervisory Board.

| 9 |<br />

Activities of the Remuneration and Nomination<br />

Committee<br />

The Remuneration and Nomination Committee<br />

focused in <strong>2008</strong> on the incorporation of the newly<br />

appointed CFO, drs. G.M. Raghoenathsingh MBA, in<br />

the compensation structure of the Executive Board.<br />

Furthermore the Committee prepared proposals for<br />

the Board concerning the adjustment and modification<br />

of salaries and other provisions for the<br />

Executive Board in <strong>2008</strong>. Against this backdrop the<br />

Committee, with the support of an actuarial firm, also<br />

focussed its attention on the preparation of a pension<br />

fund for the Executive Board and will be tasked with<br />

implementing pension regulations for the Board. In<br />

addition the committee has continued with the<br />

further preparation of a performance management<br />

system for the Executive Board The importance of a<br />

well functioning system still requires the necessary<br />

preparation and as a result the Committee has not yet<br />

been able to make a final proposal to the Supervisory<br />

Board. The Committee has always reported on its<br />

activities in the meetings of the Supervisory Board.<br />

Independence and composition of the<br />

Supervisory Board<br />

The Supervisory Board believes that all of its<br />

members comply with the requirements for<br />

independence as referred to in the <strong>Hakrinbank</strong> N.V.<br />

corporate governance code. Information on the<br />

individual Board members and their ancillary<br />

positions can be found elsewhere in this report.<br />

Drs. J.J.F. Tjang-A-Sjin steps down at his own request<br />

as member. The Supervisory Board thanks him for his<br />

contributions to the Board during his time as<br />

member; he has proposed to the General Shareholders’<br />

Meeting the appointment of drs.A.K. Moensi-<br />

Sokowikromo to fill up the vacancy. There were no<br />

further changes in the Supervisory Board during<br />

<strong>2008</strong>, and the Board continues to have seven members.<br />

Ir. R.A. Mac Donald and Mr. A.K.R. Shyamnarain are<br />

the next supervisory board members scheduled to<br />

resign by rotation. Both have confirmed that they<br />

wish to be considered for reappointment. The<br />

Supervisory Board recommends the appointment of<br />

drs. A.K. Moensi-Sokowikromo and the reappointment<br />

of ir. R.A. Mac Donald and Mr. A.K.R. Shyamnarain.<br />

Financial statements and proposed distribution of<br />

earnings<br />

The Supervisory Board is pleased to present the<br />

bank’s financial statements for the <strong>2008</strong> book year.<br />

ANN BIO CARE SKIN<br />

CLINIC<br />

In a luxurious environment Michelle Bab-<br />

Lo Fo Sang offers her clients high-tech<br />

care in the area of skin improvement and<br />

figure corrections.Ann Bio Skin care<br />

differentiates itself through the use of<br />

modern technology and devices.

| 10 |<br />

These financial statements comprise the company<br />

balance sheet as per 31 December, the company<br />

income statement, the consolidated balance sheet as<br />

per 31 December, the consolidated income statement,<br />

the consolidated cash flow statement and the accompanying<br />

notes. The financial statements have been<br />

audited by external auditors, as required by the bank’s<br />

Articles of Incorporation. This report includes the<br />

auditors’ approval of the financial statements.<br />

The operating result is essentially the outcome of the<br />

realization of the policy objectives defined in the <strong>2008</strong><br />

Policy Memorandum which were implemented by the<br />

Executive Board. This year too, the operating result was<br />

boosted to some degree by the continuing positive<br />

developments in Suriname’s macro-economic<br />

environment.<br />

The environment in <strong>2008</strong> has not been left unmarked<br />

from the less than conducive international developments<br />

that originally manifested itself as an international<br />

credit crisis, but later grew out to become a<br />

full fledged international economic crisis that finds its<br />

effects in the real economy. The ramifications of the<br />

international economic crisis are also noticeable in<br />

Suriname, despite the continued forecast of real<br />

positive growth. The sharp decline in the international<br />

prices of amongst others crude oil and<br />

aluminium has had a negative effect on state income,<br />

the balance of payments and the economic growth.<br />

The Supervisory Board is confident that through the<br />

adoption of sound policies the government and other<br />

parties in the socioeconomic arena will be able to<br />

contain the negative effects of the international<br />

economic crisis.<br />

Earnings before tax amounted to SRD 26.31 million,<br />

with a net earnings after tax of SRD 16.84 million. We<br />

propose distributing SRD 5.59 million of this for<br />

dividend pay-out to the shareholders and transferring<br />

SRD 11.25 million to retained earnings. This means a<br />

dividend of SRD 12 per share with SRD 0.15 par<br />

value. An amount of SRD 4.00 per share was<br />

previously distributed as an interim dividend in<br />

August <strong>2008</strong>, which means a final dividend of<br />

SRD 8.00 per share with SRD 0.15 par value. The<br />

dividend to be distributed accounts for 33.2%<br />

of the net earnings and corresponds to a dividend<br />

percentage of 8,000%.<br />

We recommend that you, our shareholders, adopt<br />

these financial statements and thus ratify the<br />

Executive Board’s management and the Supervisory<br />

Board’s supervision of the bank in the reporting year.<br />

We also recommend that you approve the proposed<br />

distribution of the earnings for the year.<br />

Our gratitude for the good results<br />

The Supervisory Board would like to express its<br />

gratitude for the way in which the Executive Board<br />

represented the company’s interests during the<br />

reporting year and specifically its efforts and the<br />

strategic choices that produced the good operating<br />

results for the year. We would also like to thank the<br />

management and other employees for the way in<br />

which they have individually contributed to a successful<br />

year for the bank and wish to express our<br />

recognition of the vital role that they have played in<br />

achieving the objectives set. We would also like to<br />

thank our clients and all the other parties who have<br />

placed their trust and confidence in <strong>Hakrinbank</strong> N.V.<br />

throughout the year and provided such a strong<br />

foundation for a mutually beneficial relationship. Last<br />

but not least, we would like to thank you, our shareholders,<br />

for your support of our work.<br />

This inspires us as an organisation to continue to<br />

strive for excellence in all that we do.<br />

Paramaribo, 14 April 2009<br />

Supervisory Board<br />

Mr. A.K.R. Shyamnarain - Chairman<br />

Drs. H.B. Abrahams - Deputy Chairman<br />

G. Lie Sem-Nawikromo<br />

Ir. R.A. Mac Donald<br />

H.R. Ramdhani<br />

Drs. M.M. Sandvliet M.Sc.<br />

Drs. J.J.F. Tjang-A-Sjin

| 11 |<br />

ZUS & ZO<br />

Fusion:<br />

everything<br />

under<br />

the sun.<br />

Zus & Zo is exploited by Brian van ‘t Kruys and Daphne Bruyne.<br />

Next to being a bistro with international meals, a souvenir shop,<br />

a ticketing office for tours to the interior and a guesthouse, they<br />

also frequently organize events such as exhibitions, film and<br />

discussion evenings, and jam sessions.

| 12 |<br />

<strong>REPORT</strong> OF THE EXECUTIVE BOARD<br />

To our shareholders<br />

We herewith present you with our annual report for<br />

the book year <strong>2008</strong>. It is with great pleasure that<br />

we can report that our bank has again been able to<br />

realize satisfactory results. These are the result of the<br />

strong performance of the Surinamese economy and<br />

successful execution of the bank’s strategy despite a<br />

backdrop of increased turbulence on the international<br />

financial and other markets, and competition within<br />

the Surinamese financial sector.<br />

Macroeconomic indicators showed a positive picture<br />

in <strong>2008</strong> that was duly translated into increased<br />

consumer and manufacturer confidence. In real terms<br />

the economy grew by nearly 7% and again there was a<br />

surplus in the government’s budget and balance of<br />

payments. Our bank has been able to capitalize on<br />

these positive economic developments.<br />

The most important objectives were to achieve<br />

sustainable growth, increase earnings capacity,<br />

optimize the composition of the balance sheet,<br />

improve efficiency and strengthen risk management as<br />

well as customer relations management. In addition<br />

our aim was to increase employee satisfaction and our<br />

social corporate citizenship. Tangible results were<br />

realized in a number of areas. Despite the fact that<br />

satisfactory results were booked, the financial<br />

objectives were not entirely realized as a result of oneoff<br />

setbacks.<br />

Total consolidated assets increased by 22.2% to<br />

SRD 972.6 million, in line with our projections. The<br />

market share of the <strong>Hakrinbank</strong> as measured by its<br />

total assets grew by 1.5 percentage points to nearly<br />

25%. Our most important assets, lending to corporates<br />

and consumers increased by 26% to SRD 544.4 million,<br />

somewhat higher than budgeted. The quality of the<br />

credit portfolio stayed at its previous level; the nonperforming<br />

ratio was a mere 1.72%.<br />

Income before tax grew by 10.1% to SRD 26.3 million;<br />

this is lower than projected. This was the result of an<br />

unforeseen depreciation in value of our international<br />

investment portfolio and the occurrence of other oneoff<br />

costs. Of the income after tax of SRD 16.8 million,<br />

SRD 5.6 million will be distributed as dividend to our<br />

shareholders: a pay-out ratio of 33.2%.<br />

The performance ratios of the bank declined slightly<br />

however they remained at a satisfactory level. The<br />

return on assets was 1.9% and the return on average<br />

equity 34.4%. The efficiency ratio decreased by<br />

1 percentage point to 55%. Our objective remains to<br />

improve the performance ratios of the bank through<br />

growth and efficiency improvements.<br />

In June of <strong>2008</strong> we reopened our renovated and<br />

expanded branch at the Nieuwe Havencomplex. It is a<br />

modern “Banking Centre”, where clients can expect<br />

an expedited and efficient handling of their banking<br />

needs. With this investment of nearly USD 0.5 million<br />

we aim to capitalize on the current renovation and<br />

expansion of the Nieuwe Haven in Paramaribo that is<br />

expected to lead to an increase in business activity.<br />

We plan to also open up a new branch mid 2009 in the<br />

new departure and arrivals hall of the J.A. Pengel<br />

international airport. This branch is also intended to<br />

cater to our clients in the wider surrounding area of<br />

the airport.<br />

In the last quarter of the reporting year we introduced<br />

our <strong>Hakrinbank</strong> MasterCard credit cards. With this<br />

product our clients can carry out transactions in all<br />

countries where MasterCard is accepted.<br />

Our subsidiary, the Nationale Trust- en Financierings<br />

Maatschappij N.V., has booked satisfactory results.All<br />

production objectives were comfortably reached. The<br />

balance grew by 33% to SRD 146 million, especially<br />

thanks to the increase in lending. Revenues increased<br />

by 14%, however income decreased by 2% because of<br />

an increase in costs.<br />

The share price of “<strong>Hakrinbank</strong> N.V.” rose on the<br />

Surinamese Stock Exchange by 16% to SRD 174 at<br />

<strong>2008</strong> year end. Dividend in the book year <strong>2008</strong> was<br />

SRD 12 per share of par value SRD 0.15 of which<br />

SRD 4 was already distributed in September <strong>2008</strong> as<br />

an interim dividend. Expressed as a percentage of the<br />

par value of one share (SRD 0.15) the dividend comes<br />

down to 8,000%. This represents an attractive return

| 13 |<br />

for our shareholders and a favourable price/earnings<br />

ratio.<br />

In the remainder of this annual report we will present<br />

in more detail the economic developments of <strong>2008</strong><br />

that are relevant to our bank’s performance. This<br />

report is more detailed than is customary in the<br />

banking sector because we decided that the limited<br />

availability of, and access to, up-to-date statistical<br />

information for large parts of the society justified<br />

devoting extra attention to these aspects in our<br />

annual report. We subsequently discuss in this report<br />

various developments within <strong>Hakrinbank</strong> and<br />

Nationale Trust- en Financierings Maatschappij, as<br />

well as the bank’s financial development and the<br />

proposed distribution of earnings.<br />

From left to right:<br />

drs. G. Raghoenathsingh, Chief Financial Officer,<br />

mr. M. Tjon A Ten, Chief Operating Officer,<br />

drs. J. Bousaid, Chief Executive Officer en<br />

H. Liu Hung Chung, Deputy Officer Operations.

| 14 |<br />

HEDI INFRA N.V. Economic Developments in <strong>2008</strong><br />

Hedi Infra N.V. constructs electric and<br />

water distribution systems.<br />

In the daily operations the company’s<br />

belief in working with environmentallyfriendly,<br />

sustainable and innovative materials<br />

is clearly manifested.<br />

<strong>2008</strong> will be recognized in the history books as the<br />

year in which the international financial crisis erupted<br />

in all its fury. It marked the beginning of a worldwide<br />

economic recession that had all the ingredients to<br />

make its effects deep and fundamentally game<br />

changing. Ever more often parallels are drawn<br />

between this recession and the Great Depression of<br />

the 30’s of the last century.<br />

The year <strong>2008</strong> shall also be etched in our memory as<br />

the year in which democrat Barack Obama was<br />

elected by a large majority as the first black president<br />

of the United Stated of America. He is faced with an<br />

enormous task of getting the derailed American<br />

economy back on track and repairing the tarnished<br />

image of the United States internationally.<br />

The direct effects of the international financial crisis<br />

on our country are as of yet limited. The global<br />

economic crisis that followed will however leave its<br />

marks on the Surinamese economy especially during<br />

2009 and 2010. Our country has however in the past<br />

years been able to build financial and other buffers<br />

that should enable it to weather the crisis relatively<br />

unscathed.<br />

The macroeconomic performance of Suriname<br />

remained in <strong>2008</strong> – as in previous years - robust, for<br />

which compliments were given by the Article IV<br />

Consultation Mission of the International Monetary<br />

Fund (IMF) and the rating agency “Standard &<br />

Poor’s”.<br />

According to estimates by the IMF, real economic<br />

growth was approximately 6.8%, somewhat higher<br />

than in 2007. This growth was the result of an<br />

increase in demand on the world markets for our<br />

most important export goods during most of the year.<br />

Consumer spending also rose, as well as the volume of<br />

investments.<br />

A surplus was realized on the current account of the<br />

balance of payments that added to the increase in the<br />

monetary reserve. The public finances closed (on a<br />

cash basis) with a surplus, while the national debt<br />

showed only a slight increase.<br />

On a less positive note, the abovementioned developments<br />

also led to the acceleration of the inflation rate<br />

as a result of the increased price of oil and staple

| 15 |<br />

foods, the appreciation of the Euro, and the stagnant<br />

development of the country’s productivity. Since<br />

October inflation has showed a decrease mainly due<br />

to dropping import prices as a result of the worldwide<br />

economic recession and the appreciation of the<br />

US dollar - to which our currency is pegged - vis-à-vis<br />

the Euro.<br />

In this chapter we aim to discuss more in detail the<br />

economic developments that have taken place in our<br />

country during the <strong>2008</strong> book year.<br />

Government Finances<br />

As can be seen from the table below, the actual figures<br />

of government finances were significantly better on a<br />

cash basis than initially budgeted by the National<br />

Assembly in <strong>2008</strong>.<br />

Actual current expenditure was as follows (in millions<br />

of SRD):<br />

Realised Budgeted Realised<br />

2007 <strong>2008</strong> <strong>2008</strong><br />

Wages and salaries 692.4 754.8 758.5<br />

Goods and services 411.0 435.2 435.8<br />

Subsidies/<br />

Government grants 458.9 397.3 487.7<br />

Interest on state debt 94.5 74.8 60.8<br />

Total current<br />

expenditure 1,656.8 1,662.1 1,742.8<br />

Budget for <strong>2008</strong> financial year (in millions of SRD)<br />

Description Expenditures Income Difference As % of GDP<br />

Current account 1,662.1 1,720.5 58.4 0.8<br />

Capital account 551.8 0.0 -551.8 -7.4<br />

Total current and capital account 2,213.9 1,720.5 -493.4 -6.6<br />

* Source: Financial Memorandum <strong>2008</strong> and 2009<br />

Thanks primarily to higher than forecast direct and<br />

indirect tax revenues, together with lower than<br />

budgeted capital expenditures, the country recorded a<br />

surplus.<br />

Income on the current account totalled SRD 2,111.1<br />

million, which was SRD 345.6 million, or 20%, higher<br />

than budgeted.<br />

Realised Budgeted Realised<br />

2007 <strong>2008</strong> <strong>2008</strong><br />

Direct taxes 737,6 672,2 835,5<br />

Indirect taxes 731,5 672,0 878,7<br />

Non-tax<br />

revenues 359,1 421,3 396,9<br />

Total income 1,828,2 1,765,5 2,111,1<br />

Expenditures on the current account totalled<br />

SRD 1,742.8 million, which was SRD 80.7 million, or<br />

5%, above budgetary forecasts.<br />

Wages and salaries in <strong>2008</strong> rose by around 8%, in line<br />

with budgetary forecasts. The increase in current<br />

public expenditures was furthermore the result of a<br />

rise in subsidies and government grants by SRD 487.7<br />

million. These expenditures formed more than a<br />

quarter of all current account expenditures, which<br />

can be regarded as high.<br />

The surplus on the current account totalled<br />

SRD 368.3 million or SRD 264.9 million higher than<br />

budgeted. Because of the limited execution capacity<br />

available for the implementation of projects, only a<br />

limited number of investment projects were realized.<br />

As a result capital expenditures were SRD 278.4 million,<br />

significantly lower than budgeted.<br />

The developments presented above resulted in a total<br />

budget surplus of SRD 145.9 million, or approximately<br />

2% of the Gross Domestic Product (GDP),<br />

instead of the budgeted deficit of SRD 493.4 million.<br />

Despite the positive figures realised above, government<br />

finances remained structurally weak. No significant<br />

measures were taken to improve this situation

| 16 |<br />

Another challenge to the government finances is<br />

posed by the possible negative ramifications of the<br />

worldwide recession. Constant monitoring and a<br />

proactive stance are therefore essential to balance the<br />

government’s financial affairs as well as the economy.<br />

National Debt<br />

Domestic as well as internationally placed government<br />

debt has increased in <strong>2008</strong>. It should be noted<br />

that the definition of state debt used in the State Debt<br />

Act differs from the definition widely used internationally.<br />

According to the Surinamese definition, state<br />

debt includes undrawn amounts under committed<br />

loan facilities and also State guarantees that have not<br />

been called, whereas the international markets do not<br />

normally include these items.<br />

This in turn leads to an overestimation of the real<br />

debt. The extent and nature of Suriname’s domestic<br />

and foreign state debt are shown below.<br />

The domestic debt increased by SRD 48.2 million or<br />

8.3% to SRD 628 million. By entering into a number<br />

of loan agreements resulting from the financing of<br />

large infrastructural projects, future debt repayments<br />

have increased in SRD as well as in foreign currencies.<br />

This explains the strong increase of the line item<br />

“State guarantees and committed loans”. The internationally<br />

placed debt increased by USD 16.7 million or<br />

5.6% to USD 315.4 million. This rise is predominantly<br />

the result of arrears on the bilateral loans from<br />

Brazil and the United States.<br />

The Surinamese government is in negotiations with<br />

these befriended nations in order to find a solution to<br />

this debt situation. Despite the increase of the national<br />

debt, Suriname’s debt ratio (debt as a percentage of<br />

GDP) of 25% is still on the low side. This ratio has<br />

consistently shown a downward trend in recent years.<br />

Year end<br />

Lender Type <strong>2008</strong>*) 2007 2006<br />

Domestic debt by lender type (x SRD 1000)<br />

Debt to Central Bank of Suriname 397,272 302,598 326,007<br />

Debt to Banks 85,649 151,204 206,395<br />

Debt to Private Clients 145,112 126,007 118,438<br />

Total domestic debt 628,033 579,809 650,840<br />

State guarantees 25,628 21,931 19,547<br />

Committed Loans 260,860 31,037 50,646<br />

Total domestic debt including state guarantees 914,521 632,778 721,034<br />

and committed loans<br />

Foreign debt by lender type (x USD 1000)<br />

Multilateral lenders 72,936 70,437 63,083<br />

Bilateral lenders 242,456 228,303 322,950<br />

Commercial lenders 0 0 5,077<br />

Total foreign debt 315,392 298,740 391,110<br />

State Guarantees 18,789 19,873 0<br />

Committed Loans 309,800 120,807 107,104<br />

Total foreign debt including State Guarantees<br />

and committed Loans 643,981 439,420 498,213<br />

*) preliminary figures<br />

Source: Government Debt Management Office

| 17 |<br />

Monetary Developments<br />

The Central Bank of Suriname’s monetary policy<br />

remained unchanged in <strong>2008</strong>. The mandatory cash<br />

reserve requirements for SRD as well as foreign<br />

currencies remained unchanged. On January 2 <strong>2008</strong><br />

the interest rate on Treasury Bills of the Republic of<br />

Suriname were further decreased from 8% to 7.5%<br />

per annum while the Central Bank discount rate fell<br />

from 10% to 9.5% per annum.<br />

The expanded monetary aggregate, M2, an important<br />

indicator for monetary policy, rose in the <strong>2008</strong> book<br />

year by SRD 209.5 million or 15.4% to SRD 1,569.8<br />

million. This increase, that was less than in 2007, was<br />

predominantly due to an increase in bank lending to<br />

the private sector and less by liquidity inflows from<br />

abroad. It is also noteworthy to mention that the fiscal<br />

behaviour of the government resulted in a substantial<br />

liquidity destruction of SRD 228.7 million.<br />

Liquidity growth has led to a small increase in the<br />

liquidity ratio (domestic monetary aggregate (M2) as<br />

% of GDP), to an estimated 21%. This variable<br />

currently hovers under the long-term average<br />

of25%.It should,however,be noted that payments<br />

and bank balances in foreign currencies do not<br />

form part of M2. Aforementioned balances rose by<br />

SRD 138.9 million (as converted) or 8.4% to<br />

SRD 1,796 million – this is 114.4% of M2. The room<br />

for liquidity as a consequence needs to be closely<br />

monitored in order to reign in inflation.<br />

Despite the fact that cash reserve requirements<br />

remain unchanged, interest rates have shown a<br />

further downward trend. This is in part due to the<br />

large liquid position of the banking system and the<br />

intensified competition. The average interest rate<br />

spreads of commercial banks declined as a result by 1<br />

percentage point to 5.6%. In 2005 this was still at<br />

9.6%. With the USD loans interest rate margins fell by<br />

0.1 percentage points to 6.5% and with Euro loans<br />

margins fell by 0.3 percentage points.<br />

Foreign Exchange<br />

The official foreign exchange rate with the US dollar,<br />

our most important foreign trade currency, has seen<br />

negligible fluctuations in <strong>2008</strong>. The following chart<br />

shows the monthly movements in the buy and sell<br />

quotes for the US dollar in <strong>2008</strong>.<br />

The following table shows the changes in the money supply in the Surinamese economy<br />

(M2, in millions of SRD):<br />

<strong>2008</strong>*) 2007*) 2006<br />

1. Liquidity created for the state -228.7 -114.3 -31.7<br />

2. Lending to the private sector 244.5 154.1 58.8<br />

3. Other liquidity created 16.6 -228.5 -89.2<br />

Total domestic liquidity created 32.4 -188.7 -62.1<br />

4. Liquidity from abroad 177.1 466.8 263.9<br />

Total 1 to 4 209.5 278.1 201.8<br />

Liquidity ratio (M2 : Nominal GNP market prices) 20.9 1) 20.4 18.9<br />

*) Preliminary figures<br />

1) Own estimates<br />

Source: Central Bank of Suriname

| 18 |<br />

USD:SRD buy and sell quotes <strong>2008</strong><br />

2.82<br />

2.80<br />

2.78<br />

2.76<br />

2.74<br />

2.72<br />

2.70<br />

jan<br />

feb<br />

mar<br />

apr<br />

may<br />

june<br />

july<br />

aug<br />

sept<br />

oct<br />

nov<br />

dec<br />

Buy<br />

2.758<br />

2.758<br />

2.757<br />

2.757<br />

2.758<br />

2.758<br />

2.758<br />

2.761<br />

2.754<br />

2.753<br />

2.758<br />

2.756<br />

Sell<br />

2.800<br />

2.800<br />

2.800<br />

2.800<br />

2.800<br />

2.800<br />

2.800<br />

2.800<br />

2.801<br />

2.800<br />

2.800<br />

2.800<br />

The situation in <strong>2008</strong> with respect to the foreign<br />

exchange market is almost the same as it was in 2007.<br />

At that time there was upward pressure on the<br />

exchange rate for the USD. This pressure was<br />

apparently the result of a shortage in supply that<br />

extended to the months in which there was normally<br />

an increased supply (June till August and December).<br />

The increased demand can be in part allocated to<br />

speculators and those looking for arbitrage opportunities<br />

in the foreign exchange market. Non banking<br />

institutes offered foreign currency at a number of<br />

basis points above the maximum that the Central<br />

Bank of Suriname has laid down. The commercial<br />

banks, obliged to comply to these ceilings, lost<br />

competitive terrain as a result. The Central Bank of<br />

Suriname has by means of foreign currency interventions<br />

tried to relieve the upward pressure on the USD,<br />

however these have had insufficient effect.<br />

The EUR:USD exchange rate displayed strong<br />

volatility in <strong>2008</strong>, in contrast to the upward trend<br />

shown in 2007. This volatility stimulated trading in<br />

these currencies in order to earnings from volatility<br />

swings. Given that the SRD is linked to the USD and<br />

consequently floats against the Euro, exchange rates<br />

movements between the SRD and the Euro are<br />

directly linked to the EUR:USD movements on the<br />

international foreign exchange markets. In June the<br />

free market Euro exchange rate reached an all time<br />

high of approximately SRD 4.50. In October this rate<br />

dropped to a low of SRD 3.63 before regaining some<br />

of its value to end up at SRD 4.00 year end. The Euro<br />

sell rate of the Central Bank dropped from SRD 4.13<br />

as of year end 2007 to SRD 3.81 at the end of <strong>2008</strong>.<br />

Balance of Payments<br />

An average increase of prices of our most important<br />

exports namely crude oil, gold and to a lesser extent<br />

alumina resulted in a rise in export value by 28.2% to<br />

USD 1,689.2 million. Thanks to the increased trade<br />

and production and the increase in consumer<br />

demand, imports also increased by USD 412.5 million<br />

or 36.7% to USD 1,537.6 million. Because of imports<br />

outweighing our exports, the surplus on the balance<br />

of payments accounts decreased by USD 40 million to<br />

USD 151.6 million.<br />

There was a larger deficit on the services account as a<br />

result of increased expenditures. The primary balance<br />

again showed a surplus that was in part due to the<br />

increased interest rate income from bank investments<br />

in the international money and capital markets, and<br />

the decreased interest rate payments to non citizens.<br />

Due to the abovementioned developments the surplus<br />

on the current account decreased by USD 88.6 million<br />

to USD 124.6 million. The movements on the<br />

various sub-accounts that make up the balance of

| 19 |<br />

Balance of payments on cash basis<br />

(in millions of US dollars)<br />

<strong>2008</strong>*) 2007*) 2006<br />

Goods 151.6 192.1 232.3<br />

Services -132.5 -62.0 -34.9<br />

Primary Incomes 18.1 5.7 -51.6<br />

Income Transfers 87.4 77.4 35.9<br />

Balance current accounts 124.6 213.2 181.7<br />

Capital account -33.2 -186.4 -159.6<br />

Items still to be classified 1) -47.0 131.3 66.9<br />

Balance non-monetary 44.4 158.1 89.0<br />

sectors<br />

*) preliminary figures<br />

1) Movements in residents’ foreign currency accounts.<br />

Source: Central Bank of Suriname<br />

payments resulted in the balance of the non-monetary<br />

sectors diminishing to USD 44.4 million, substantially<br />

lower than in 2007.<br />

The worldwide economic recession has since the<br />

fourth quarter of <strong>2008</strong> led to a substantial drop in<br />

world commodity prices especially of crude oil and<br />

alumina. The overall revenues from these important<br />

commodities shall as a result drop and it is to be<br />

expected that this will also affect our balance of payments<br />

for 2009.<br />

Monetary reserve<br />

Due to the surplus in the balance of payments, net<br />

foreign assets rose in <strong>2008</strong> by USD 65.6 million or<br />

15% to USD 501.5 million. This growth is however<br />

less than in 2007 due to the smaller surplus. This<br />

reserve translates into almost 4 months import<br />

coverage of goods and services and lies somewhat<br />

above the internationally accepted standard of at least<br />

3 months.<br />

Development of the monetary reserve<br />

(in millions of USD)<br />

Year-end<br />

Description <strong>2008</strong>*) 2007*) 2006<br />

1. Monetary authorities<br />

a. Gold reserves 42.3 34.8 23.0<br />

b. IMF special drawing rights 0.6 0.9 1.3<br />

c. IMF reserve position 9.5 9.7 9.2<br />

d. Foreign exchange receivables 624.7 396.0 237.8<br />

e. Foreign exchange owed to residents -200.9 -40.1 -28.8<br />

f. Secured foreign exchange obligations -0.6 -0.6 -0.6<br />

Total 1 475.6 400.7 241.9<br />

2. Currency banks<br />

a. Foreign exchange receivables 379.8 409.0 303.5<br />

b. Foreign exchange owed to residents -319.2 -339.9 -253.7<br />

c. Foreign exchange owed to non-residents -28.4 -27.7 -24.3<br />

Total 2 32.2 41.4 25.5<br />

Total 1 +2 507.8 442.1 267.4<br />

3. Amounts owed in SRD to non-residents -6.3 -6.2 -6.2<br />

Net foreign exchange assets 501.5 435.9 261.2<br />

*) preliminary figures<br />

Source: Central Bank of Suriname

| 20 |<br />

The expected deterioration of the balance of payments<br />

in 2009 shall also have its effect on the monetary<br />

reserve. A continued build up of this reserve is in our<br />

view necessary in order to protect the value of the<br />

Surinamese dollar. In addition, in view of the high<br />

dollarization level of bank balances, we deem it<br />

beneficial that the Central Bank builds up an extra<br />

reserve that it can utilize if the Bank needs to act as a<br />

lender of last resort in case of (temporary) bank<br />

liquidity shortfalls.<br />

The Surinamese Stock Exchange<br />

The following table provides an overview of trade on the Surinamese Stock Exchange in <strong>2008</strong><br />

Stock Par value Trading Volume Closing share price<br />

per share # shares SRD dec. dec.<br />

2007 <strong>2008</strong><br />

Assuria 0.10 2,536 44,601 15.50 19.05<br />

C.I.C. 0.01 3,167 24,202 6.80 8.00<br />

DSB Bank 0.10 1,229 22,383 47.25 20.00<br />

Elgawa 0.01 28 224 6.00 8.00<br />

<strong>Hakrinbank</strong> 0.15 302 49,902 150.00 174.00<br />

Margarine & Vettenfabriek 0.01 3,082 16,797 5.20 5.45<br />

Self Reliance 0.01 270 2,514 8.60 9.10<br />

Surinaamse Brouwerij 5.00 - - 98.00 125.00<br />

Torarica 0.10 600 29,950 39.20 54.00<br />

Varossieau 0.10 - - 16.00 16.60<br />

VSH-United 0.01 50 1,100 21.50 22.00<br />

Total shares 11,264 191,673<br />

- Exchange Index as of 31 December <strong>2008</strong>: 2,323,0<br />

- Source: Securities Trading Association of Suriname<br />

On the Surinamese Stock Exchange the effective turnover<br />

dropped by 90% to SRD 192,000 in comparison<br />

with the year before. The number of traded shares<br />

also declined. In the case of 2 stocks there were no<br />

transactions at all. The most actively traded shares<br />

were those of the <strong>Hakrinbank</strong>, Assuria and Torarica,<br />

which accounted for 26.0%, 23.3% and 15.6% respectively<br />

of the total trading volume in SRD.<br />

The number of listings remained unchanged. The<br />

most active brokers were the DSB bank and<br />

<strong>Hakrinbank</strong> which accounted for 37.7% and 37.5% of<br />

the total trading volume in SRD terms.<br />

The stock index reflecting the developments in<br />

(weighted) market capitalisation of all listed stocks,<br />

rose in <strong>2008</strong> by 553.3 points or 31% to 2,323.0. This<br />

increase lay well above the inflation rate, which means<br />

that the average investment in shares generated an<br />

attractive return in real terms during the year.<br />

The distribution of stock dividend of 300% in the<br />

book year of <strong>2008</strong> has resulted in a decrease in the<br />

share price for the DSB Bank.<br />

The Banking System in Suriname<br />

In contrast to many banks elsewhere in the world,<br />

Surinamese banks have in <strong>2008</strong> experienced a<br />

favourable development. The relative isolation from<br />

the international banking system has prevented<br />

contagion by risky structured finance products such<br />

as collateralized debt obligations, assets backed<br />

securities and credit default swaps, leaving the<br />

Suriname banking system relatively unscathed. Assets<br />

as well as lending increased substantially and earnings<br />

ability remained in line.

| 21 |<br />

Key figures of the general banking sector in Suriname (in millions of SRD)<br />

Year-end <strong>2008</strong>*) 2007*) 2006<br />

Total assets 4,438.9 3,745.7 2,871.0<br />

Funds available for lending and cash/cash equivalents<br />

Funds on current accounts 818.6 696.6 539.7<br />

(Compulsory cash reserve) (227.1) 6) (197.9) 4) (179.4) 2)<br />

591.5 498.7 360.3<br />

Savings 464.1 408.9 311.8<br />

Term deposits 219.8 181.8 126.5<br />

Capital and reserves 233.2 195.2 157.3<br />

Total funds available for lending and cash/cash equivalents 1,508.6 1,284.6 955.9<br />

Lending and investments<br />

in SURINAMESE DOLLARS 1,270.3 5) 953.9 3) 764.2 1)<br />

in US DOLLARS 295.7 223.8 177.4<br />

in EURO 60.0 54.3 44.7<br />

Key ratios<br />

Capital Adequacy ratio I<br />

(capital and reserves as % of total assets) 5.25 5.21 5.48<br />

Capital Adequacy ratio II<br />

(capital and reserves as % of lending) 10.24 11.14 11.30<br />

1. Excluding provision for bad and doubtful debts of SRD 36,1 million *) preliminary figures<br />

2. Excluding cash reserve of SRD 76,8 million for housing loans Source: Central Bank of Suriname<br />

3. Excluding provision for bad and doubtful debts of SRD 42,7 million<br />

4. Excluding cash reserve of SRD 115,9 million for housing loans<br />

5. Excluding provisions for bad and doubtful debts of SRD 46,2 million<br />

Excluding cash reserve of SRD 146,3 million for housing loans<br />

Total consolidated assets rose by 18.5% to SRD 4,438.9<br />

million while total lending rose by more than 31%.<br />

Funds available for lending rose less rapidly than the<br />

growth in SRD lending, in turn leading to less room<br />

for liquidity. The Capital Adequacy ratio I remained<br />

relatively unchanged. The Capital Adequacy ratio II<br />

according to the BIS definition decreased to more<br />

than 10% and remained above the accepted norm<br />

of 8%.<br />

Previous annual reports discussed the increasing<br />

US dollarization of bank balance sheets and the<br />

implications of this in detail. The Central Bank of<br />

Suriname and the commercial banks’ executive<br />

boards have pursued policies aimed at reversing this<br />

trend. The Central Bank has laid down a high foreign<br />

exchange cash reserve obligation of 33.3% on<br />

commercial banks and is considering increasing this<br />

reserve requirement. In addition it aims to – as<br />

previously indicated – further increase its monetary<br />

reserves such that it can play a role in case a bank<br />

would suddenly require liquidity support.<br />

Commercial banks give interest rates incentives for<br />

SRD credits and have escape clauses built in to their<br />

foreign exchange credit arrangements, such that these<br />

can be converted to local currency loans if necessary.<br />

As can be seen from the following diagram, these<br />

polices have led to some success.

| 22 |<br />

PICTURE<br />

PERFECT<br />

Custom<br />

made<br />

frames.<br />

A search abroad for<br />

adequate picture<br />

frames for her<br />

upcoming exhibition<br />

introduced Mandy<br />

Chiu Hung to the<br />

world of frames and<br />

passé-partouts.<br />

Three years ago<br />

Picture Perfect was<br />

established.The<br />

company uses the<br />

latest techniques to<br />

produce customized<br />

frames.

| 23 |<br />

US dollarisation in 1996 – <strong>2008</strong> as a percentage of total loans and deposits<br />

The share of total deposits denominated in foreign<br />

currencies decreased in <strong>2008</strong> by 1.9 percentage points<br />

to 54.4%. The extent to which lending was in dollars<br />

decreased substantially by 3.8 percentage points to<br />

45.6%. Our expectation is that this will further<br />

decrease in 2009 due to the limited interest rate<br />

differential between the SRD- and foreign exchange<br />

loans. The goal is to bring back these rates substantially,<br />

in part in order to decrease foreign exchange risk.<br />

Deteriorating economic growth and the changing<br />

macro economic environment shall influence the<br />

banking system in 2009. Lower growth percentages<br />

will need to be taken into account. The financial<br />

position and the earnings capacity will however<br />

remain at a satisfactory level.<br />

Inflation<br />

Inflation in Suriname is measured on the basis of the<br />

development of the consumer price index (an average<br />

change in the price of a fixed, representative basket of<br />

240 consumer goods). According to preliminary<br />

figures compiled by the General Office of Statistics<br />

consumer prices rose on average by 14.7% in <strong>2008</strong>, in<br />

comparison with 6.4% in 2007. Inflation according to<br />

the year-end method rose by much less, namely from<br />

8.3% to 9.4%.<br />

The acceleration of the inflation rate is predominantly<br />

due to price increases in crude oil, food staples and<br />

the appreciation of the Euro. Inflation is higher in<br />

Suriname than for our relevant foreign trading partners<br />

which could lead to pressure on exchange rates.<br />

Year Average Year End<br />

inflation (%) inflation (%)<br />

2005 9.5 15.8<br />

2006 11.3 4.7<br />

2007 6.4 8.3<br />

<strong>2008</strong> 1) 14.7 9.4<br />

1) preliminary figures<br />

As a result of the worldwide recession, import prices<br />

have been dropping since the third quarter and its<br />

effect on price indices has been visible in Suriname<br />

since October 2007. It is expected that this trend will<br />

continue in 2009 and inflation will decrease. At<br />

the end of February 2009 year-on-year inflation<br />

(February 2009 - February <strong>2008</strong>) already declined to<br />

6%. As a result a moderate stance can be expected of<br />

the labour unions during the 2009 wage negotiations<br />

in order to limit local cost increases, maintain<br />

employment positions and uphold the competitiveness<br />

of the private sector. The employees of Suralco<br />

LLC also deserve an honourable mention due to their<br />

decline of an earlier agreed upon loan increase for<br />

2009. In this way they are contributing to an increased<br />

competitive positioning of their company that is<br />

currently struggling as a result of the international<br />

recession.

| 24 |<br />

Developments in important production sectors<br />

Driven by high average mineral prices on the world<br />

markets and increased consumer and production<br />

confidence, the real economy grew in <strong>2008</strong> according<br />

to estimates by almost 7%. In particular the sector<br />

mining, building and construction and trade<br />

contributed to this growth.<br />

Especially the prices of crude oil and gold rose<br />

significantly. The agricultural sector also capitalized<br />

on the positive situation on the world markets.<br />

Investments in the hotel and tourism sector remained<br />

high.<br />

In the fourth quarter prices of alumina and crude oil<br />

dropped substantially as a result of the worldwide<br />

recession that will negatively influence economic<br />

growth in 2009 and 2010. It is expected that a slack in<br />

foreign demand may be partly mitigated by the<br />

increased local activity that is related to large government<br />

infrastructure projects.<br />

This will culminate in an expected real GDP growth<br />

in 2009 of approximately 4-5%, still very acceptable<br />

taken the current worldwide situation.<br />

Bauxite Sector<br />

The jointly operating bauxite companies, Suralco and<br />

BHP-Billiton, have operated satisfactorily in <strong>2008</strong>,<br />

despite the negative effects of the worldwide crisis in<br />

the last quarter.<br />

In the reporting year alumina production declined by<br />

1.1% to 2,153,968 metric ton. The refinery operated at<br />

98% capacity and export volume rose by 0.7% to<br />

2,176,531 metric tons.<br />

The total export value was USD 715.5 million, an<br />

increase of nearly 2%. The average export price<br />

increased by merely 1.2% to USD 329 per metric ton.<br />

Transfers to Suriname amounted to USD 88.5 million<br />

related to local payments (excluding to Staatsolie<br />

N.V., for delivered oil products).<br />

This amount is 28.4% lower than in 2007. State income<br />

from this sector amounted to USD 44.7 million, a<br />

decrease of 46.3%. The number of employees rose by<br />

0.6% to 1,170 persons. The short term outlook for the<br />

alumina sector is not positive. The negotiations<br />

between the Surinamese government and the domestically<br />

operating alumina companies did not result in<br />

an agreement in <strong>2008</strong> and no agreement could be<br />

established with BHP-Billiton to set up a mine in West<br />

Suriname near the Bakhuysgebergte. As a result this<br />

company has decided to abort operations in<br />

Suriname by the end of 2010 and the country is now<br />

on the lookout for other partners to develop the<br />

bauxite reserves in West Suriname.<br />

Oil Sector<br />

Due to increased production and strong prices, the<br />

State Oil Company booked record revenue and<br />

earnings in <strong>2008</strong>. Production of crude oil increased by<br />

0.5 million barrels or 8.5% to more than 5.9 million.<br />

The average daily production from more than 1100<br />

production wells amounted to 16,200 barrels. The<br />

average net selling price of “Saramacca crude oil” was<br />

USD 76.75 per barrel, 36% higher than in 2007.<br />

Over <strong>2008</strong> gross revenue amounted to USD 540 million,<br />

an increase from USD 203 million or 60% versus the<br />

previous year. Earnings before taxes resulted in<br />

USD 388 million, an increase of 152%. Net income<br />

contribution (on a cash basis) to the balance of<br />

payments was USD 269 million and to the State<br />

approximately USD 180 million.<br />

The refinery achieved a good capacity utilisation<br />

and refined 2.54 million barrels of crude oil. The<br />

production is however almost 4% lower than in 2007<br />

because operations at the refinery were temporarily<br />

suspended for maintenance during 4 weeks. Of the<br />

total production, 46% was delivered to Suralco, 10%<br />

as shipping fuel, 39% was exported and 5% was sold<br />

on the domestic market.<br />

Refining capacity is planned to double in a number of<br />

years to 15,000 barrels per day, whilst gasoline,<br />

premium diesel, heating oil, sulphuric acid and<br />

bitumen shall also be produced. A pre-feasibility<br />

study has been concluded in <strong>2008</strong>. In addition a start<br />

has been made with the site development and<br />

environmental impact assessment study. The aim is to<br />

round this project off by 2013.<br />

The exploration of the Surinamese off-shore area,<br />

where four foreign oil companies are currently active<br />

in numerous sea blocks, has been continued<br />

intensively. Noteworthy are the drillings by Repsol in<br />

the West Tapir 1 well in Block 30. Despite the fact that<br />

no oil was discovered, the information gathered will<br />

be of importance for further planning of activities. In<br />

the meantime the international tendering process for<br />

blocks 43 and 44 have commenced.<br />

The onshore exploration activities have also been<br />

intensified in <strong>2008</strong> with the aim to guarantee long<br />

term production. In this respect drilling is being

| 25 |<br />

carried out in the Weg naar Zee Oost and the<br />

Commewijne Area, where oil reserves have been discovered.<br />

It is expected that in the first half of 2009<br />

drilling shall commence in the Coesewijne Areas.<br />

A contract has been signed with Geokenetics for the<br />

carrying out of a 2D-seismolgocial survey of 540 km<br />

coastal area. The official commencement took place<br />

on November 13, <strong>2008</strong> in Nickerie and the program is<br />

planned to finalize in June 2009. A budget of USD 25<br />

million has been made available for this project.<br />

Since September <strong>2008</strong> oil prices have considerably<br />

dropped on the international market especially due to<br />

the drop in demand emanating from the worldwide<br />

recession. This will lead to a decrease in revenues and<br />

earnings for the State Oil Company in 2009. The midterm<br />

outlook is however positive for the oil sector.<br />

Gold Sector<br />

The upward trend of gold continued in <strong>2008</strong>. For<br />

the first time since the 80’s in the last century the<br />

magical threshold of US dollar 1,000 per troy ounce<br />

(31.1 grams) was broken for a number of days in<br />

mid march <strong>2008</strong>. The price peaked at USD 1,033 on<br />

17 March.<br />

The average gold price on the London Metal<br />

Exchange was USD 871.96 per troy ounce in the<br />

reporting year, 25.4% higher than in 2007. This<br />

increase was predominantly caused by the “flight to<br />

quality” due tot the increased economical and political<br />

uncertainties and the limited outlook for the world<br />

economy. Various analysts expect that this upward<br />

trend will continue in 2009, whereby a new high continues<br />

to be a real possibility.<br />

The positive developments in the international<br />

markets had a positive influence on the Surinamese<br />

gold sector. Production as well as returns increased.<br />

The largest gold mining company in Suriname,<br />

IAMGOLD, a listed Canadian company with a market<br />

cap of USD 2 billion, produced approximately<br />

315,000 troy ounce (10,000 kg) in <strong>2008</strong>, an increase of<br />

17% versus the previous year. The average selling<br />

price was approximately USD 800 per troy ounce<br />

whilst the cost price was USD 480. The company’s<br />

performance improved in <strong>2008</strong>, so that the transfers<br />

to the Surinamese state in taxes on salaries, royalties<br />

and income tax increased to USD 50 million. The<br />

company invested in the book year USD 46 million in<br />

exploration and capacity expansion. The proven<br />

reserves increased by more than 20,000 kg, putting<br />

the life of the mine at an estimated 10 years. The<br />

expectation is that the production will further<br />

increase in 2009.<br />

The largest Surinamese gold mining company,<br />

Sarakreek Resource Corporation that owns a<br />

concession on the Sarakreek to the South of<br />

VanBlommenstein dam, also achieved good operating<br />

results. The company strives towards a larger scale<br />

operation, in all likelihood with a foreign partner.<br />

Surgold, the joint venture between Alcoa N.V. and<br />

Newmont Mining Corporation, has in the meantime<br />

concluded its exploration program in the Nassau<br />

Mountains in East Suriname. Commercially extractable<br />

reserves of 2.2 mln troy ounce have been proven,<br />

although at higher operating costs than IAMGOLD in<br />

Brokopondo.<br />

In the meantime negotiations have commenced<br />

between the Surinamese government and Surgold in<br />

order to arrive at an exploitation agreement. Speed is<br />

of the essence to capitalize on the achieved momentum<br />

in order to come up with the best agreement for<br />

all parties. The signal that will given by such an agreement<br />

shall positively indicate that Suriname is an<br />

upcoming gold mining country.<br />

Agricultural Sector<br />

Rice Sector<br />

The total area of rice fields under cultivation<br />

increased by 3.7% to 43,654 ha. This increase was for<br />

large as well as small paddy producers. In the fall of<br />

<strong>2008</strong> volumes sown rose remarkably by approximately<br />

3,850 ha to 23,751 ha, due to favourable market<br />

prices and a strong outlook. Various key figures<br />

showing the developments in the sector over the past<br />

five years can be seen in the following table.<br />

In the reporting year the average production dropped<br />

per hectare by 1.5% to 4,189 metric ton, due in large<br />

part to the less favourable climatic conditions. As a<br />

result of an increase of land under cultivation, the<br />

production increased by 2.2% to 182,877 metric ton.<br />

The export volume of rice increased in <strong>2008</strong> by more<br />

than 1%. Partly as a result of administrative barriers<br />

on the side of the government, exporters were not able<br />

to capitalize more on the favourable conditions that<br />

presented themselves in the market. These barriers<br />

were lifted after a number of months.

| 26 |<br />

Average export prices of cargo as well as white rice<br />

were significantly higher because of developments on<br />

both the supply and demand sides in the world market.<br />

The export values more than doubled. Shipments<br />

to the EU, our most important market, increased by<br />

more than 85% or 29,000 metric ton. Exports to the<br />

Caricom market however dropped by 26% to 20,500<br />

metric ton. Because the EU market predominantly<br />

buys cargo rice, the export of the latter was higher<br />

than white rice. In previous years the reverse was true.<br />

paddy have also shown a downward trend since the<br />

beginning of Q4 as a result of lower diesel and<br />

fertilizer input costs. In order to attain reasonable<br />

returns, productivity improvements across the value<br />

chain are crucial.<br />

The rice sector is still supported by the European<br />

Union and the Cariforum who have made available an<br />

amount for the sector that is well utilized by entrepreneurs<br />

active in it.<br />

Prices of rice have since the second half of <strong>2008</strong><br />

shown a downward trend. The production costs of<br />

<strong>2008</strong>*) 2007 2006 2005 2004<br />

Under cultivation (hectares) 43,654 42,087 44,232 45,563 49,020<br />

Production of dry paddy (Mt) 182,877 179,012 182,659 163,955 174,490<br />

Average production per hectare (Mt) 4,189 4,253 4,130 3,598 3,560<br />

Export volumes (USD 1,000) 53,091 52,499 41,462 35,877 51,830<br />

Export value (USD 1,000) 32,313 15,415 11,516 8,913 11,891<br />

Exportprijs cargorijst (USD/mton/gemiddeld) 604 255 236 220 190<br />

Exportprijs witte rijst (USD/mton/gemiddeld) 610 325 297 301 268<br />

Source: Ministry of Agriculture, Animal Husbandry and Fisheries<br />

* Preliminary figures<br />

RIJSTPAK N.V.<br />

The core business of Rijstpak N.V is the processing, distribution and<br />

export of rice and rice derivates under the brand name Paloma.The<br />

company was ISO certified in <strong>2008</strong> and exploits 2 state of the art<br />

hulling mills in the Nickerie district.This company is considered to<br />

be one of Suriname’s main rice exporters to Europe.

| 27 |<br />

Banana Industry<br />

The banana industry is important to our country for<br />

a variety of reasons: production and export, as well as<br />

the creation of employment. Employing 2,416 people,<br />

the Stichting Behoud Bananen Sector (SBBS) is, next<br />

to the State, the largest employer.<br />

Production rose in <strong>2008</strong> from 56,246 ton to 65,438<br />

ton, an increase of more than 16% that was entirely<br />

exported to the European Union. The FOB export<br />

value was USD 33.1 million, an increase of USD 13.7<br />

million or 70% in comparison to 2007, in large part as<br />

the result of the increased export volume, better<br />

prices and the average higher exchange rate of the<br />

Euro against the USD.<br />

In our previous annual report we presented the<br />

problem of market entry into the EU by ACP countries<br />

(including Suriname), and this challenge has to<br />

date not been solved. The Latin American countries<br />

demand a substantial decrease in the import tariffs,<br />

which the ACP countries vehemently protest against<br />

this. It doesn’t require much explanation to realise that<br />

due to this situation, the price that SBBS receives for<br />

her products isn’t satisfactory.<br />

The privatization process is struggling because of the<br />

uncertainties surrounding the abovementioned<br />

market entry and pricing issues. Currently talks are<br />

being held with the Belgian company Univeg that<br />

already maintains a management agreement with the<br />

SBBS, with regards to the full acquisition of SBBS.<br />

Economic outlook for 2009<br />

The continuing worldwide economic recession will<br />

undoubtedly have negative ramifications for the<br />