in PDF - Hongkong Land

in PDF - Hongkong Land

in PDF - Hongkong Land

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

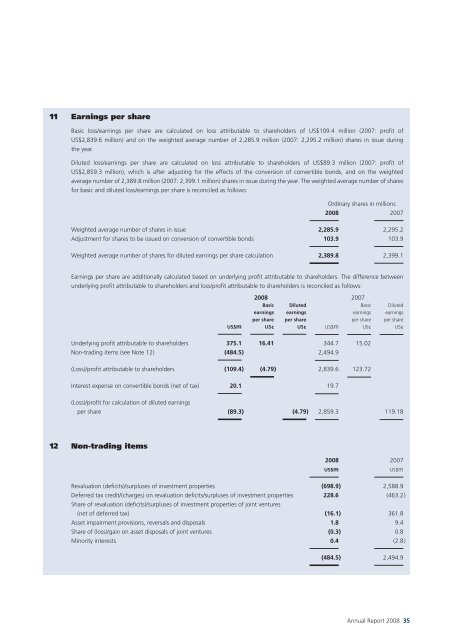

11 Earn<strong>in</strong>gs per share<br />

Basic loss/earn<strong>in</strong>gs per share are calculated on loss attributable to shareholders of US$109.4 million (2007: profit of<br />

US$2,839.6 million) and on the weighted average number of 2,285.9 million (2007: 2,295.2 million) shares <strong>in</strong> issue dur<strong>in</strong>g<br />

the year.<br />

Diluted loss/earn<strong>in</strong>gs per share are calculated on loss attributable to shareholders of US$89.3 million (2007: profit of<br />

US$2,859.3 million), which is after adjust<strong>in</strong>g for the effects of the conversion of convertible bonds, and on the weighted<br />

average number of 2,389.8 million (2007: 2,399.1 million) shares <strong>in</strong> issue dur<strong>in</strong>g the year. The weighted average number of shares<br />

for basic and diluted loss/earn<strong>in</strong>gs per share is reconciled as follows:<br />

Ord<strong>in</strong>ary shares <strong>in</strong> millions<br />

2008 2007<br />

Weighted average number of shares <strong>in</strong> issue 2,285.9 2,295.2<br />

Adjustment for shares to be issued on conversion of convertible bonds 103.9 103.9<br />

Weighted average number of shares for diluted earn<strong>in</strong>gs per share calculation 2,389.8 2,399.1<br />

Earn<strong>in</strong>gs per share are additionally calculated based on underly<strong>in</strong>g profit attributable to shareholders. The difference between<br />

underly<strong>in</strong>g profit attributable to shareholders and loss/profit attributable to shareholders is reconciled as follows:<br />

2008 2007<br />

Basic Diluted Basic Diluted<br />

earn<strong>in</strong>gs earn<strong>in</strong>gs earn<strong>in</strong>gs earn<strong>in</strong>gs<br />

per share per share per share per share<br />

US$m US¢ US¢ US$m US¢ US¢<br />

Underly<strong>in</strong>g profit attributable to shareholders 375.1 16.41 344.7 15.02<br />

Non-trad<strong>in</strong>g items (see Note 12) (484.5 ) 2,494.9<br />

(Loss)/profit attributable to shareholders (109.4 ) (4.79 ) 2,839.6 123.72<br />

Interest expense on convertible bonds (net of tax) 20.1 19.7<br />

(Loss)/profit for calculation of diluted earn<strong>in</strong>gs<br />

per share (89.3) (4.79) 2,859.3 119.18<br />

12 Non-trad<strong>in</strong>g items<br />

2008 2007<br />

US$m<br />

US$m<br />

Revaluation (deficits)/surpluses of <strong>in</strong>vestment properties (698.9) 2,588.9<br />

Deferred tax credit/(charges) on revaluation deficits/surpluses of <strong>in</strong>vestment properties 228.6 (463.2)<br />

Share of revaluation (deficits)/surpluses of <strong>in</strong>vestment properties of jo<strong>in</strong>t ventures<br />

(net of deferred tax) (16.1) 361.8<br />

Asset impairment provisions, reversals and disposals 1.8 9.4<br />

Share of (loss)/ga<strong>in</strong> on asset disposals of jo<strong>in</strong>t ventures (0.3) 0.8<br />

M<strong>in</strong>ority <strong>in</strong>terests 0.4 (2.8)<br />

(484.5 ) 2,494.9<br />

Annual Report 2008 35