in PDF - Hongkong Land

in PDF - Hongkong Land

in PDF - Hongkong Land

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the F<strong>in</strong>ancial Statements<br />

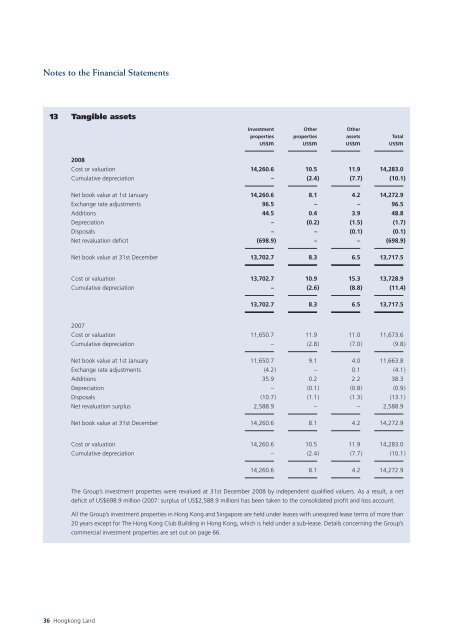

13 Tangible assets<br />

Investment Other Other<br />

properties properties assets Total<br />

US$m US$m US$m US$m<br />

2008<br />

Cost or valuation 14,260.6 10.5 11.9 14,283.0<br />

Cumulative depreciation – (2.4) (7.7) (10.1)<br />

Net book value at 1st January 14,260.6 8.1 4.2 14,272.9<br />

Exchange rate adjustments 96.5 – – 96.5<br />

Additions 44.5 0.4 3.9 48.8<br />

Depreciation – (0.2) (1.5) (1.7)<br />

Disposals – – (0.1) (0.1)<br />

Net revaluation deficit (698.9) – – (698.9)<br />

Net book value at 31st December 13,702.7 8.3 6.5 13,717.5<br />

Cost or valuation 13,702.7 10.9 15.3 13,728.9<br />

Cumulative depreciation – (2.6 ) (8.8 ) (11.4 )<br />

13,702.7 8.3 6.5 13,717.5<br />

2007<br />

Cost or valuation 11,650.7 11.9 11.0 11,673.6<br />

Cumulative depreciation – (2.8) (7.0) (9.8)<br />

Net book value at 1st January 11,650.7 9.1 4.0 11,663.8<br />

Exchange rate adjustments (4.2) – 0.1 (4.1)<br />

Additions 35.9 0.2 2.2 38.3<br />

Depreciation – (0.1) (0.8) (0.9)<br />

Disposals (10.7) (1.1) (1.3) (13.1)<br />

Net revaluation surplus 2,588.9 – – 2,588.9<br />

Net book value at 31st December 14,260.6 8.1 4.2 14,272.9<br />

Cost or valuation 14,260.6 10.5 11.9 14,283.0<br />

Cumulative depreciation – (2.4 ) (7.7 ) (10.1 )<br />

14,260.6 8.1 4.2 14,272.9<br />

The Group’s <strong>in</strong>vestment properties were revalued at 31st December 2008 by <strong>in</strong>dependent qualified valuers. As a result, a net<br />

deficit of US$698.9 million (2007: surplus of US$2,588.9 million) has been taken to the consolidated profit and loss account.<br />

All the Group’s <strong>in</strong>vestment properties <strong>in</strong> Hong Kong and S<strong>in</strong>gapore are held under leases with unexpired lease terms of more than<br />

20 years except for The Hong Kong Club Build<strong>in</strong>g <strong>in</strong> Hong Kong, which is held under a sub-lease. Details concern<strong>in</strong>g the Group’s<br />

commercial <strong>in</strong>vestment properties are set out on page 66.<br />

36 <strong>Hongkong</strong> <strong>Land</strong>