in PDF - Hongkong Land

in PDF - Hongkong Land

in PDF - Hongkong Land

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the F<strong>in</strong>ancial Statements<br />

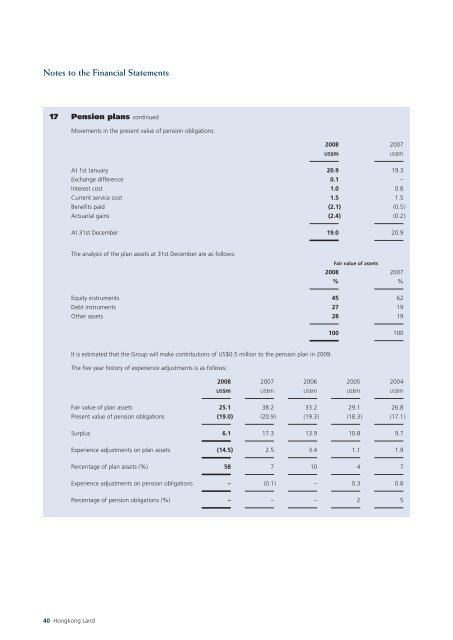

17 Pension plans cont<strong>in</strong>ued<br />

Movements <strong>in</strong> the present value of pension obligations:<br />

2008 2007<br />

US$m<br />

US$m<br />

At 1st January 20.9 19.3<br />

Exchange difference 0.1 –<br />

Interest cost 1.0 0.8<br />

Current service cost 1.5 1.5<br />

Benefits paid (2.1) (0.5)<br />

Actuarial ga<strong>in</strong>s (2.4) (0.2)<br />

At 31st December 19.0 20.9<br />

The analysis of the plan assets at 31st December are as follows:<br />

Fair value of assets<br />

2008 2007<br />

% %<br />

Equity <strong>in</strong>struments 45 62<br />

Debt <strong>in</strong>struments 27 19<br />

Other assets 28 19<br />

100 100<br />

It is estimated that the Group will make contributions of US$0.5 million to the pension plan <strong>in</strong> 2009.<br />

The five year history of experience adjustments is as follows:<br />

2008 2007 2006 2005 2004<br />

US$m US$m US$m US$m US$m<br />

Fair value of plan assets 25.1 38.2 33.2 29.1 26.8<br />

Present value of pension obligations (19.0 ) (20.9 ) (19.3 ) (18.3 ) (17.1 )<br />

Surplus 6.1 17.3 13.9 10.8 9.7<br />

Experience adjustments on plan assets (14.5 ) 2.5 3.4 1.1 1.9<br />

Percentage of plan assets (%) 58 7 10 4 7<br />

Experience adjustments on pension obligations – (0.1 ) – 0.3 0.8<br />

Percentage of pension obligations (%) – – – 2 5<br />

40 <strong>Hongkong</strong> <strong>Land</strong>