Corporate Governance - Emmi

Corporate Governance - Emmi

Corporate Governance - Emmi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30 <strong>Corporate</strong> GovernanCe<br />

<strong>Corporate</strong> <strong>Governance</strong><br />

The <strong>Emmi</strong> Group is committed to modern corporate governance principles<br />

and aims to provide all stakeholders with the greatest transparency<br />

possible. The following information complies with the current<br />

information relating to corporate governance (DCG) of the SIX Swiss<br />

Exchange. <strong>Emmi</strong>’s corporate governance principles are also oriented to<br />

the guidelines of the Swiss Code of Best Practice for <strong>Corporate</strong> <strong>Governance</strong>.<br />

Unless indicated otherwise, all data relate to the balance sheet<br />

as at 31 December 2010.

Contents<br />

<strong>Corporate</strong> <strong>Governance</strong><br />

32 Group structure and shareholders<br />

32 Capital structure<br />

33 Board of Directors<br />

40 Group Management<br />

43 Compensation, participations and loans<br />

43 Shareholders’ rights of co-determination<br />

44 Change of control and defensive measures<br />

44 Auditors<br />

45 Information policy<br />

<strong>Corporate</strong> GovernanCe<br />

31

32 <strong>Corporate</strong> GovernanCe<br />

1. Group structure and shareholders<br />

1.1 Group structure as at 31 December 2010<br />

The Group structure of <strong>Emmi</strong> AG (hereinafter “<strong>Emmi</strong>”) is presented<br />

on this page.<br />

All investments in subsidiaries and associates are listed on<br />

pages 70, 71 and 77 of the Financial Report together with the<br />

headquarters, share capital and the size of the equity interest.<br />

The group of consolidated companies contains only non-listed<br />

companies.<br />

1.2 Significant shareholders<br />

Shareholders holding more than 3 % of the voting rights are<br />

listed on page 78 of the Financial Report. No notification in<br />

accordance with Art. 20 of the Federal Stock Exchange and<br />

Securities Trading Act (SESTA) was received in the year under<br />

review.<br />

ZMP Invest AG, Lucerne, the Zentralschweizerischer Milchkäuferverband<br />

(ZMKV), Willisau, and the MIBA Milchverband<br />

der Nordwestschweiz, Basel, form a group in the sense of Article<br />

20 of the SESTA. The group owns 62.4 % (prior year 62.3 %)<br />

of the total voting rights.<br />

Group structure as at<br />

31 December 2010<br />

Robert Muri<br />

Dairy products<br />

Othmar Dubach<br />

Cheese<br />

Group functions:<br />

– Agriculture<br />

– <strong>Corporate</strong> Development<br />

– Strategic Projects<br />

– Coordination Research & Development<br />

– Legal<br />

Matthias Kunz<br />

International<br />

Markus Willimann<br />

Industry<br />

Konrad Graber<br />

Chairman of the Board<br />

Urs Riedener<br />

Chief Executive Officer<br />

– Group Communications & Investor Relations<br />

– Milk Procurement<br />

– Quality Management<br />

– System & Process Development<br />

– Internal Auditing<br />

1.3 Cross-shareholdings<br />

There are no cross-shareholdings with other companies that<br />

exceed 5 % of capital or votes on both sides.<br />

2. Capital structure<br />

2.1 Share capital<br />

<strong>Emmi</strong>’s share capital amounts to CHF 53,498,100.<br />

2.2 Authorized and conditional capital in<br />

particular<br />

<strong>Emmi</strong> did not create any conditional or authorized capital in<br />

financial year 2010 and there is no conditional or authorized<br />

capital from previous years.<br />

2.3 Changes in capital<br />

An overview of changes in capital for the years 2007–2010<br />

can be found on page 76 of the Financial Report.<br />

Robin Barraclough<br />

Marketing<br />

Marc Heim<br />

Sales<br />

Reto Conrad<br />

Finance & Controlling<br />

Max Peter<br />

Trade & Supply<br />

Chain Management<br />

Natalie Rüedi 1)<br />

Human Resources<br />

1) Member of<br />

Group Management from<br />

1 January 2011

2.4 Shares and participation certificates<br />

The share capital of <strong>Emmi</strong> comprises 5,349,810 registered<br />

shares (security no.: 1,282,989/ISIN Code: CH0012829898)<br />

with a par value of CHF 10 per share. Only one category of<br />

registered share exists and no participation certificates exist.<br />

Further information on shares can be found on page 83 of<br />

the Annual Report.<br />

2.5 Dividend-right certificates<br />

No dividend-right certificates exist.<br />

2.6 Restrictions on transferability and<br />

nominee registrations<br />

There are no restrictions on the transfer of registered shares<br />

of <strong>Emmi</strong>. The only precondition for entry in the share register<br />

3. Board of Directors<br />

is a declaration on the part of the purchaser that the shares<br />

have been acquired in his/her own name and for his/her<br />

account. No other registration restrictions exist. The registration<br />

of fiduciaries/nominees without voting rights is permitted.<br />

On request, the Board of Directors shall decide on the<br />

registration of fiduciaries/nominees with voting rights on<br />

a case-by-case basis. No fiduciaries/nominees with voting<br />

rights were entered during the year under review, nor did the<br />

Board of Directors approve any other exceptions for entry in<br />

the share register.<br />

2.7 Convertible bonds and options<br />

<strong>Emmi</strong> has neither convertible bonds nor options outstanding<br />

to acquire ownership interests in <strong>Emmi</strong>. The same applies to<br />

the other Group companies.<br />

3.1 Members of the Board of Directors<br />

All nine members of the <strong>Emmi</strong> Board of Directors are non-executive members who were not previously members of <strong>Emmi</strong> Group<br />

Management. Alexander Jost stepped down at the 2010 General Meeting and Dominique Christian Bach was elected as a new<br />

Board member. The following table shows the names of the Board members, their country of origin and the year in which they were<br />

elected. Moritz Erni, Hans Herzog and Thomas Oehen-Bühlmann are members of the Board of the Central Switzerland Milk Producers<br />

cooperative (ZMP), which supplies a large proportion of its milk to the <strong>Emmi</strong> Group. Josef Schmidli produces a significant<br />

proportion of his cheese for the <strong>Emmi</strong> Group.<br />

Fritz Wyss (born 1944) has been Honorary President of the <strong>Emmi</strong> Board of Directors since 2010. Fritz Wyss was a member of the<br />

Board of Directors from 1993 to 2009, as Delegate from 1993 to 2003 and Chairman from 2003 to 2009.<br />

Members of the <strong>Emmi</strong> Board of Directors Year of birth Country of origin Education First elected<br />

Konrad Graber<br />

Chairman of the Board of Directors<br />

Moritz Erni<br />

Vice-Chairman of the Board of Directors<br />

1958 Switzerland Business Administration, HWV<br />

Certified Auditor<br />

1952 Switzerland Certified Master Farmer<br />

Certified Independent Farmer<br />

Dominique Christian Bach 1957 France Stanford Executive Program, USA<br />

Marketing EDHEC, Lille, France<br />

2010<br />

Stephan Baer 1952 Switzerland Economics lic.oec.publ. 1999<br />

Joseph Deiss 1946 Switzerland Economics and Sociology<br />

Prof. Dr. rer. pol.<br />

2007<br />

Hans Herzog 1951 Switzerland Certified Master Farmer 2002<br />

Hanspeter Müller 1943 Switzerland Certified Accountant 1999<br />

Thomas Oehen-Bühlmann 1958 Switzerland Certified Master Farmer 2009<br />

Josef Schmidli 1957 Switzerland Federal Commercial Diploma<br />

Certified Master Cheesemaker<br />

<strong>Corporate</strong> GovernanCe<br />

2006<br />

2009 Chairman<br />

2003<br />

2003<br />

33

34 <strong>Corporate</strong> GovernanCe<br />

Members of the Board of Directors from left: Stephan Baer, thomas oehen-Bühlmann, Hans Herzog, Dominique Christian Bach, Konrad Graber (Chairman),<br />

Hanspeter Müller, Moritz erni (vice-Chairman), Josef Schmidli, Joseph Deiss and Ingrid Schmid (secretary of the Board of Directors)<br />

3.2 Professional background and other<br />

activities and interests<br />

Konrad Graber<br />

Member of the Board of Directors since 2006,<br />

Chairman since 2009<br />

Konrad Graber worked for KPMG in the auditing department<br />

for both national and international companies from 1983,<br />

latterly as Partner and Director. He spent eight years as Chairman<br />

of the Berufsprüfung für Treuhänder organization for professional<br />

qualification as a fiduciary. Since 1999 he has been a<br />

Partner at BDO AG, Lucerne, where he was also member of the<br />

Swiss Executive Board from 2005 to 2009. In this capacity he<br />

was responsible for management consultancy and IT.<br />

Konrad Graber has been a member of the Board of Directors<br />

of BDO AG since 2009. He is also Chairman of the Board of<br />

Directors of the Lucerne Transport Corporation (Verkehrsbetriebe<br />

Luzern AG) and a member of the Board of Directors<br />

of the health insurer CSS Versicherungen. He was a long-<br />

standing councillor for the canton of Lucerne, and from 1997<br />

to 2001 he served as Chairman of the CVP (Christian Democratic<br />

People’s Party), also in the canton of Lucerne. In 2007<br />

Konrad Graber was elected to the Council of States, becoming<br />

a member of the National Parliament.<br />

Moritz Erni<br />

Member of the Board of Directors since 2003,<br />

Vice-Chairman since 2006<br />

Moritz Erni works as an independent farmer and a training<br />

instructor on his dairy farm. From 1980 to 2003 he was a<br />

technical expert for apprentice and master examinations.<br />

He has been Chairman of the Board of the Central Switzerland<br />

Milk Producers cooperative (ZMP) since 2003 and Chairman<br />

of the Board of Directors of ZMP Invest AG since 2006.<br />

He is also a member of the Board of Swiss Milk Producers<br />

(SMP) in Berne and a member of the Agricultural Chamber of<br />

the Swiss Farmers’ Union.

Dominique Christian Bach<br />

Member of the Board of Directors since 2010<br />

Dominique C. Bach has held numerous key and management<br />

roles in internationally active companies in the food and luxury<br />

goods sectors, including Danone in France (1980 to 1985)<br />

and Mars Incorporated in France and Sweden (1985 to 1996).<br />

He also ran a San Francisco-based wine company belonging to<br />

the luxury goods group LVMH/Moët Hennessy-Louis Vuitton<br />

from 1996 to 2001, and was active as an independent entrepreneur<br />

in London from 2001 to 2002. From 2003 to 2008 he<br />

was responsible for the Central and Eastern European region<br />

at the food and beverages company Pepsico, and from 2009<br />

to 2010 he was Head of the Strauss Coffee division of the<br />

Israeli food and beverages company Strauss Group.<br />

Stephan Baer<br />

Member of the Board of Directors since 1999<br />

Stephan Baer worked at OPM AG as a business analyst from<br />

1979 to 1982 before moving to Baer AG in Küssnacht am Rigi,<br />

where he was appointed Chief Executive Officer one year later<br />

and became Chairman of the Board of Directors in 1997. Since<br />

Baer AG was acquired by the French Lactalis Group in 2008,<br />

he has worked as an independent management consultant.<br />

Stephan Baer is also a member of the Boards of Directors of<br />

several companies including Bio Partner Schweiz AG, Seon<br />

and frXsh AG, Küssnacht am Rigi (Chairman).<br />

Joseph Deiss<br />

Member of the Board of Directors since 2007<br />

Prof. Dr. Joseph Deiss was a longstanding lecturer in macroeconomics<br />

at the University of Fribourg, before being appointed<br />

Professor of Macroeconomics and Economic Policy in 1984.<br />

Now a former Federal Councillor, Joseph Deiss began his political<br />

career with an extended period as a member of the cantonal<br />

council of Fribourg, of which he was Chairman in 1991. From<br />

1982 to 1996 he was the Mayor of Barberêche (FR) and from<br />

1991 to 1999 a member of the National Council. From 1993 to<br />

1996 he was Switzerland’s price regulator, and in 1999 he was<br />

elected to the Federal Council as a representative of the CVP<br />

(Swiss Christian Democratic People’s Party). From 1999 to 2002<br />

he was head of the Federal Department of Foreign Affairs, and<br />

in 2003 he moved to the Department of Economic Affairs. He<br />

served as Federal President in 2004.<br />

Since his retirement from the Federal Council in 2006, Joseph<br />

Deiss has been teaching a Masters course in Economic Policy<br />

at the University of Fribourg. He is also a business consultant<br />

and a member of the Board of Directors of various companies<br />

(Zurich Insurance Company South Africa; Zurich Insurance Compa-<br />

<strong>Corporate</strong> GovernanCe<br />

ny Ireland; Clinique Générale, Fribourg). Joseph Deiss has been<br />

elected President of the United Nations General Assembly for<br />

its 65th session from September 2010 to September 2011.<br />

Hans Herzog<br />

Member of the Board of Directors since 2002<br />

Hans Herzog works as an independent farmer and a training<br />

instructor on his dairy farm. From 1992 to 2004 he was Chairman<br />

of the Central Switzerland Association of Producers of<br />

Silage-Free Milk. Hans Herzog is a member of the Board of the<br />

Central Switzerland Milk Producers cooperative (ZMP).<br />

Hanspeter Müller<br />

Member of the Board of Directors since 1999<br />

Hanspeter Müller joined the MIBA Milchverband der Nordwestschweiz<br />

in 1970 as Head of Finance. From 1994 to 1998<br />

he was a member of the Board of Directors of Toni Holding<br />

AG, Berne and from 1994 to 2003 he served as Managing<br />

Director of MIBA.<br />

Thomas Oehen-Bühlmann<br />

Member of the Board of Directors since 2009<br />

Thomas Oehen-Bühlmann is a certified master farmer and<br />

works as an independent farmer on his own dairy and arable<br />

farm. For many years he acted as a technical expert for<br />

apprentice and master exams and was also Chairman of the<br />

Supervisory Committee. He was head of the local branch of<br />

the CVP (Christian Democratic People’s Party) for a number of<br />

years and was a district councillor from 1996 to 2008, including<br />

from 1996 to 2006 in Lieli and from 2007 to 2008 in<br />

Hohenrain following the amalgamation of the municipalities.<br />

Thomas Oehen-Bühlmann has been Mayor of Hohenrain since<br />

2008 and is head of a municipal association for waste disposal<br />

in the canton of Lucerne. He is a member of the Board of the<br />

Central Switzerland Milk Producers cooperative (ZMP).<br />

Josef Schmidli<br />

Member of the Board of Directors since 2003<br />

After receiving a federal commercial diploma, Josef Schmidli<br />

qualified as a master cheesemaker in 1982 and has worked as<br />

a cheesemaker in Mühlau since then. Josef Schmidli has been<br />

the proprietor and CEO of Käserei Schmidli GmbH since its<br />

foundation in 1998.<br />

Since 2002 he has been the Chairman of the Central Switzerland<br />

Milk Purchasers Association in Lucerne and its pension<br />

fund. He is also Vice-Chairman of Fromarte, the association of<br />

Swiss cheese specialists, and President of a municipal power<br />

utility.<br />

35

36 <strong>Corporate</strong> GovernanCe<br />

3.3 Election and term of office<br />

Members are elected to the <strong>Emmi</strong> Board of Directors for a<br />

term of three years. Reelection is permitted. The members<br />

are elected by the General Meeting, with the period between<br />

one General Meeting and the end of the next deemed to be<br />

one year. All current members of the Board of Directors are<br />

elected until the 2012 General Meeting.<br />

The elections of the existing members of the Board of Directors<br />

put forward for reelection are carried out as a block election<br />

unless at least one shareholder requests individual elections.<br />

The elections of the Chairman and of new members are<br />

carried out as individual elections. All votes and elections are<br />

carried out by open ballot unless a majority requests a secret<br />

ballot.<br />

3.4 Internal organization<br />

3.4.1 Allocation of duties within the Board of Directors<br />

The following table shows the names of the Chairman and Vice-Chairman of the Board of Directors and the allocation of other duties<br />

within the <strong>Emmi</strong> Board of Directors.<br />

Allocation of duties within<br />

the <strong>Emmi</strong> Board of Directors<br />

Konrad Graber<br />

Chairman of the Board of Directors<br />

Moritz Erni<br />

Vice-Chairman of the Board of Directors<br />

Dominique Christian Bach<br />

Member<br />

Stephan Baer<br />

Member<br />

Joseph Deiss<br />

Member<br />

Hans Herzog<br />

Member<br />

Hanspeter Müller<br />

Member<br />

Thomas Oehen-Bühlmann<br />

Member<br />

Josef Schmidli<br />

Member<br />

Controlling<br />

Committee<br />

Market<br />

Committee<br />

Committee for<br />

Personnel Matters<br />

Agricultural<br />

Council<br />

• (Chairman) • • (Chairman) • (Chairman)<br />

•<br />

•<br />

• (Chairman)<br />

• •<br />

• •<br />

• •<br />

• •<br />

•

3.4.2 Composition, duties and delimitation of responsibili-<br />

ties of the committees<br />

The composition of the committees and the Agricultural<br />

Council (hereinafter the “committees”) is shown in the table<br />

above. The committees are subject to a regular assessment<br />

of their performance (self-assessment).<br />

The Controlling Committee supports the Board of Directors<br />

in monitoring the management of the company, in particular<br />

from a financial perspective. It is entitled to view all documents<br />

necessary for the performance of its duties and to request<br />

comprehensive information from all areas of the Group,<br />

as well as the external auditors, at any time.<br />

It comprises at least three members of the Board of Directors,<br />

of whom one is the Chairman of the Board of Directors.<br />

Its meetings are attended by the CEO, the CFO, the Head of<br />

Group Controlling and, on invitation, the head of internal auditing<br />

and the auditor in charge. The Controlling Committee<br />

deliberates on and approves the auditing plan and the remuneration<br />

budget for the external auditors, and at the request<br />

of the CFO, approves the choice of auditors for foreign Group<br />

companies.<br />

The Controlling Committee assesses the following, in particular,<br />

for the Board of Directors in an advisory or preparatory<br />

capacity:<br />

– the organization of accounting and the organization and<br />

content of financial control, including internal auditing<br />

– the effectiveness and independence of the external<br />

auditors<br />

– the results of internal and external auditing and the monitoring<br />

of action plans by management based on these<br />

results<br />

– Group and holding accounts and the results of subsidiary<br />

companies<br />

– the annual and investment budget<br />

– the evaluation of risks and of the measures based on this<br />

– financial and liquidity planning as well as business relations<br />

with financial institutions<br />

– financial reporting to shareholders and the public<br />

– legal proceedings and out-of-court settlement of disputes<br />

whose outcome may have implications for the financial<br />

situation of the Group.<br />

<strong>Corporate</strong> GovernanCe<br />

The Market Committee supports the Board of Directors in<br />

monitoring the management of the company, in particular<br />

from a medium and long-term strategic perspective. It offers<br />

recommendations on the basic organization of brand, product<br />

and market strategy as preparation for corporate strategy.<br />

It comprises at least three members of the Board of Directors,<br />

of whom one is the Chairman of the Board of Directors,<br />

and its meetings are attended by the CEO and, on invitation,<br />

members of Group Management. The Market Committee has<br />

no approval power. The Committee assesses or processes the<br />

following for the Board of Directors in an advisory or preparatory/follow-up<br />

capacity:<br />

– the organization and composition of management based<br />

on the Group’s strategy<br />

– merger and acquisition projects, brand projects and product<br />

and market investments based on the Group’s strategy<br />

– the strengthening of the <strong>Emmi</strong> brand portfolio and innovations<br />

based on the Group’s strategy<br />

– the preparation of changes in strategy<br />

– the development of key customers and markets as well as<br />

critical business units<br />

– the controlling of major projects.<br />

The Committee for Personnel Matters supports the Board of<br />

Directors in monitoring the management of the company, in<br />

particular from a personnel perspective.<br />

It comprises at least three members of the Board of Directors,<br />

of whom one is the Chairman of the Board of Directors, and<br />

its meetings are attended by the CEO on invitation. The Committee<br />

for Personnel Matters deliberates on and approves<br />

remuneration for the Chairman of the Board of Directors, the<br />

CEO and other members of Group Management. It elects the<br />

members of Group Management, excluding the CEO.<br />

The Committee for Personnel Matters assesses or processes<br />

the following, in particular, for the Board of Directors in an advisory<br />

or preparatory capacity:<br />

– the salary policy of the Group as well as bonus and similar<br />

performance-related plans, basic changes to pension fund<br />

regulations and other retirement benefit plans<br />

– the composition of Group Management<br />

– succession planning and the evaluation of candidates for<br />

the Board of Directors<br />

– succession planning for the Chairman of Group Management<br />

and, at the request of the CEO, for members of Group<br />

Management<br />

– employer representation in the <strong>Emmi</strong> Pension Foundation,<br />

the <strong>Emmi</strong> Welfare Foundation and Group Management’s<br />

supplementary retirement benefit plan.<br />

37

38 <strong>Corporate</strong> GovernanCe<br />

The Agricultural Council, which consists of members of the<br />

Board of Directors and specialists, supports the Board of Directors<br />

in monitoring the management of the company, in<br />

particular with regard to milk procurement and agricultural<br />

issues.<br />

It comprises at least four individuals, of whom at least three<br />

are members of the Board of Directors (the Chairman of the<br />

Board of Directors plus two further members).<br />

Internal and external experts inform the Agricultural Council<br />

about the latest developments and provide its members with<br />

advice where necessary. Members from the <strong>Emmi</strong> Group who<br />

attend meetings include, as internal experts, the CEO, the<br />

Head of Agriculture and the Head of Milk Procurement. The<br />

external experts are the Managing Directors of the regional<br />

milk producer organizations ZMP and MIBA, both of which<br />

have a stake in <strong>Emmi</strong>, as well as the national milk producer<br />

organization SMP.<br />

The Agricultural Council has no approval power. It assesses<br />

or processes the following, in particular, for the Board of<br />

Directors in an advisory or preparatory capacity:<br />

– general political issues<br />

– the development of the milk and cheese industry and its<br />

organizations<br />

– milk volumes and price management<br />

– milk and cheese procurement.<br />

3.4.3 Work methods of the Board of Directors and its<br />

committees<br />

As a rule, the <strong>Emmi</strong> Board of Directors and its committees<br />

meet as often as business requirements dictate. In 2010 the<br />

Board of Directors held eleven approximately half-day meetings<br />

and one whole-day strategy meeting. The Controlling<br />

Committee met five times for 3 hours each, the Market Committee<br />

four times for 2.5 hours each and the Committee for<br />

Personnel Matters four times for 1.5 hours each. The Agricultural<br />

Council met twice for two hours each in 2010 (average<br />

times).<br />

Meetings held by the Board of Directors are also attended<br />

by the CEO, the CFO and, depending on the topic, individual<br />

members of Group Management. Individual items on the<br />

agenda are handled exclusively within the Board of Directors,<br />

i.e. excluding all participants who are not members of the<br />

Board of Directors. The entire Group Management participates<br />

in the strategy meeting held by the Board of Directors.<br />

The inclusion of members of Group Management in meetings<br />

held by the committees is shown under Point 3.4.2. With the<br />

exception of the Agricultural Council, the <strong>Emmi</strong> Board of Directors<br />

holds its meetings without any external experts.<br />

The Chairman of the Board of Directors is a member of all<br />

committees for the purposes of coordinating the various<br />

committees of the Board of Directors and integrating the<br />

Board of Directors as a whole. The chairpersons of the<br />

committees report to the Board of Directors at every Board<br />

meeting regarding their activities and results, and record<br />

details of their consultations and decisions in minutes that<br />

are distributed to all members of the Board of Directors. If any<br />

important issues arise, the Board of Directors is informed<br />

immediately. Overall responsibility for the duties assigned to<br />

the committees remains with the <strong>Emmi</strong> Board of Directors.<br />

3.5 Definition of responsibilities between the<br />

Board of Directors and Group Management<br />

The Board of Directors is responsible for the overall management<br />

of the company and the Group, as well as for monitoring the<br />

management of the company. In accordance with Art. 716a Swiss<br />

Code of Obligations, it has the following inalienable and nontransferrable<br />

duties:<br />

– the overall management of the company and the Group, including<br />

the definition of medium and long-term strategies,<br />

focal points for planning and guidelines for company policy, as<br />

well as issuing the necessary directives<br />

– the definition of basic organizations and related regulations<br />

– the definition of guidelines for the organization of accounting,<br />

financial control and financial planning<br />

– the appointment and dismissal of individuals entrusted with<br />

the task of both managing and representing the company,<br />

namely the CEO, and the granting of signing authority<br />

– the overall supervision of the corporate bodies entrusted with<br />

the task of managing the company, namely with regard to<br />

compliance with the law, Articles of Association, regulations<br />

and directives<br />

– the drafting of the Annual Report as well as the preparation of<br />

the General Meeting and the implementation of its decisions<br />

– the notification of the court in the event of over-indebtedness<br />

– the determination of capital increases and related amendments<br />

to the Articles of Association.<br />

Based on the duties mentioned above, the <strong>Emmi</strong> Board of Directors<br />

deliberates on and determines the following issues:<br />

– the annual and investment budget<br />

– the annual and half-year results<br />

– Group structure up to and including Group Management<br />

– salary policy<br />

– evaluation of the main risks<br />

– investments, apart from budget, above CHF 0.5 million<br />

– multi-year financial and liquidity planning

– strategy-relevant cooperations and agreements, in particular<br />

the purchase and sale of participations, companies, business<br />

units, business areas and rights to products or intellectual property<br />

rights, provided the annual turnover relating to the subject<br />

of the transaction exceeds CHF 1 million<br />

– the founding and dissolution of companies<br />

– the proposal of candidates for the Board of Directors to the<br />

General Meeting<br />

– the election of the Boards of Directors of major subsidiaries<br />

– Group regulations of strategic importance.<br />

All other areas of management are delegated in full by the Board<br />

of Directors to the Chairman and the CEO, who is authorized to<br />

issue instructions to other members of Group Management. The<br />

Board of Directors can, at any time, on a case-by-case basis or on<br />

the basis of general powers reserved, intervene in the duties and<br />

areas of competence of the corporate bodies that report to it and<br />

take over business carried out by these bodies.<br />

The CEO is the Chairman of Group Management. He leads, supervises<br />

and coordinates the members of Group Management and<br />

grants them the necessary authority to perform their functions.<br />

In accordance with the law and <strong>Emmi</strong>’s Articles of Association<br />

and organizational regulations, he has the necessary authority to<br />

lead the <strong>Emmi</strong> Group. He has in particular the following duties:<br />

– the implementation of strategic objectives, definition of operational<br />

thrusts and priorities and provision of the necessary<br />

material and personnel resources to this end<br />

– the leadership, supervision and coordination of the other members<br />

of Group Management<br />

– the convening, preparation and chairing of Group Management<br />

meetings<br />

– regular communication with the Chairman of the Board of Directors<br />

or the Board of Directors as a whole regarding business<br />

developments. The Chairman of the Board of Directors must be<br />

informed immediately of any important and unexpected business<br />

events.<br />

– representation of the Group internally and, upon consultation<br />

(on strategic issues) with the Chairman of the Board of Directors,<br />

externally<br />

– nominations to the Board of Directors for the election of all<br />

members of the Boards of Directors of major subsidiaries.<br />

The members of Group Management manage day-to-day business<br />

independently. Their areas of competence and responsibility<br />

are determined, in particular, by the budget approved by the<br />

Board of Directors and by the agreed business strategy.<br />

<strong>Corporate</strong> GovernanCe<br />

3.6 Information and control instruments<br />

vis-à-vis Group Management<br />

The <strong>Emmi</strong> Board of Directors is informed at every meeting by<br />

the Chairman, the Chairmen of the committees, the CEO, CFO<br />

and – depending on the agenda item – by other members of<br />

Group Management about current business developments,<br />

the financial situation and key business events. The CEO and<br />

CFO attend meetings held by the Controlling Committee,<br />

while the CEO also participates in meetings of the Market<br />

Committee, the Agricultural Council and, where necessary, the<br />

Committee for Personnel Matters. In addition to the meetings,<br />

every member of the Board of Directors can, having first informed<br />

the Chairman of the Board of Directors accordingly, request<br />

information about business developments and, with the<br />

authorization of the Chairman, about individual transactions.<br />

The Chairman is kept up to date by the CEO on a regular basis, at<br />

least once every fortnight, and receives the minutes of all Group<br />

Management meetings. He ensures an appropriate flow of information<br />

between Group Management and the Board of Directors.<br />

Members of the Board of Directors are informed immediately<br />

of exceptional incidents by means of circular letter. The<br />

management information system (MIS) is structured as follows:<br />

– Members of the Board of Directors receive detailed sales<br />

statistics on a monthly basis.<br />

– On a quarterly basis, consolidated financial statements are<br />

prepared and the Board of Directors is provided with detailed<br />

documents showing the performance and financial<br />

situation of the company.<br />

– The members of the Controlling Committee receive the<br />

Group financial statements as well as the accounts of all<br />

subsidiaries on a quarterly basis and are informed in detail<br />

in order to assess quarterly financial performance.<br />

At least once a year the Board of Directors is informed by the<br />

CEO for its approval concerning the development of the main<br />

risks and their assessment on the basis of relevance and likelihood<br />

of occurrence. The Board of Directors monitors the definition<br />

and implementation of risk management measures by<br />

Group Management.<br />

The Controlling Committee evaluates the effectiveness of the<br />

internal and external control systems as well as the risk management<br />

organization and process of the <strong>Emmi</strong> Group.<br />

The external auditor PricewaterhouseCoopers and the internal<br />

auditor, who are directly linked to both the Chairman of the Controlling<br />

Committee and the Controlling Committee itself, act as<br />

additional information and control systems. Compliance is also<br />

supported and jointly monitored by the Legal department.<br />

39

40 <strong>Corporate</strong> GovernanCe<br />

4. Group Management<br />

4.1 Members of Group Management<br />

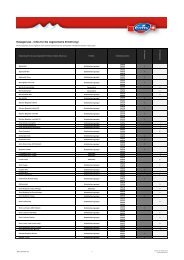

The following table shows the names of the ten members of <strong>Emmi</strong> Group Management, their country of origin and current function.<br />

Members of <strong>Emmi</strong> Group<br />

Management Year of birth Country of origin Education Current function<br />

Urs Riedener 1965 Switzerland Business Economist lic.oec. HSG<br />

Stanford Executive Program, USA<br />

CEO<br />

Robin Barraclough 1967 United Kingdom Economist Head of Marketing<br />

Reto Conrad 1966 Switzerland Business Economist lic.oec. HSG<br />

Certified Auditor<br />

CFO<br />

Othmar Dubach 1958 Switzerland Certified Food Engineer ETH<br />

MBA<br />

Head of the Cheese Division<br />

Marc Heim 1967 Switzerland Business Economist lic.oec. HSG Head of Sales<br />

Matthias Kunz 1960 Switzerland Certified Agronomics Engineer ETH<br />

MBA<br />

Robert Muri 1950 Switzerland Certified Engineer HTL Dairy Farming<br />

MBA<br />

Max Peter 1954 Switzerland Certified Engineer HTL Mechanical<br />

and Production Engineering<br />

Natalie Rüedi 1971 Switzerland Certified Primary School Teacher<br />

EMBA<br />

Markus Willimann 1956 Switzerland Certified Food Engineer ETH<br />

Dr. sc. techn. ETH<br />

4.2 Professional background and other activities<br />

and interests<br />

Urs Riedener<br />

CEO and Chairman of Group Management since 2008<br />

Urs Riedener was an Assistant Brand Manager at Jacobs<br />

Suchard in Neuchâtel from 1992 to 1995 and latterly Group<br />

Brand Manager at Kraft Jacobs Suchard in Zurich. From 1995<br />

to 2000 he held various management positions at Lindt &<br />

Sprüngli, both in Switzerland and abroad, the most recent<br />

of which were National Sales Manager and Member of the<br />

Board of Management, Switzerland. Until 2008 he was Head<br />

of Marketing and Member of the Executive Board of the Migros<br />

Cooperative in Zurich.<br />

Urs Riedener joined <strong>Emmi</strong> as its CEO in 2008. He also sits on<br />

the committees of the Swiss branded products association<br />

Promarca and the Swiss marketing association GfM.<br />

Head of the International<br />

Division<br />

Deputy CEO,<br />

Head of the Dairy Products<br />

Division<br />

Head of Retail and Supply<br />

Chain Management<br />

Head of Human Resources<br />

Head of Industrial Business<br />

Robin Barraclough<br />

Head of Marketing and member of Group Management<br />

since 2009<br />

From 1991 to 2007, Robin Barraclough performed various<br />

managerial marketing functions at national and international<br />

level at Mars Incorporated, latterly as senior member of the<br />

Marketing Leadership Team at the European Masterfoods<br />

headquarters in Bremen (Germany). In 2008 he was in charge<br />

of the coffee business in German-speaking Europe for Kraft<br />

Foods.<br />

Robin Barraclough joined <strong>Emmi</strong> Group Management in 2009.<br />

As Head of Marketing he is responsible for the ongoing development<br />

and marketing of the <strong>Emmi</strong> product and brand portfolio<br />

both in Switzerland and internationally.

Reto Conrad<br />

CFO and member of Group Management since 2006<br />

Reto Conrad worked as a controller for UBS in Basel from 1990<br />

to 1992. From 1992 to 2001 he held various functions in the<br />

auditing department of PricewaterhouseCoopers in Basel and<br />

San Francisco. In 2001 he was appointed CFO of the Bachem<br />

Group, which is headquartered in Bubendorf.<br />

Reto Conrad joined the <strong>Emmi</strong> Group in 2005 as Head of Group<br />

Controlling, and in 2006 was appointed CFO with responsibility<br />

for the finance and controlling, legal and tax departments,<br />

and became a member of Group Management. Reto Conrad<br />

is also a member of the expert commission of Swiss GAAP FER<br />

(Swiss Accounting and Reporting Recommendations). At<br />

the beginning of 2011 Reto Conrad received from the CFO<br />

Forum Switzerland the CFO of the year award.<br />

Othmar Dubach<br />

Head of the Cheese Division and member of Group<br />

Management since 1993<br />

Othmar Dubach worked as assistant to Prof. Bachmann at the<br />

Institute of Dairy Technology at the Swiss Federal Institute of<br />

Technology Zurich before moving in 1983 to the Central Switzerland<br />

Milk Association in Lucerne, where he took over as<br />

Head of Dairy Controlling and Advisory Services. He also took<br />

on additional tasks in the areas of consulting for cooperatives<br />

and cheese factory structures. Othmar Dubach joined the<br />

<strong>Emmi</strong> Group in 1992 and spent a year heading up marketing<br />

<strong>Corporate</strong> GovernanCe<br />

Members of Group Management from left: robin Barraclough, Markus Willimann, Marc Heim, natalie rüedi, reto Conrad, Urs riedener (Ceo),<br />

othmar Dubach, robert Muri, Max peter and Matthias Kunz<br />

activities. In 1993 he became a member of Group Management<br />

and took on the role of Head of the Cheese Division<br />

with responsibility for production, packaging and maturation<br />

both in Switzerland and internationally.<br />

Marc Heim<br />

Head of Sales and member of Group Management<br />

since 2009<br />

Between 1992 and 1999, Marc Heim held various positions<br />

with the former Effems AG (now Mars Schweiz AG) in Zug,<br />

latterly as Senior Product Manager for the Snackfood Division,<br />

specifically for the Balisto brand. From 1999 until 2004, he<br />

was Head of Sales and Marketing and a member of the Board<br />

of Management at Swiss biscuit specialist Kambly SA in Trubschachen,<br />

where he was responsible for the Swiss market,<br />

export business and marketing. From 2004 to 2009 he was<br />

Managing Director of Halter Bonbons AG.<br />

Marc Heim joined the <strong>Emmi</strong> Group in 2009 and, as Head of<br />

Sales for Switzerland and internationally, became a member<br />

of Group Management.<br />

Matthias Kunz<br />

Head of the International Division and member of Group<br />

Management since 2002<br />

Matthias Kunz was head of the department responsible for exports<br />

and economic affairs at what was then known as Central<br />

Switzerland Milk Producers (now known as Swiss Milk Producers,<br />

41

42 <strong>Corporate</strong> GovernanCe<br />

or SMP) from 1988 to 1992. He then became the proprietor and<br />

Managing Director of Tucano, Inc. Carmel, California before<br />

joining the Western Orient Trading Company, which exports US<br />

agricultural products. In 1997 he took over as Managing Director<br />

of the newly founded Toni International AG. Following the<br />

merger between Toni and Säntis to form Swiss Dairy Food, he<br />

was appointed Head of the Cheese Division and a member of<br />

Group Management in 1999, and became Managing Director of<br />

Top Cheese Switzerland AG in 2002.<br />

The same year, following the acquisition of Top Cheese Switzerland<br />

by <strong>Emmi</strong>, he took over as Head of <strong>Emmi</strong>’s International<br />

Cheese Division and became a member of Group Management.<br />

Since 2009 he has been responsible for the International Division<br />

and thus for the ongoing development of <strong>Emmi</strong> in the international<br />

markets.<br />

Robert Muri<br />

Head of the Dairy Products Division and member of Group<br />

Management since 1996, Deputy CEO since 2007<br />

From 1974 onwards Robert Muri worked in sales for Falag International<br />

AG in Langenthal and as Head of Quality Control<br />

at Roco Conserven AG in Rorschach. From 1976 to 1980 he<br />

worked in development at International Flavors & Fragrances<br />

I.F.F. AG in Reinach (Aargau). In 1980 he moved to the Central<br />

Switzerland Milk Association in Lucerne as Head of Production,<br />

going on to become Works Manager.<br />

In 1994 he took over responsibility for marketing and sales in<br />

the Fresh Products Division of the <strong>Emmi</strong> Group and in 1996<br />

was appointed Head of the Fresh Products Division and a<br />

member of Group Management. The Fresh Products and<br />

Dairy Products Divisions were merged in 2004, with Robert<br />

Muri taking over as Head of the new Dairy Products Division.<br />

In this function he is responsible for the production of fresh<br />

and dairy products both in Switzerland and internationally.<br />

Robert Muri has also been Managing Director of Mittelland<br />

Molkerei AG in Suhr since 2006 and Deputy CEO since 2007.<br />

Max Peter<br />

Head of the Retail and Supply Chain Management Division<br />

and member of Group Management since 2002<br />

Max Peter worked as a consultant for the company Zoller from<br />

1977 and subsequently as a project manager for Nestlé in Vevey<br />

from 1980 to 1987. He spent the period from 1987 to 1988 in a<br />

consulting and project management capacity at Suter+Suter AG<br />

in Basel. In 1988 he moved to Coop Schweiz, initially as Head of<br />

the main department of Technical Planning (Logistics & Engineering)<br />

and later as Member of Management for Merchandising/CRS.<br />

In 1999 he was appointed CIO and Member of Group<br />

Management for Supply Chain Management of Bon Appétit<br />

Group AG in Volketswil.<br />

In 2002 he joined <strong>Emmi</strong> as Head of <strong>Corporate</strong> Development<br />

and became a member of Group Management. In this function<br />

he has been responsible for Retail and Supply Chain Management,<br />

including IT, since 2005. Max Peter is also a Member of<br />

the Board of Directors of GS 1 Switzerland, Vice-President of<br />

Schweizer Sporthilfe, and a member of the executive council of<br />

Swiss Olympic.<br />

Natalie Rüedi<br />

Head of Human Resources and member of Group<br />

Management since 2011<br />

Natalie Rüedi taught at Kriens primary school from 1992 to<br />

2000 and became its headmistress in 1996.<br />

She joined the <strong>Emmi</strong> Group as an Human Resources specialist<br />

in 2000, going on to take over the enhancement and leadership<br />

of staff development in 2004 and being appointed Head<br />

of Human Resources and member of the extended Group<br />

Management in 2009. She has been a member of Group Management<br />

since 2011.<br />

Markus Willimann<br />

Head of Industrial Business and member of Group<br />

Management since 1998<br />

Dr. Markus Willimann worked from 1982 to 1987 as a technical<br />

assistant at the Swiss Breweries Testing Station. From<br />

1987 to 1990 he worked as a research and development<br />

project manager at Jacobs-Suchard SA. From 1990 to 1998 he<br />

served as business unit head and member of the Executive<br />

Board of UFA AG in Sursee.<br />

In 1998 he joined the <strong>Emmi</strong> Group as a member of Group<br />

Management and Head of the Dairy Products Division. He<br />

assumed responsibility for Industrial Business, Development<br />

Coordination and Agricultural Policy within Group Management<br />

in 2004.<br />

Markus Willimann is also Chairman of the Swiss Dairy Industry<br />

Association and member of the Board of Directors of the<br />

Swiss Milk Sector Organization (BOM), the Swiss Butter Sector<br />

Organization (BOB) and the Federation of Swiss Food Industries<br />

(fial).<br />

Detailed CVs of the members of Group Management can<br />

be found on the <strong>Emmi</strong> website at http://group.emmi.ch/en/<br />

about-emmi/corporate-governance/group-management/.<br />

4.3 Management contracts<br />

No management contracts exist.

5. Compensation, participations<br />

and loans<br />

5.1 Content and definition process for compensation<br />

and share ownership programmes<br />

The remuneration system for the compensation of the Board<br />

of Directors and – with the exception of the Chairman – the<br />

remuneration of members of the Board of Directors is determined<br />

by the Board of Directors at the recommendation<br />

of the Committee for Personnel Matters. The remuneration<br />

system for the compensation of Group Management is deliberated<br />

on and determined by the Committee for Personnel<br />

Matters. This committee deliberates on and determines<br />

remuneration for the Chairman of the Board of Directors, the<br />

CEO and other members of Group Management. The Chairman<br />

of the Board of Directors and the CEO are not involved in<br />

determining their own remuneration.<br />

The Committee for Personnel Matters assesses remuneration<br />

in connection with the general Group pay round (fixed component)<br />

and the company result (variable component). The<br />

Board of Directors is informed at its next meeting as well as by<br />

means of the minutes of the committee meeting convened to<br />

discuss the definition and implementation of remuneration.<br />

External experts are only called upon during the determination<br />

of the remuneration system in the event of a fundamental<br />

change to the system. At Group Management level,<br />

function-specific benchmarks are used when determining remuneration<br />

in the event of new appointments or promotions.<br />

The reference market is taken as companies from the “fast<br />

moving consumer goods” industry to which the <strong>Emmi</strong> Group<br />

also belongs.<br />

The remuneration paid to the Board of Directors comprises a<br />

fixed basic salary only and is thus not related to performance.<br />

The remuneration paid to the members of Group Management<br />

comprises a fixed component as well as a variable component<br />

based on business performance and achievement of<br />

individual performance targets, as well as payments in kind<br />

(company car).<br />

Variable remuneration can account for up to one-third of total<br />

remuneration and consists of the following components:<br />

1. Group performance (weighting 40 %)<br />

2. Business area performance (weighting 40 %)<br />

3. Achievement of individual performance targets<br />

(weighting 20 %).<br />

The measurement of business performance is based on the<br />

three pillars of sales, income and market share. For service<br />

areas, the relevant targets also relate to the ongoing development<br />

of the appropriate area with a view to providing the<br />

core business with even better support. An individual objective<br />

can, for example, be the launch of a product in a key<br />

market, the implementation of a project aimed at enhancing<br />

earnings in a particular product area, or the implementation<br />

of improvement measures in the area of corporate culture.<br />

Share ownership programmes and loans: As is the case elsewhere<br />

in the <strong>Emmi</strong> Group, no share or option plans exist for<br />

members of the Board of Directors or members of Group<br />

Management. Furthermore, no loans are granted as a rule.<br />

Remuneration during the year under review is listed on pages<br />

79 and 80 of the Notes to the Financial Statements of <strong>Emmi</strong><br />

AG (Holding Company) 2010.<br />

6. Shareholders’ rights of<br />

co-determination<br />

<strong>Corporate</strong> GovernanCe<br />

6.1 Restrictions on voting rights and proxies<br />

<strong>Emmi</strong>’s Articles of Association contain no restrictions on voting<br />

rights. A shareholder who has voting rights may only be<br />

represented at the General Meeting by a legal representative,<br />

another shareholder attending the General Meeting who<br />

has voting rights, an officer of the company, an independent<br />

proxy designated by the company or a proxy for shares held in<br />

safekeeping. The Articles of Association can be downloaded<br />

from the Group website at http://group.emmi.ch/en/aboutemmi/corporate-governance/articles-of-association/.<br />

6.2 Statutory quorum<br />

Unless the law stipulates otherwise, the General Meeting<br />

passes its resolutions and performs its elections by an absolute<br />

majority of the voting rights represented, not taking<br />

into account blank and invalid votes. In addition to the legal<br />

exceptions, the resolution concerning the amendment of the<br />

provision of the Articles of Association relating to the restrictions<br />

on registration (see Point 2.6 concerning Nominees) also<br />

requires at least two-thirds of voting rights represented and<br />

the absolute majority of shares represented.<br />

43

44 <strong>Corporate</strong> GovernanCe<br />

6.3 Convening of the General Meeting<br />

The Ordinary General Meeting takes place annually, at the<br />

latest six months after the end of the financial year. It is convened<br />

by the Board of Directors. The procedure for convening<br />

Extraordinary General Meetings is governed by the applicable<br />

legal provisions.<br />

6.4 Agenda<br />

Shareholders who represent shares with a par value of CHF 1<br />

million and above can request that an item be placed on the<br />

agenda at the General Meeting. Requests for an item to be<br />

placed on the agenda must be submitted to the Board of Directors<br />

in writing at least 45 days before the General Meeting,<br />

citing the motions concerned.<br />

6.5 Entries in the share register<br />

The share register is usually closed ten days prior to the General<br />

Meeting. The Board of Directors may approve exceptional<br />

subsequent entries on request. The effective closing date<br />

is published in the invitation to the General Meeting and in<br />

good time in the financial calendar on the <strong>Emmi</strong> website at<br />

http://group.emmi.ch/english/investor-relations/dates/.<br />

7. Change of control and defensive<br />

measures<br />

7.1 Obligatory offer<br />

<strong>Emmi</strong>’s Articles of Association do not include any “opting up”<br />

or “opting out” clauses pursuant to Art. 22 of the Federal Stock<br />

Exchange and Securities Trading Act (SESTA) regarding the<br />

legal obligation to make a takeover bid.<br />

7.2 Change-of-control clauses<br />

No contractual agreements exist either for members of the<br />

Board of Directors or for members of Group Management in<br />

the event of a change in the controlling majority stake.<br />

8. Auditors<br />

8.1 Duration of the mandate and term of the<br />

auditor in charges<br />

Auditors PricewaterhouseCoopers, Werftestrasse 3, P.O. Box,<br />

6002 Lucerne, have acted as the statutory auditors for the<br />

Consolidated Financial Statements of the <strong>Emmi</strong> Group and<br />

the Annual Financial Statements of <strong>Emmi</strong> AG since its incorporation<br />

in 1993. At the General Meeting on 12 May 2010,<br />

PricewaterhouseCoopers, Lucerne, were reappointed for a<br />

further period of one year.<br />

Matthias von Moos has been the auditor in charge since the<br />

General Meeting convened in 2009.<br />

8.2 Audit fees<br />

The auditors charged total fees of CHF 915,000 for the 2010<br />

reporting year for the performance of their mandate as statutory<br />

auditors (including audit of the Consolidated Financial<br />

Statements).<br />

8.3 Additional fees<br />

During the year under review, PricewaterhouseCoopers<br />

charged a total of CHF 608,000 for additional services beyond<br />

the scope of their statutory mandate, i.e. tax, legal and<br />

transaction-related advice. This fee includes CHF 282,000 for<br />

tax advice, CHF 11,000 for legal advice and CHF 315,000 for<br />

advice related to transactions.<br />

8.4 Auditor supervision and control mechanisms<br />

in respect of the auditors<br />

The Board of Directors’ Controlling Committee assesses the<br />

performance, invoicing and independence of the external auditors<br />

and provides the Board of Directors with corresponding<br />

recommendations. The auditors provide Group Management<br />

and the Committee with regular reports that set out the results<br />

of their work and recommendations. The Committee annually<br />

reviews the scope of the external audit, the audit plans<br />

and the relevant procedures, and discusses the audit reports<br />

with the external auditors. The chief auditor attended four<br />

meetings of the Controlling Committee in 2010.

9. Information policy<br />

Investor Relations guidelines: <strong>Emmi</strong> strives to maintain open<br />

and ongoing communication with shareholders, potential<br />

investors and other stakeholder groups. <strong>Emmi</strong>’s aim is to<br />

provide rapid, real-time and transparent information about<br />

the company, its strategy and business developments, and<br />

to offer a picture of <strong>Emmi</strong>’s performance in the past and the<br />

present, as well as its future prospects. This picture is intended<br />

to reflect the assessment of the current situation of the<br />

company by Group Management and the Board of Directors.<br />

Methodology: <strong>Emmi</strong> publishes an extensive Annual Report<br />

every year that presents operating activities, corporate governance<br />

and financial reporting for the current year drafted and<br />

audited in accordance with Swiss GAAP FER. A half-year report<br />

is also produced.<br />

Furthermore, media releases are published about events<br />

relevant to the share price, such as acquisitions, minority or<br />

majority shareholdings, joint ventures and alliances in accordance<br />

with guidelines relating to ad-hoc publicity. Important<br />

announcements, in particular half and full-year results, are accompanied<br />

by presentations together with press and analyst<br />

conferences, or analyst calls.<br />

<strong>Emmi</strong> meets during the course of the year with institutional<br />

investors both in Switzerland and abroad, presents its results<br />

on a regular basis, organizes road shows and holds meetings<br />

with individual institutional investors and groups. The main<br />

point of contact for these meetings and presentations is the<br />

Chief Financial Officer, and they focus on <strong>Emmi</strong>’s financial<br />

results, its strategic orientation and the current initiatives of<br />

the Group.<br />

<strong>Emmi</strong> uses the Internet in order to ensure rapid, real-time and<br />

consistent distribution of information. The company’s website<br />

also offers an electronic information tool that enables<br />

shareholders and other interested parties to add their names<br />

to an electronic distribution list (http://group.emmi.ch/english/investor-relations/news-service/).<br />

<strong>Corporate</strong> GovernanCe<br />

Media releases and investor information can be accessed via<br />

the following links:<br />

http://group.emmi.ch/en/media/media-releases/2011/<br />

http://group.emmi.ch/en/investor-relations/<br />

Notifications to SIX Exchange Regulation of participations<br />

that exceed the level at which notification becomes obligatory<br />

can be found via the following link: http://www.six-exchange-regulation.com/obligations/disclosure/major_shareholders_en.html.<br />

No participation amendments leading to<br />

compulsory notification were made at <strong>Emmi</strong> in 2010.<br />

Contact for Investor Relations:<br />

<strong>Emmi</strong> Schweiz AG, Investor Relations, Habsburgerstrasse 12,<br />

CH-6002 Lucerne<br />

Tel. 041 227 27 86, e-mail ir@emmi.ch<br />

The General Meeting will take place on 5 May 2011. All registered<br />

shareholders receive an invitation to the General Meeting<br />

by mail.<br />

The next business results (half-year results 2011) will be published<br />

on 31 August 2011.<br />

Note on the <strong>Emmi</strong> links:<br />

<strong>Emmi</strong>’s website will be renewed in 2011 and the links might<br />

change. However, the CVs and the Articles of Association will<br />

continue to be available in the corporate governance section,<br />

media information in the media section and investor relations<br />

information in the investor relations section.<br />

45