HSBC Holdings plc Sustainability Report 2007

HSBC Holdings plc Sustainability Report 2007

HSBC Holdings plc Sustainability Report 2007

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Managing <strong>Sustainability</strong> Risk<br />

How <strong>HSBC</strong> views sustainability risk<br />

<strong>HSBC</strong> assesses potential environmental and social risks when agreeing<br />

new business with customers, a process similar to analysing other types<br />

of business risk, such as credit risk. In 2002, we introduced a Group<br />

standard that requires offices to manage this risk, followed by the<br />

development of a series of industry sector policies to provide further<br />

guidance to our business.<br />

Policies<br />

Equator Principles<br />

The Equator Principles are a set of voluntary guidelines to help financial<br />

institutions assess and monitor the environmental and social impacts of<br />

large projects such as power plants and airports. <strong>HSBC</strong> adopted the<br />

Equator Principles in 2003 and they are applied in our Project and Export<br />

Finance business both to project finance loans and also to other facilities<br />

where the use of proceeds is known to be directly related to a project.<br />

Together with our sustainability risk sector policies, they form an<br />

important part of our process of managing sustainability risks. <strong>HSBC</strong><br />

plays a key role in the continued development of the Equator Principles.<br />

We are a member of the Equator Principles Steering Committee and the<br />

leader of the Governance Working Group. In <strong>2007</strong>, we helped to develop<br />

the management structure for the Equator Principles and we are currently<br />

managing the policy development on governance.<br />

The Principles categorise projects according to the scale of potential<br />

Summary of sustainability risk policies (see p.24)<br />

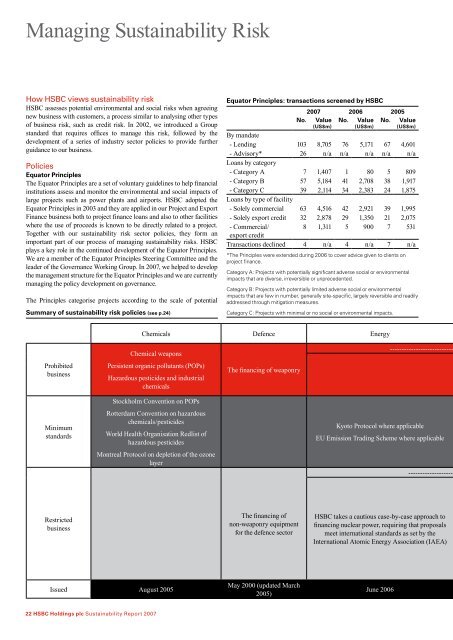

Equator Principles: transactions screened by <strong>HSBC</strong><br />

<strong>2007</strong> 2006 2005<br />

No. Value No. Value No. Value<br />

(US$m) (US$m) (US$m)<br />

By mandate<br />

- Lending 103 8,705 76 5,171 67 4,601<br />

- Advisory* 26 n/a n/a n/a n/a n/a<br />

Loans by category<br />

- Category A 7 1,407 1 80 5 809<br />

- Category B 57 5,184 41 2,708 38 1,917<br />

- Category C 39 2,114 34 2,383 24 1,875<br />

Loans by type of facility<br />

- Solely commercial 63 4,516 42 2,921 39 1,995<br />

- Solely export credit 32 2,878 29 1,350 21 2,075<br />

- Commercial/ 8 1,311 5 900 7 531<br />

export credit<br />

Transactions declined 4 n/a 4 n/a 7 n/a<br />

*The Principles were extended during 2006 to cover advice given to clients on<br />

project finance.<br />

Category A: Projects with potentially significant adverse social or environmental<br />

impacts that are diverse, irreversible or unprecedented.<br />

Category B: Projects with potentially limited adverse social or environmental<br />

impacts that are few in number, generally site-specific, largely reversible and readily<br />

addressed through mitigation measures.<br />

Category C: Projects with minimal or no social or environmental impacts.<br />

Chemicals Defence Energy<br />

Prohibited<br />

business<br />

Minimum<br />

standards<br />

Chemical weapons<br />

Persistent organic pollutants (POPs)<br />

Hazardous pesticides and industrial<br />

chemicals<br />

Stockholm Convention on POPs<br />

Rotterdam Convention on hazardous<br />

chemicals/pesticides<br />

World Health Organisation Redlist of<br />

hazardous pesticides<br />

Montreal Protocol on depletion of the ozone<br />

layer<br />

The financing of weaponry<br />

---------------------------<br />

Kyoto Protocol where applicable<br />

EU Emission Trading Scheme where applicable<br />

--------------------<br />

Restricted<br />

business<br />

The financing of<br />

non-weaponry equipment<br />

for the defence sector<br />

<strong>HSBC</strong> takes a cautious case-by-case approach to<br />

financing nuclear power, requiring that proposals<br />

meet international standards as set by the<br />

International Atomic Energy Association (IAEA)<br />

Issued August 2005<br />

May 2000 (updated March<br />

2005)<br />

June 2006<br />

22 <strong>HSBC</strong> <strong>Holdings</strong> <strong>plc</strong> <strong>Sustainability</strong> <strong>Report</strong> <strong>2007</strong>