Technology in Banking-Insight and Foresight for BTA_2011 ... - IDRBT

Technology in Banking-Insight and Foresight for BTA_2011 ... - IDRBT

Technology in Banking-Insight and Foresight for BTA_2011 ... - IDRBT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Technology</strong> <strong>in</strong> Bank<strong>in</strong>g – <strong>Insight</strong> & <strong>Foresight</strong> 30<br />

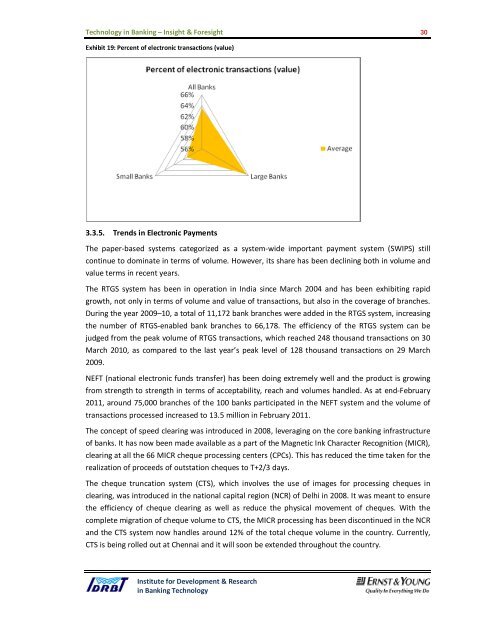

Exhibit 19: Percent of electronic transactions (value)<br />

3.3.5. Trends <strong>in</strong> Electronic Payments<br />

The paper-based systems categorized as a system-wide important payment system (SWIPS) still<br />

cont<strong>in</strong>ue to dom<strong>in</strong>ate <strong>in</strong> terms of volume. However, its share has been decl<strong>in</strong><strong>in</strong>g both <strong>in</strong> volume <strong>and</strong><br />

value terms <strong>in</strong> recent years.<br />

The RTGS system has been <strong>in</strong> operation <strong>in</strong> India s<strong>in</strong>ce March 2004 <strong>and</strong> has been exhibit<strong>in</strong>g rapid<br />

growth, not only <strong>in</strong> terms of volume <strong>and</strong> value of transactions, but also <strong>in</strong> the coverage of branches.<br />

Dur<strong>in</strong>g the year 2009–10, a total of 11,172 bank branches were added <strong>in</strong> the RTGS system, <strong>in</strong>creas<strong>in</strong>g<br />

the number of RTGS-enabled bank branches to 66,178. The efficiency of the RTGS system can be<br />

judged from the peak volume of RTGS transactions, which reached 248 thous<strong>and</strong> transactions on 30<br />

March 2010, as compared to the last year’s peak level of 128 thous<strong>and</strong> transactions on 29 March<br />

2009.<br />

NEFT (national electronic funds transfer) has been do<strong>in</strong>g extremely well <strong>and</strong> the product is grow<strong>in</strong>g<br />

from strength to strength <strong>in</strong> terms of acceptability, reach <strong>and</strong> volumes h<strong>and</strong>led. As at end-February<br />

<strong>2011</strong>, around 75,000 branches of the 100 banks participated <strong>in</strong> the NEFT system <strong>and</strong> the volume of<br />

transactions processed <strong>in</strong>creased to 13.5 million <strong>in</strong> February <strong>2011</strong>.<br />

The concept of speed clear<strong>in</strong>g was <strong>in</strong>troduced <strong>in</strong> 2008, leverag<strong>in</strong>g on the core bank<strong>in</strong>g <strong>in</strong>frastructure<br />

of banks. It has now been made available as a part of the Magnetic Ink Character Recognition (MICR),<br />

clear<strong>in</strong>g at all the 66 MICR cheque process<strong>in</strong>g centers (CPCs). This has reduced the time taken <strong>for</strong> the<br />

realization of proceeds of outstation cheques to T+2/3 days.<br />

The cheque truncation system (CTS), which <strong>in</strong>volves the use of images <strong>for</strong> process<strong>in</strong>g cheques <strong>in</strong><br />

clear<strong>in</strong>g, was <strong>in</strong>troduced <strong>in</strong> the national capital region (NCR) of Delhi <strong>in</strong> 2008. It was meant to ensure<br />

the efficiency of cheque clear<strong>in</strong>g as well as reduce the physical movement of cheques. With the<br />

complete migration of cheque volume to CTS, the MICR process<strong>in</strong>g has been discont<strong>in</strong>ued <strong>in</strong> the NCR<br />

<strong>and</strong> the CTS system now h<strong>and</strong>les around 12% of the total cheque volume <strong>in</strong> the country. Currently,<br />

CTS is be<strong>in</strong>g rolled out at Chennai <strong>and</strong> it will soon be extended throughout the country.<br />

Institute <strong>for</strong> Development & Research<br />

<strong>in</strong> Bank<strong>in</strong>g <strong>Technology</strong>