Corporate Governance for Banks in Southeast Europe: Policy - IFC

Corporate Governance for Banks in Southeast Europe: Policy - IFC

Corporate Governance for Banks in Southeast Europe: Policy - IFC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Skepticism regard<strong>in</strong>g disclosure<br />

Beyond these technical concerns, there is considerable skepticism regard<strong>in</strong>g the benefits of disclosure <strong>in</strong><br />

the region. In best-practice countries, the usual benefits of disclosure are described as better accountability<br />

to owners and the public, improvements <strong>in</strong> per<strong>for</strong>mance, better access to capital, and improved public<br />

perceptions. Yet, SEE managers and owners tend to be more conscious of the short-term costs than of the<br />

considerably less tangible benefits that might accrue to them <strong>in</strong> the longer term.<br />

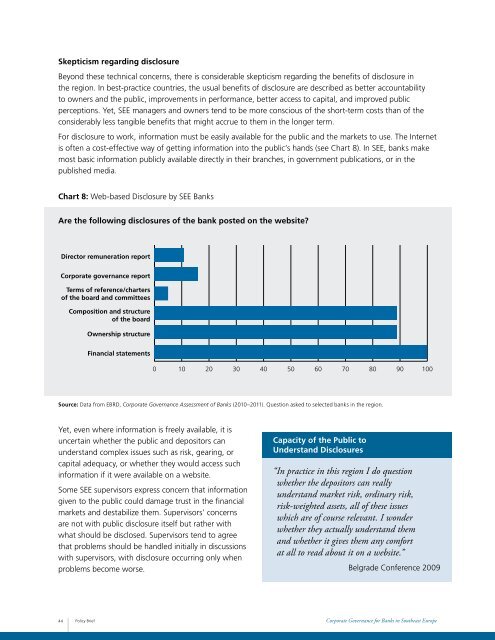

For disclosure to work, <strong>in</strong><strong>for</strong>mation must be easily available <strong>for</strong> the public and the markets to use. The Internet<br />

is often a cost-effective way of gett<strong>in</strong>g <strong>in</strong><strong>for</strong>mation <strong>in</strong>to the public’s hands (see Chart 8). In SEE, banks make<br />

most basic <strong>in</strong><strong>for</strong>mation publicly available directly <strong>in</strong> their branches, <strong>in</strong> government publications, or <strong>in</strong> the<br />

published media.<br />

Chart 8: Web-based Disclosure by SEE <strong>Banks</strong><br />

Are the follow<strong>in</strong>g disclosures of the bank posted on the website?<br />

Director remuneration report<br />

<strong>Corporate</strong> governance report<br />

Terms of reference/charters<br />

of the board and committees<br />

Composition and structure<br />

of the board<br />

Ownership structure<br />

F<strong>in</strong>ancial statements<br />

0 10 20 30 40 50 60 70 80 90 100<br />

Source: Data from EBRD, <strong>Corporate</strong> <strong>Governance</strong> Assessment of <strong>Banks</strong> (2010–2011). Question asked to selected banks <strong>in</strong> the region.<br />

Yet, even where <strong>in</strong><strong>for</strong>mation is freely available, it is<br />

uncerta<strong>in</strong> whether the public and depositors can<br />

understand complex issues such as risk, gear<strong>in</strong>g, or<br />

capital adequacy, or whether they would access such<br />

<strong>in</strong><strong>for</strong>mation if it were available on a website.<br />

Some SEE supervisors express concern that <strong>in</strong><strong>for</strong>mation<br />

given to the public could damage trust <strong>in</strong> the f<strong>in</strong>ancial<br />

markets and destabilize them. Supervisors’ concerns<br />

are not with public disclosure itself but rather with<br />

what should be disclosed. Supervisors tend to agree<br />

that problems should be handled <strong>in</strong>itially <strong>in</strong> discussions<br />

with supervisors, with disclosure occurr<strong>in</strong>g only when<br />

problems become worse.<br />

Capacity of the Public to<br />

Understand Disclosures<br />

“In practice <strong>in</strong> this region I do question<br />

whether the depositors can really<br />

understand market risk, ord<strong>in</strong>ary risk,<br />

risk-weighted assets, all of these issues<br />

which are of course relevant. I wonder<br />

whether they actually understand them<br />

and whether it gives them any com<strong>for</strong>t<br />

at all to read about it on a website.”<br />

Belgrade Conference 2009<br />

44<br />

<strong>Policy</strong> Brief<br />

<strong>Corporate</strong> <strong>Governance</strong> <strong>for</strong> <strong>Banks</strong> <strong>in</strong> <strong>Southeast</strong> <strong>Europe</strong>