Asset-Backed Alert - IMN

Asset-Backed Alert - IMN

Asset-Backed Alert - IMN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

APRIL 12, 2013<br />

2 JP Morgan Maps Next MBS Issue<br />

2 Discover Pressed for Junior Paper<br />

2 Europe CLO Pros Hail New Approach<br />

3 CLO Issuers Grumble Over S&P Stance<br />

3 BTG Sells Mortgage-Bond Holdings<br />

4 Uncertainty Clouds CLO Forecasts<br />

4 Auto Performance Back at Pinnacle<br />

5 S&P Gets Look at ‘Mock’ Solar Deal<br />

5 Budget Cuts Leave Brazos in Limbo<br />

6 Alt-A Securities Setting the Pace<br />

6 Trups CDO Offering Tests Market<br />

8 Equipment Shop Courts Buysiders<br />

9 Mortgage-Seizure Threat Subsides<br />

10 INITIAL PRICINGS<br />

THE GRAPEVINE<br />

The leader of PineBridge Investments’<br />

structured-product buying unit has left<br />

the firm to join Fifth Third Bank as head<br />

of a Cincinnati unit that helps buyside<br />

clients devise fixed-income investment<br />

strategies. As a member of PineBridge’s<br />

New York office, John Dunlevy was<br />

responsible for all of the $68.6 billion<br />

firm’s investments in asset- and<br />

mortgage-backed bonds. He also has<br />

worked as chief fixed-income strategist<br />

at Nomura, and as a portfolio manager at<br />

Beacon Funds and Hyperion Capital.<br />

Director Kashif Gilani has resigned from<br />

Barclays’ asset-backed bond banking<br />

unit. As a member of Barclays’ New York<br />

team, Gilani focused on structuring deals<br />

backed by student loans and credit-card<br />

See GRAPEVINE on Back Page<br />

Bank of Japan Moves Seen as Boon for ABS<br />

Look for some of Japan’s largest institutional investors to become active buyers of<br />

U.S. asset-backed securities in the months ahead.<br />

The risk-averse Japanese institutions don’t often invest in structured products<br />

issued in the U.S. So why now? With the Bank of Japan about to begin buying Japanese<br />

government bonds as part of an aggressive quantitative-easing program, the<br />

already-low yields on those notes are expected to fall even further. That should<br />

motivate yield-starved institutional investors in the nation to take a fresh look at<br />

the U.S. asset-backed bond market, sources said.<br />

“Mark my words, it won’t be long before we start seeing the Japanese venturing<br />

into our space,” one syndication specialist said. “This program won’t just drive down<br />

rates on Japanese government bonds, but on all securities. Stateside, asset-backed<br />

bonds will be seen as a safe haven with solid yields.”<br />

Among the Japanese institutions viewed as likely buyers of newly issued paper in<br />

See JAPAN on Page 4<br />

TD Pulling Trigger on Bond-Issuing Initiative<br />

Toronto-Dominion Bank is moving forward with plans to issue bonds backed by<br />

credit-card accounts and auto loans.<br />

After several months of preparation, the Toronto bank appears to be almost<br />

ready to float offerings in both asset classes — distributing the deals separately in<br />

the U.S. and Canada according to collateral location. Multiple transactions would<br />

follow throughout the year.<br />

The effort is led by Craig Lowery, a vice president in charge of treasury and funding.<br />

On the credit-card side, he’s focusing on a growing book of bankcard accounts<br />

that TD offers in the U.S. and Canada. He’s also considering deals backed by Target<br />

accounts, despite earlier indications that those receivables would be funded solely<br />

through deposits.<br />

TD bought $5.7 billion of Visa and private-label accounts from Target in March,<br />

See TRIGGER on Page 6<br />

Knight Traders Bristle at Stifel’s Ultimatum<br />

Stifel Financial appears to be playing hardball with a team of bond traders it is<br />

absorbing from Knight Capital.<br />

Up to 100 Knight traders and sales professionals who cover mortgage-backed<br />

securities or corporate debt are set to join Stifel as it completes its acquisition of<br />

Knight’s fixed-income unit. On March 15, Stifel agreed to pay an undisclosed sum<br />

for the business, with a closing date expected in about three months.<br />

In the past, Stifel generally has proved adept when it comes to integrating businesses<br />

it acquires, according to executive recruiters. But this time its tactics are<br />

rankling the Knight crew — to the point where litigation now seems inevitable.<br />

“Everyone who has left [Knight] has hired a lawyer to fight off Stifel,” a source<br />

said.<br />

What’s their gripe? Sources said Stifel is offering the Knight traders and salespeople<br />

weak accounts with a paltry 6-10 clients apiece, compared to the fatter client<br />

See KNIGHT on Page 8

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

2<br />

ALERT<br />

JP Morgan Maps Next MBS Issue<br />

J.P. Morgan is moving quickly to float its next jumbo-mortgage<br />

securitization.<br />

After pricing its first such deal in years on March 25, the<br />

bank is aiming to complete a follow-up offering of undisclosed<br />

size by the end of June — proceeding with plans to establish a<br />

routine issuance program. It already has an initial blueprint for<br />

the transaction in hand, and has been showing it to Fitch, DBRS<br />

and Kroll.<br />

The same agencies rated the $616.3 million deal that J.P.<br />

Morgan completed last month. Moody’s and S&P didn’t grade<br />

that offering, and it’s unclear whether they’ll get an opportunity<br />

to weigh in on the upcoming one.<br />

Moody’s seems a less-likely candidate. J.P. Morgan declined<br />

to retain the agency for the March transaction after it refused<br />

to give triple-A grades to the offering’s senior classes, citing<br />

concerns over how long investors are given to pursue claims<br />

involving loans that fail to meet representations and warranties.<br />

And the bank apparently remains miffed.<br />

S&P, meanwhile, was pulled from the March deal after saying<br />

it would assign top ratings to the senior securities only if<br />

they were supported by subordinate classes equal to more than<br />

8% of the issue’s overall balance. That’s more than the agency<br />

required for offerings from Credit Suisse and Redwood Trust,<br />

and likewise exceeded the 7.4% subordination level assigned<br />

to J.P. Morgan by Fitch, DBRS and Kroll. While J.P. Morgan and<br />

S&P have discussed the matter further since then, there’s no<br />

word on whether they reached an agreement.<br />

Issuers in the U.S. have completed eight jumbo-mortgage<br />

securitizations totaling $3.4 billion this year, according to<br />

<strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong>’s ABS Database. That’s about a third of<br />

total production for the asset class since the credit crisis. Other<br />

issuers in the second-quarter pipeline include Credit Suisse,<br />

Everbank and Redwood, which began shopping a $463 million<br />

transaction on April 2. Citigroup also has a $300 millionplus<br />

securitization in the works, although the timing remains<br />

unknown. <br />

Discover Pressed for Junior Paper<br />

Nudged by investors, Discover is giving serious thought to<br />

issuing more subordinate tranches from its credit-card securitization<br />

trust.<br />

In the wake of the financial crisis, card bonds carrying<br />

below-triple-A grades were few and far between, as investors<br />

demanded yields on junior paper that were too costly for most<br />

issuers. That began to change last year, though, as yield-starved<br />

buysiders showed a greater willingness to bear the risk.<br />

Following in the footsteps of American Express and GE<br />

Capital, Discover in November issued a $250 million securitization<br />

made up of a single tranche of subordinate paper, rated<br />

A1/AA+/A- by Moody’s, S&P and Fitch. Its most recent deal, a<br />

$1.7 billion offering that priced Feb. 6, was entirely triple-Arated.<br />

Since then, sources said, investors have put increasing<br />

pressure on the Riverwoods, Ill., company to conduct future<br />

offerings of subordinate tranches. Discover issues about once<br />

a quarter.<br />

One factor motivating investors, beside the promise of higher<br />

returns, is the fact that card-bond collateral has performed<br />

well. Indeed, credit card charge-off and delinquency rates —<br />

key indicators of bond performance — are near their lowest<br />

levels ever, according to an index maintained by Moody’s.<br />

Still, issuers remain wary about increasing production of<br />

subordinate bonds. So far this year, only one such offering<br />

has taken place — a $555.6 million securitization by American<br />

Express on March 14 that included both senior and junior<br />

tranches. In that case, Amex sold two subordinate slices totaling<br />

$55.5 million — one rated single-A, the other triple-B. <br />

Europe CLO Pros Hail New Approach<br />

A European collateralized loan obligation that Pramerica<br />

Fixed Income priced April 10 is expected to serve as a model<br />

for such deals going forward, with the collateral pool including<br />

both high-yield corporate bonds and leveraged loans.<br />

The thinking is that the approach could help in efforts to<br />

revive Europe’s moribund CLO market, which has seen only<br />

a handful of deals since the financial crisis. Investec Bank is<br />

teeing up a deal, joining Apollo Management, BNY Mellon unit<br />

Alcentra, Carlyle Group, New Amsterdam Capital and 3i Debt<br />

Management among the firms expected to issue European collateralized<br />

loan obligations this year.<br />

“I haven’t seen it like this in a couple of years,” one source<br />

said of the renewed optimism. “It’s getting to the point where if<br />

there is consistent flow, you have to be out there as well if you’re<br />

going to be taken as a serious issuer.”<br />

Pramerica’s €300 million ($395 million) offering was just the<br />

second “CLO 2.0” in Europe — industry jargon for a new deal<br />

structure that includes a range of investor protections. But the<br />

most striking thing about the deal is its investment parameters:<br />

Up to 40% of the assets can be high-yield European corporate<br />

bonds, making for an unusual collateral mix of securities and<br />

loans. Investors can expect that to be a standard feature of<br />

European CLOs for the foreseeable future, sources said.<br />

That’s significant because a key reason for the dearth of<br />

European CLOs in recent years has been a severe shortage<br />

of leveraged loans. Loan-origination volume for the first two<br />

months of the year plummeted to less than €1 billion in 2009,<br />

after reaching €31.3 billion in 2006. Last year, €4.1 billion of<br />

leveraged loans were issued in January and February.<br />

More recently, origination has increased substantially,<br />

to more than €10 billion in the first two months of this year,<br />

according to S&P. That, coupled with the inclusion of corporate<br />

bonds in the collateral pools, has led to forecasts of as many as<br />

a dozen CLOs being issued in Europe by yearend.<br />

Barclays ran the books on the Pramerica deal, dubbed<br />

Dryden 27 Euro CLO. The only previous CLO 2.0 offering in<br />

Europe was a €300.5 million offering that Cairn Capital priced<br />

Feb. 20 via Credit Suisse.

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

3<br />

ALERT<br />

CLO Issuers Grumble Over S&P Stance<br />

S&P’s recent warnings about deteriorating quality among<br />

collateralized loan obligation pools are being met with<br />

increased agitation from issuers who fault the agency’s rating<br />

methods.<br />

The complaints became especially amplified after S&P said<br />

last week that it expects to increase the credit protections<br />

required to earn triple-A grades on CLOs underpinned by certain<br />

types of loans, while separately releasing an April 5 report<br />

that voiced concerns about weakening credit profiles among<br />

such deals. The issuers’ main gripe: that the agency has consistently<br />

underestimated the amount of money that managers<br />

stand to recover when a collateral account defaults.<br />

While the dispute has been developing for some time, S&P’s<br />

decision to lower the boom prompted a quick retaliation by<br />

some issuers. They include Apollo Management, which plans<br />

to leave the agency off its next CLO. Apollo has issued seven<br />

CLOs totaling $2.9 billion dating back to 2010, each of which<br />

was graded by S&P and Moody’s. This time, it will be Moody’s<br />

and Fitch.<br />

Sources said dissatisfaction with S&P’s methods also might<br />

explain why a March 26 deal from GoldenTree <strong>Asset</strong> Management<br />

came without a rating from the agency. That $669 million<br />

issue, sold under the New York firm’s GoldenTree Loan Opportunities<br />

brand, also carried marks from Moody’s and Fitch.<br />

While GoldenTree has occasionally launched CLOs through<br />

other programs without S&P’s blessing, last month’s transaction<br />

marked the first time in the 11-year history of GoldenTree<br />

Loan Opportunities that the agency wasn’t engaged. All told,<br />

the series has produced seven deals adding up to $4.5 billion.<br />

That issuers are forgoing S&P ratings isn’t necessarily a surprise,<br />

as the agency has acknowledged that it expects to lose<br />

some market share over its stance. But the fact that high-profile<br />

issuers already are dropping the agency demonstrates the<br />

depth of the division.<br />

As CLO volume exploded in recent years, S&P emerged as<br />

the most active rating agency in the sector. Given that status,<br />

issuers have had little choice but to grudgingly include the<br />

shop’s recovery projections in their deal documents — following<br />

its borrower-by-borrower assumptions rather than setting<br />

a single recovery target for the entire asset pool.<br />

They also have had to leave out certain borrowers that score<br />

poorly in S&P’s recovery forecasts, even if the issuers’ own<br />

analysis suggests a positive outcome. In recent days, however,<br />

more and more managers have said privately that they’ve had<br />

enough. “For years we’ve had an issue with how they derive<br />

recovery rates,” one manager said. “It’s very simplistic and inaccurate.<br />

As a result, they show very low recovery rates on highly<br />

rated loans.”<br />

Much of the head-butting involves so-called covenant-lite<br />

loans, which are credits that limit the actions lenders can take<br />

when borrowers run into trouble. While last week’s report from<br />

S&P broadly addressed concerns that the credit cycle is entering<br />

a decline, the agency emphasized that growing use of covlite<br />

loans as CLO collateral in particular has been dampening<br />

its outlook. That’s partly because recoveries among those assets<br />

could become especially difficult in a downturn.<br />

S&P says its view is supported by the fact that it rates more<br />

corporate borrowers than anyone else, and that ratings among<br />

cov-lite borrowers have been falling. It plans to stick with its<br />

approach.<br />

Managers counter that S&P is guessing where credit quality<br />

is headed, adding that cov-lite assets typically have performed<br />

well and can help them assemble collateral pools at a time<br />

when leveraged-loan supply has lagged demand. They additionally<br />

point out that most CLOs contain enough subordination<br />

to protect senior investors even under pessimistic recovery<br />

scenarios, and suggest the agency underestimates the amount<br />

of cash on borrowers’ balance sheets.<br />

Some also accuse S&P of taking an overly cautious tack<br />

in response to the $5 billion lawsuit it is facing from the U.S.<br />

Department of Justice. That complaint, filed in February in U.S.<br />

District Court in Los Angeles, accuses the shop of bolstering its<br />

market share prior to the credit crisis by knowingly assigning<br />

high grades to mortgage bonds and collateralized debt obligations<br />

with weak asset pools. <br />

BTG Sells Mortgage-Bond Holdings<br />

BTG Pactual <strong>Asset</strong> Management has been taking profits on<br />

its holdings of non-agency mortgage bonds, following a steep<br />

increase in the values of those instruments.<br />

The asset sales have flowed from the shop’s BTG Pactual<br />

Distressed Mortgage Fund, which so far this year has cut the<br />

volume of private-label home-loan securities in its portfolio to<br />

$315 million from $400 million. The vehicle now holds 75 such<br />

positions, down from 112, according to a letter distributed to<br />

investors on March 28.<br />

Looking forward, BTG plans to continue taking advantage<br />

of what it calls “lofty price levels” in the market. “Our primary<br />

motivation was to take some profits while disposing of less liquid<br />

positions,” the firm’s managers wrote.<br />

Despite the maneuvering, the manager noted that it believes<br />

it still has enough positions to benefit if bond prices keep moving<br />

up and ample buying power should values decline.<br />

Its 2-year-old vehicle gained nearly 46% in 2012, ranking in<br />

the upper echelon of-mortgage bond funds, and followed up<br />

with a 7.4% gain for the first two months of this year. However,<br />

BTG has been warning shareholders that it would be difficult to<br />

repeat last year’s performance — while acknowledging that it is<br />

too early to exit the trade all together.<br />

The fund runs $260 million of equity, boosting its buying<br />

power through the use of leverage. <br />

Unless your company holds a multi-user license, it is a violation of<br />

U.S. copyright law to photocopy or reproduce any part of this<br />

publication, or forward it electronically, without first obtaining<br />

permission from <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong>. For details about licenses,<br />

contact JoAnn Tassie at 201-234-3980 or jtassie@hspnews.com.

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

4<br />

ALERT<br />

Uncertainty Clouds CLO Forecasts<br />

Collateralized loan obligation professionals are still all over<br />

the map when it comes to forecasting this year’s issuance volume.<br />

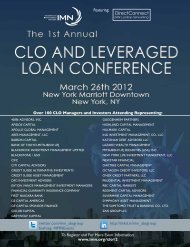

As 1,500 industry participants crammed into Information<br />

Management Network’s “2nd Annual Investors’ Conference on<br />

CLOs and Leveraged Loans” at the Conrad Hotel in New York<br />

on April 10-11, many trumpeted the crowd as a testament to the<br />

market’s current strength. Away from the panel discussions, conferencegoers<br />

expressed differing views about future dealflow.<br />

In one camp is Joseph Moroney of Apollo Management, who<br />

predicts that CLO volume in the U.S. this year will amount to<br />

roughly $55 billion — more or less matching the 2012 total. But<br />

ING Investment senior vice president Marc Boatwright said he<br />

could see the figuring topping $75 billion. Also calling for growth<br />

is Golub Capital portfolio manager Michael Loehrke.<br />

Loehrke expects CLO-issuing opportunities to rise with an<br />

increase in loan production, fed in part by a rising volume of<br />

mergers and acquisitions. However, he tempers that forecast by<br />

noting that issuers won’t maintain the quarterly pace of $28.7 billion<br />

that they set during the January-March period of this year.<br />

One point of agreement: Nobody expects volume to decrease<br />

from last year’s levels. That’s true even of those who offer only<br />

vague outlooks, like Deutsche Bank CLO-banking head Chris<br />

Dauria, who said supply could meet or exceed last year’s level.<br />

Coming off a year of explosive growth, CLO professionals<br />

have struggled since the beginning of 2013 to reach a consensus<br />

on what to expect in terms of new-issue supply going forward.<br />

Amid the general bullishness at <strong>IMN</strong>’s conference, for example,<br />

there were undercurrents of uncertainty about difficulties managers<br />

have been facing in finding suitable loans and deteriorating<br />

credit quality among asset pools (see article on Page 3).<br />

Conferencegoers also noted that frequent loan restructurings<br />

and an apparent refusal by investors to accept tighter spreads on<br />

senior CLO paper have been leading to jerky dealflow. So have<br />

new FDIC policies that prompted at least two large buyers of top<br />

CLO classes to halt those purchases as of April 1. Investors continue<br />

to grumble about a lack of deal transparency as well.<br />

Then there are those who see market forecasts as a self-serving<br />

exercise. “The big issuers want to tell everyone that the party<br />

is over, move along,” one source said. “If they didn’t, then investors<br />

might just sit back and wait for something better to come<br />

along. The dealers will tell you their pipeline stretches through<br />

the fourth quarter. Everyone is just talking their book.” <br />

Bank of Japan announced April 4 that it plans to boost its buying<br />

of government bonds by 50 trillion yen ($520 billion) annually.<br />

Quantitative-easing measures pursued by the U.S. central<br />

bank since the financial crisis have driven down yields on Treasury<br />

securities and agency mortgage bonds to historic lows.<br />

That, in turn, has sent investors scurrying into the asset-backed<br />

bond market in search of yield.<br />

The Bank of Japan’s announcement prompted a selloff of Japanese<br />

government bonds, sending yields surprisingly higher in<br />

recent days. Still, the returns on those notes remain well below<br />

those of comparable U.S. Treasurys — not to mention assetbacked<br />

securities.<br />

“We’re watching this very closely,” another banker said of<br />

Japan’s quantitative-easing initiative, which has been in the<br />

works since the beginning of the year. “Since this started, Japanese<br />

government bonds are yielding next to nothing. Japanese<br />

investors are going to have to start looking at alternatives.” <br />

Auto Performance Back at Pinnacle<br />

Delinquencies among securitized pools of prime-quality<br />

auto loans have dipped to a level visited only once in the<br />

past dozen years. The volume of past-due accounts dropped<br />

8 bp to 0.33% during the month ended March 15, matching<br />

a recent low seen in April 2012, according to an index maintained<br />

by Fitch. The last time delinquencies were lower was<br />

in June 2001. Losses also declined, dropping 7 bp to an annualized<br />

rate of 0.33%. That indicator has been aided in part<br />

by strong demand for used cars, which improves recoveries<br />

from sales of repossessed vehicles. Among subprime loans,<br />

delinquencies fell 63 bp to 3.02% while losses declined 17<br />

bp to 5.36%. Those improvements, driven in part by distributions<br />

of tax refunds, at least temporarily defy widespread<br />

expectations that weaker underwriting standards would<br />

cause subprime-loan performance to suffer. Fitch expects<br />

the pattern to continue into June.<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

Prime Auto Loans<br />

0.0<br />

1/08 1/09 1/10 1/11 1/12 1/13<br />

Japan ... From Page 1<br />

the States are heavy hitters Government Pension Investment<br />

Fund of Japan, Nihon Keizai Shimbun Pension Fund and Yokahama<br />

National University.<br />

While Japanese investors have occasionally bought into<br />

deals from the U.S. in the past, little of that activity involved<br />

pension systems and other institutional players. Rather, the<br />

demand was driven by banks — which lately have shown a<br />

particular interest in collateralized loan obligations.<br />

Following in the footsteps of the U.S. Federal Reserve, the<br />

15 Subprime Auto Loans<br />

12<br />

9<br />

6<br />

3<br />

0<br />

1/08 1/09 1/10 1/11 1/12 1/13<br />

Loss Rate (%)<br />

60-Day Delinquencies (%)<br />

Source: www.fitchratings.com

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

5<br />

ALERT<br />

S&P Gets Look at ‘Mock’ Solar Deal<br />

A government-sanctioned organization is constructing a<br />

prototype securitization of leases on solar-power equipment,<br />

with the aim of determining whether such issues could earn<br />

high-enough ratings to be feasible.<br />

The undertaking is the product of Solar Access to Public<br />

Capital, a group of about 40 companies brought together by the<br />

U.S. Department of Energy’s National Renewable Energy Laboratory<br />

with the aim of creating a market for solar-equipment<br />

securities. SolarCity is playing the role of issuer on the model<br />

deal, with Credit Suisse as the underwriter — mirroring a relationship<br />

that the shops already have in place for an actual offering<br />

that’s in the works.<br />

The theoretical transaction would total $50 million and would<br />

be based on a portfolio of leases on residential installations. The<br />

plan is to submit the sample to S&P prior to the July 8 start of the<br />

“Intersolar North America” conference in San Francisco.<br />

A second model securitization involving installations on<br />

commercial buildings will also be presented to S&P, with Credit<br />

Suisse again acting as underwriter. However, no issuer has been<br />

assigned for that side of the project.<br />

The goal in both cases is to determine whether S&P will<br />

grade the securities double-A or higher, which is the level that<br />

prospective issuers see as necessary to move forward with their<br />

inaugural offerings.<br />

Why assemble a model securitization? Ever since companies<br />

like SolarCity began expressing an eagerness to securitize<br />

more than two years ago, rating agencies have hesitated over<br />

the complexities and unfamiliar nature of the targeted assets.<br />

The view is that an informal mark from S&P, which has yet to<br />

officially sign on to grade the sample deal, could help issuers<br />

tweak their offerings to ensure broad appeal from the start —<br />

rather than floating potentially lower-rated transactions that<br />

could dampen enthusiasm for the asset class.<br />

S&P’s concerns about solar-equipment deals have included<br />

a lack of historical lease-payment data. The Department of<br />

Energy and the Solar Access group are answering by drafting<br />

standard power-purchase and lease contracts and by creating a<br />

database of lease performance.<br />

That said, it’s unclear why the focus is on how S&P alone<br />

would rate the deals. Credit Suisse, which already has supplied<br />

financing to SolarCity and prospective issuer SunRun, was in<br />

talks with Moody’s last year about possibly grading deals of<br />

$500 million from each company. And while Moody’s is not a<br />

member of the Solar Access group, it has been talking to the<br />

Department of Energy about its approach to the market.<br />

S&P is a member. So are Kroll, Credit Suisse, SolarCity, Sun-<br />

Run and most other solar-equipment solar installation and<br />

leasing companies interested in securitization. <br />

Budget Cuts Leave Brazos in Limbo<br />

The U.S. Department of Education is withholding a servicing<br />

contract that it was poised to award to Brazos Higher Education,<br />

pushing the education lender’s securitization plans onto<br />

the backburner.<br />

The Department of Education had been looking at mid-<br />

June to add Brazos to a list of not-for-profit servicers assigned<br />

to handle collections on government-originated Direct Loans.<br />

But on April 1, the agency said it would halt such assignments<br />

at least until the end of its current fiscal year on Sept. 30.<br />

That decision, brought on by the federal spending cuts<br />

known as sequestration, came as a shock to Brazos. In fact, the<br />

Waco, Texas, lender already had spent $2 million and hired 20<br />

people in anticipation that it would receive the contract.<br />

So what does that have to do with Brazos’ presence in the<br />

asset-backed bond market? The company, once an active<br />

issuer, had been eyeing the assignment as a key source of fee<br />

income at a time when many of its other lines of business dried<br />

up — with the idea that it could use the revenues to launch or<br />

expand other lending projects that it eventually would fund via<br />

a renewed securitization program.<br />

In the three years since the Obama Administration blocked<br />

private-sector lenders from writing fresh loans via the Department<br />

of Education’s Federal Family Education Loan Program,<br />

those shops have been pursuing Direct Loan servicing contracts<br />

as a revenue lifeline. In the meantime, many have seen<br />

their lending volume founder.<br />

Brazos wrote only $300,000 of non-government private<br />

loans in 2012, giving it little in the way of fresh assets to securitize.<br />

The company was negotiating for a $10 million warehouse<br />

line from a regional bank, with the goal of using the capital<br />

to write and eventually securitize loans to students of trade<br />

schools and specialized training programs. But that deal never<br />

materialized.<br />

Brazos has sought alternative sources of revenue in the meantime,<br />

including its December purchase of online job-interview<br />

service InterviewStream. But any securitization plans — seen as<br />

a driver of ongoing lending growth — now are on hold until the<br />

company learns of its future as a Direct Loan servicer.<br />

The Department of Education’s intentions on that front<br />

are unclear. In the meantime, Brazos will lay off the workers<br />

it hired. It also will submit a letter to the agency next week<br />

explaining the importance of the contract and urging for a<br />

quick resolution.<br />

Brazos began issuing student-loan backed bonds in 1995,<br />

and to date has completed 42 deals totaling $15.7 billion,<br />

according to <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong>’s ABS Database. It last was in<br />

the market in August 2012 with a $115.2 million issue, with<br />

Morgan Stanley as bookrunner. <br />

Corrections<br />

An April 5 article, “CLO Issuers Mulling Capital Calls,” overstated<br />

the spread for a class of a Carlyle Group collateralized<br />

loan obligation. The 5.4-year senior tranche of the deal, Carlyle<br />

Global Market Strategies, 2013-2, priced at 115 bp over threemonth<br />

Libor.<br />

An item in The Grapevine on April 5 misidentified the headquarters<br />

of Ares Management. The firm is based in Los Angeles.

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

6<br />

ALERT<br />

Alt-A Securities Setting the Pace<br />

Hedge funds that started buying alternative-A mortgage<br />

paper late last year knew what they were doing.<br />

Turns out that bonds backed by alt-A adjustable-rate mortgages<br />

have outperformed other types of home-loan securities<br />

since the start of the year. According to an April 5 research<br />

report from Bank of America, the values of alt-A bonds issued<br />

from 2005 to 2007 are up at least 6% year to date — compared<br />

to a 3.6% average gain for legacy jumbo-mortgage securities.<br />

The top performers: alt-A bonds issued in 2006, which have<br />

gained an average of 7.4% since Jan. 1.<br />

Hedge funds and other buyside players turned their attention<br />

to alt-A paper late in the fourth quarter as a nearly yearlong<br />

rally in the market for jumbo-mortgage bonds appeared to<br />

be losing steam. Among the shops thought to have been active<br />

buyers at the time are Greg Lippmann’s LibreMax Capital and<br />

BTG Pactual. <br />

Trups CDO Offering Tests Market<br />

Investors are salivating over an unusually large offering of<br />

collateralized debt obligations backed by trust-preferred securities<br />

that hit the secondary market this week.<br />

The $200 million “BWIC” — for bids wanted in competition<br />

— is made up of senior bonds from 16 transactions issued<br />

prior to the financial crisis. Sources identified the seller as Commerce<br />

Street Investment, a Dallas shop that appears to be liquidating<br />

its entire inventory of so-called Trups CDOs. Bids are<br />

due April 17.<br />

The expectation is that the offering could establish a new<br />

pricing benchmark for such securities, whose values plummeted<br />

during the financial crisis. Some believe the notes will<br />

change hands above 70 cents on the dollar, and possibly as high<br />

as 80 cents, compared to a mere 30 cents four years ago.<br />

“Prices are up 6% this year,” one trader said. “Everyone is<br />

looking for this stuff, even though not a lot is coming out.”<br />

Indeed, offerings of Trups CDOs have been sporadic, and a<br />

$200 million batch is virtually unheard of. That largely reflects<br />

the fact that no such deals have been issued since the financial<br />

crisis, and an increasing number of transactions are in run-off<br />

mode.<br />

That’s one factor behind the price gains. Another is that deal<br />

performance has been improving, after many of the regional<br />

banks that issued Trups deferred payments to bondholders<br />

during the credit crisis have resumed installments. In most<br />

cases, payment deferrals are permitted for up to five years —<br />

meaning the window is now closing for those issuers.<br />

That’s part of the reason rating agencies lately have upgraded<br />

a broad swath of Trups CDOs. “All the rating agencies are acting<br />

uniformly,” another trader said. “There is no question all<br />

the trends and ratings actions are favorable. There is probably<br />

more room to run.”<br />

Commerce Street’s offering is dominated by bonds from FTN<br />

Financial’s once-popular PreTSL shelf, which sold $12.5 billion<br />

of Trups CDOs from 2000 to 2007, according to <strong>Asset</strong>-<strong>Backed</strong><br />

<strong>Alert</strong>’s ABS Database. The portfolio encompasses pieces with<br />

face values up to $30 million, though half are $10 million or<br />

less.<br />

Bidders will likely include one or more insurance companies,<br />

which last year began snapping up senior Trups CDOs as<br />

buy-and-hold investments. One of the largest buyers following<br />

the financial crisis was Hildene Capital of New York, which has<br />

amassed a portfolio with a face value of $2 billion. <br />

Trigger ... From Page 1<br />

in a deal that also gives the bank the right to write and fund all<br />

of the retailer’s plastic in the U.S. for the next seven years.<br />

Industry professionals have been talking about TD’s potential<br />

as an issuer of credit-card bonds since mid-2012, when<br />

several Canadian banks indicated that they would lean more<br />

heavily on securitization for funding. So far this year, CIBC,<br />

National Bank of Canada and RBC have securitized accounts<br />

written at home. However, predicted deals backed by U.S.<br />

receivables have yet to materialize.<br />

TD’s plans for issuing auto-loan paper have been more of a<br />

moving target. Last year, sources said they expected the bank to<br />

act on a rumored push to securitize the loans of Chrysler Financial,<br />

the former Chrysler Corp. unit it bought from Cerberus<br />

Capital in 2011. But TD set aside any such bond-issuing ambitions<br />

as it pushed to replace Ally Bank as the preferred lender<br />

for the automaker — which years earlier had removed Chrysler<br />

Financial from that role.<br />

TD eventually lost out to Banco Santander. With that matter<br />

out of the way, however, the word is that its securitization plan<br />

is back in motion. “TD is the one people keep talking about,<br />

and they’ve been planning this for a while,” one source said.<br />

“Ultimately, they want to expand the funding alternatives they<br />

have.”<br />

TD has never been an issuer of credit-card accounts in the<br />

U.S., but has completed a few deals in Canada, most recently<br />

in 2003. The bank hasn’t sold auto-loan paper to date in either<br />

country. It has been behind some collateralized bond and<br />

loan obligations in both nations and in Europe, but not since<br />

well before the credit crisis. Separately, TD has issued covered<br />

bonds in Canada and has been looking at similar deals in the<br />

States. <br />

Sizing Up an Issuer?<br />

Instantly track down whomever or whatever you’re<br />

looking for by searching <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong>’s archives<br />

and the ABS Database at:<br />

AB<strong>Alert</strong>.com<br />

Free for <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong> subscribers.

[YES]<br />

Start my 3-issue FREE trial subscription to <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong>.<br />

There’s no obligation - I won’t receive an invoice unless I choose to subscribe.<br />

Name:<br />

Address:<br />

Tel:<br />

Company:<br />

City: State: Zip:<br />

Email:<br />

You can also start your free trial at AB<strong>Alert</strong>.com, or fax this coupon to 201-659-4141. To order by phone, call 201-659-1700.<br />

Or mail to: <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong>, 5 Marine View Plaza, #400, Hoboken, NJ 07030.

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

8<br />

ALERT<br />

Equipment Shop Courts Buysiders<br />

Commercial Credit Group is preparing its first broadly offered<br />

securitization of equipment loans.<br />

The $194.5 million offering is expected to price in the next<br />

two weeks, with J.P. Morgan and SunTrust Bank serving as<br />

bookrunners. It will encompass $179.4 million of senior securities<br />

spread across two classes with triple-A ratings from S&P<br />

and DBRS, plus $15.1 million of subordinate notes with single-<br />

A grades.<br />

Commercial Credit is offering the securities quasi-publicly<br />

under Rule 144A. The Charlotte company’s only two previous<br />

securitizations were privately placed. Those offerings, totaling<br />

$170 million, priced in the past two years with Wells Fargo and<br />

SunTrust running the books.<br />

Commercial Credit offers equipment financing to construction,<br />

shipping and waste-management companies. The company<br />

was founded in 2004. <br />

Knight ... From Page 1<br />

books the Knight staffers are used to. And if they don’t like<br />

it? Stifel apparently has told them they’ll have to take a gardening<br />

leave until yearend before joining another shop. The<br />

St. Louis-based brokerage has made it clear it would sue any<br />

Knight staffers who defy the edict, on the grounds that they’d<br />

be damaging Stifel’s business by delivering clients to competitors.<br />

“Stifel is basically saying, take these crappy accounts or<br />

you don’t work for the next eight months,” a source said.<br />

So far, nearly a dozen Knight staffers have ignored Stifel’s<br />

ultimatum and jumped ship.<br />

Knight is being broken up following a trading error last<br />

August that resulted in a $440 million loss for the Jersey City,<br />

N.J., brokerage. Getco, a high-speed trading operation in Chicago,<br />

has agreed to pay $1.4 billion for Knight’s equity business.<br />

<br />

CALENDAR<br />

Main Events<br />

Dates Event Location Sponsor Information<br />

June 18-20 Global ABS 2013 Brussels <strong>IMN</strong> www.imn.org<br />

Oct. 6-8 ABS East Miami <strong>IMN</strong> www.imn.org<br />

Events in US<br />

Dates Event Location Sponsor Information<br />

April 16-17 CLO Credit Risk Workshop New York Fitch Training www.fitchtraining.com<br />

April 17 Future of Capital Requirements New York SIFMA www.sifma.org<br />

April 17-19 New York School of Aviation Finance 2013 New York Euromoney www.euromoneyseminars.com<br />

April 22-23 Single Family Aggregation: REO-to-Rental Forum Miami <strong>IMN</strong> www.imn.org<br />

April 22-23 Airfinance Conference New York Euromoney www.euromoneyseminars.com<br />

April 24 Practical Look at Loan Operations & Settlement Today New York LSTA www.lsta.org<br />

April 29-30 Auto Finance Risk Summit Dallas Royal Media autofinancerisksummit.com<br />

April 29-30 Residential Mtge. Litigation & Regulatory Enforcement Washington ACI www.americanconference.com<br />

May 3 Sunshine <strong>Backed</strong> Bonds Conference New York <strong>IMN</strong> www.imn.org<br />

May 7-8 Education Loan & Financing Summit Washington iiBIG www.iibig.com<br />

May 8 MBS: introduction to Securitization & Processing New York FMW www.fmwonline.com<br />

May 14-15 Risk & Regulation New York CFP www.risk-regulation-usa.com<br />

May 16-17 SiLAS 2013 Miami Euromoney Seminars www.euromoneyseminars.com<br />

May 21 Distressed Debt Forum New York Mergermarket mergermarketgroup.com<br />

May 29-31 Spring Life Settlement Conference Las Vegas LISA www.lisa.org<br />

June 3-6 Credit Management & Debt Recovery New York Euromoney Training www.euromoneytraining.com<br />

June 17-21 Risk Minds USA 2013 Boston ICBI www.riskmindsusa.com<br />

June 24-25 Aircraft Finance & Leasing New York ACI www.americanconference.com<br />

Sept. 10-11 Commercial Paper & Money Markets Symposium New York iiBIG www.iibig.com<br />

Sept. 16-17 ASF Securitization Institute: Securitization Fundamentals New York ASF www.americansecuritization.com<br />

Oct. 16 Fundamental of Swaps & Other Derivatives 2013 New York PLI www.pli.edu<br />

Oct. 17 Covered Bonds-The Americas New York <strong>IMN</strong> www.imn.org<br />

Oct. 17-18 Advanced Swaps & Other Derivatives 2013 New York PLI www.pli.edu<br />

To view the complete conference calendar, visit The Marketplace section of AB<strong>Alert</strong>.com

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

9<br />

ALERT<br />

Mortgage-Seizure Threat Subsides<br />

The company behind a plan that calls for municipalities to<br />

seize underwater mortgages appears to be losing enthusiasm<br />

for the effort.<br />

Officially, Mortgage Resolution Partners’ project remains<br />

under way. But sources said the San Francisco firm is showing<br />

signs of conceding that rising housing prices have negated<br />

interest among its municipal partners.<br />

The California municipalities of San Bernardino County,<br />

Fontana and Ontario dropped out of the effort in January. They<br />

had been seen as the most promising prospects to work with<br />

Mortgage Resolution, which proposes to offer funding and<br />

management assistance to municipalities that use eminent<br />

domain to buy mortgages at risk of foreclosure.<br />

To finance the plan, Mortgage Resolution has lined up more<br />

than $500 million from investors. Along with rising housing<br />

prices, its momentum may have been sapped by threats of lawsuits<br />

from the American Securitization Forum and Sifma.<br />

The company is still holding out for one municipality, however.<br />

Officials in the Massachusetts town of Brockton are scheduled<br />

to vote on April 11 whether to join the effort.<br />

“This whole thing is irrelevant until some city pulls the trigger,<br />

which is appearing more unlikely,” one source said. <br />

5 th in the Global Series<br />

USA 2013<br />

RISK®ULATION<br />

New York City, May 14–15<br />

Developing Industry<br />

Standards And Best Risk<br />

Practices For The New<br />

Regulatory World Order<br />

Principal Partner<br />

Executive Search Partner<br />

<br />

<br />

<br />

<br />

HEAR FROM OVER 50 SENIOR<br />

RISK PROFESSIONALS<br />

Co-Sponsors<br />

Network Lunch Sponsor<br />

E: info@cfp-events.com T: +1 888 677 7007<br />

www.risk-regulation-usa.com<br />

SECURITIZATION SPOTLIGHT SESSION<br />

The Future of Capital<br />

Requirements<br />

APRIL 17, 2013 | 5:00PM – 7:30PM<br />

SIFMA CONFERENCE CENTER | NYC<br />

<br />

<br />

<br />

Global ABS<br />

TM<br />

2013<br />

A December 2012 consultation from the<br />

Basel Committee on Banking Supervision<br />

(BCBS) proposes significant changes<br />

to the capital regime for securitized<br />

products which could lead to major<br />

increases in capital requirements. Join<br />

the SIFMA Securitization Group (SSG)<br />

for its latest Spotlight Session, featuring<br />

an in-depth panel discussion to explore<br />

the impact these changes might have on<br />

the future viability of securitization as<br />

a funding and risk management tool, as<br />

well as industry recommendations to the<br />

BCBS for a revised framework.<br />

www.sifma.org/2013spotlight-basel/home/

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

10<br />

ALERT<br />

INITIAL PRICINGS<br />

SBA Tower Trust, 2013-1, 2013-2<br />

Priced: April 4<br />

Amount: $1.3 billion<br />

Collateral: Cell-tower leases<br />

Seller: SBA Communications<br />

Bookrunner:<br />

Deutsche Bank, Barclays, Citigroup, J.P. Morgan, Wells<br />

Fargo, RBS, TD Securities<br />

Class M/F Amount Yield WAL<br />

2013-1C A 425.000 2.250 5.00<br />

2013-1D Baa3/BBB 330.000 3.625 5.00<br />

2013-2C A 575.000 3.750 10.00<br />

Toyota Auto Receivables Owner Trust, 2013-A<br />

Priced: April 9<br />

Amount: $789.1 million<br />

Collateral: Auto loans (prime)<br />

Seller: Toyota<br />

Bookrunners: Bank of America, Morgan Stanley, RBS<br />

Class M/S Amount Yield WAL Spread Benchmark<br />

A-2 AAA 374.940 0.372 1.05 +5 EDSF<br />

A-3 AAA 307.980 0.551 2.10 +16 Int. Swaps<br />

A-4 AAA 106.155 0.700 3.20 +18 Int. Swaps<br />

FRS LLC, 1<br />

Priced: April 10<br />

Amount: $335.5 million<br />

Collateral: Railcar leases<br />

Seller: Flagship Rail Services<br />

Bookrunners: Wells Fargo, Deutsche Bank<br />

Class S&P Amount Yield WAL Spread Benchmark<br />

A-1 A 105.000 1.811 3.10 +130 Int. Swaps<br />

A-2 A 191.963 3.100 6.00 +195 Int. Swaps<br />

B BBB 38.568 4.000 6.00 +285 Int. Swaps<br />

Flagship Credit Auto Trust, 2013-1<br />

Priced: April 10<br />

Amount: $222.2 million<br />

Collateral: Auto loans (subprime)<br />

Seller: Flagship Credit Acceptance<br />

Bookrunner: Wells Fargo<br />

Class S/K Amount Yield WAL Spread Benchmark<br />

A A+/AA- 174.000 1.333 1.31 +100 EDSF<br />

B A 14.500 2.786 3.22 +225 Int. Swaps<br />

C BBB 21.000 3.627 3.71 +300 Int. Swaps<br />

D BB 12.660 5.449 3.83 +480 Int. Swaps<br />

In the know?<br />

Commercial Mortgage <strong>Alert</strong>, the weekly<br />

newsletter that guarantees your edge in<br />

real estate finance and securitization.<br />

Start your free trial at CM<strong>Alert</strong>.com or call 201-659-1700.

xxx<br />

April 12, 2013 <strong>Asset</strong>-<strong>Backed</strong><br />

11<br />

1<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

MARKET MONITOR<br />

ALERT<br />

ALERT<br />

($Bil.)<br />

350<br />

WORLDWIDE ABS ISSUANCE<br />

012 2013<br />

300<br />

0.0 0.0 Year-to-date volume ($Bil.)<br />

5.7 3.8 2013 2012<br />

7.5 14.5 250<br />

US Public 33.9 40.3<br />

1.6 21.7 US 144A 24.5 27.2<br />

1.3 22.9 200 Non-US 21.6 27.5<br />

6.6 30.1 TOTAL 80.0 95.1<br />

4.1 36.6 150<br />

9.6 50.0<br />

6.8 52.8<br />

100<br />

4.9 56.8<br />

8.2 61.6<br />

1.7 69.4<br />

50<br />

2.9 70.9<br />

2013<br />

4.8 78.6 0<br />

5.1 80.0<br />

1.7<br />

7.3<br />

2.8<br />

7.1<br />

7.5<br />

5<br />

US NON-AGENCY MBS ISSUANCE<br />

3.2<br />

Volume in past 15 months ($Bil.)<br />

7.2<br />

4<br />

5.9<br />

1.6<br />

3<br />

6.8<br />

2.4<br />

2<br />

2.8<br />

9.0<br />

1<br />

0.0<br />

8.2<br />

0<br />

4.2<br />

F M A M J J A S O N D J F M A<br />

8.4<br />

1.6<br />

6.9<br />

9.0<br />

2.8<br />

6.2<br />

3.2<br />

9.1<br />

8.3<br />

4.3<br />

4.3<br />

0.6<br />

5.6<br />

9.5<br />

5.6<br />

5.6<br />

0.2<br />

6.7<br />

4.6<br />

35<br />

30<br />

25<br />

20<br />

J F M A M J J A S O N D<br />

5-YEAR FIXED CARD SPREADS<br />

Last 12 months (basis points)<br />

15<br />

A M J J A S O N D J F M A<br />

15<br />

12<br />

9<br />

6<br />

3<br />

0<br />

SPREADS ON TRIPLE-A ABS<br />

Credit card - Fixed rate<br />

(vs. Swap)<br />

Credit card - Floating rate<br />

(vs. 1 mo Libor)<br />

Auto loan - Tranched<br />

(vs. Swap)<br />

Home equity - Fixed-rate/<br />

wrapped (vs. Swap)<br />

Swap spreads<br />

(bid/offer midpoint)<br />

2012<br />

US CLO ISSUANCE<br />

Volume in past 15 months ($Bil.)<br />

F M A M J J A S O N D J F M A<br />

Spread (bps)<br />

Avg. Week 52-wk<br />

Life 4/5 Earlier avg.<br />

2.0 +14 +13 +6.8<br />

5.0 +25 +24 +23.6<br />

2.0 +16 +14 +7.4<br />

5.0 +27 +26 +23.3<br />

2.0 +16 +14 +8.3<br />

3.0 +20 +21 +17.4<br />

2.0 +125 +125 +262.3<br />

5.0 +350 +350 +628.3<br />

2.0 +15 +18 +19.1<br />

5.0 +19 +19 +19.3<br />

10.0 +17 +16 +9.5<br />

Source: Deutsche Bank<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

1,400<br />

1,300<br />

1,200<br />

1,100<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

US ABS ISSUANCE<br />

Volume in past 15 months ($Bil.)<br />

F M A M J J A S O N D J F M A<br />

NON-US ABS ISSUANCE<br />

Volume in past 15 months ($Bil.)<br />

F M A M J J A S O N D J F M A<br />

ASSET-BACKED COMMERCIAL<br />

PAPER OUTSTANDING<br />

Since 1/1/06 ($Bil.)<br />

26<br />

24<br />

22<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

ABS SECONDARY TRADING<br />

Weekly volume reported to FINRA ($Bil.)<br />

Inv. Gr.<br />

Non-Inv. Gr.<br />

A M J J A S O N D J F M A<br />

26<br />

24<br />

22<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

MBS SECONDARY TRADING<br />

Weekly volume reported to FINRA ($Bil.)<br />

Inv. Gr.<br />

Non-Inv. Gr.<br />

A M J J A S O N D J F M A<br />

400<br />

300<br />

Source: Federal Reserve Board<br />

200<br />

1/06 1/07 1/08 1/09 1/10 1/11 1/12 1/13<br />

Data points for all charts on this page can<br />

be found in The Marketplace section of<br />

AB<strong>Alert</strong>.com

April 12, 2013<br />

<strong>Asset</strong>-<strong>Backed</strong><br />

12<br />

ALERT<br />

THE GRAPEVINE<br />

... From Page 1<br />

receivables. Word has it that he’s headed<br />

to a similar post at Credit Suisse —<br />

where he spent 13 years before joining<br />

Barclays in 2011.<br />

Trader Steven Yodowitz turned up last<br />

month in the Los Angeles office of<br />

broker-dealer Sierra Pacific Securities,<br />

where his coverage areas include assetbacked<br />

securities and residential and<br />

commercial mortgage bonds. Yodowitz<br />

had been out of work since July 2012,<br />

when he left the top mortgage-bond<br />

trading post at Crowell Weedon & Co. of<br />

Los Angeles. Before that, he was a bond<br />

trader and salesman at Bank of Manhattan<br />

in El Segundo, Calif. He also has<br />

worked at Bank of America and Nomura.<br />

Buyside shop HillMark Capital is<br />

looking for a New York-based analyst<br />

to cover collateralized loan obligations,<br />

which it buys on the new-issue and<br />

secondary markets. The shop, led<br />

by Mark Gold, is seeking candidates<br />

with at least five years of experience<br />

involving leveraged loans and CLO<br />

management. Applicants can email<br />

resumes to hr@hillmarkcapital.com.<br />

Kroll is seeking a mortgage-bond analyst.<br />

The recruit would be based in New<br />

York, leading coverage of new transactions<br />

and working with the agency’s<br />

surveillance team to monitor existing<br />

deals. He or she would report to senior<br />

managing director Glenn Costello.<br />

Trader Steven Hampton started a few<br />

weeks ago in the Charlotte office of<br />

market-making firm Tahoe Fixed Income.<br />

In his new role, Hampton is focused on<br />

whole loans, non-agency residential and<br />

commercial mortgage bonds and securities<br />

backed by student loans. He previously<br />

spent nine years at Duncan-Williams.<br />

Fitch would like to hire an analyst for<br />

its London office. The recruit would<br />

rate bonds backed by auto loans across<br />

Europe and credit-card accounts in the<br />

U.K., reporting to managing director<br />

Andreas Wilgen.<br />

Zhengyuan Lu has left Gleacher & Co.<br />

unit Gleacher-RangeMark, which offers<br />

analytics services to clients in the fixedincome<br />

market. He’s now working at<br />

New York small-business lender On Deck<br />

Capital as a vice president in charge of<br />

capital markets. Lu also has worked at<br />

Keefe, Bruyette & Woods and Fortis Bank.<br />

Analyst Bob Winata joined Union Bank’s<br />

New York office April 1 as a senior vice<br />

president overseeing the risk attached<br />

to portfolios of mortgage-servicing<br />

rights. Winata previously held similar<br />

positions at Ally Financial and Capital<br />

One, and earlier traded subprime whole<br />

loans at Freddie Mac.<br />

J.G. Wentworth is wrapping up efforts to<br />

prune the staff of Peachtree Settlement<br />

Funding, a structured-settlement buyer it<br />

bought in 2011. Wentworth dismissed at<br />

least 30 Peachtree staffers last week and<br />

plans to lay off at least 68 more, all from<br />

a unit that lends money to injury victims<br />

and their lawyers. Some 150 structuredsettlement<br />

workers already were let go<br />

in 2011. Meanwhile, Wentworth plans<br />

to keep some Peachtree staffers who<br />

focus on buying lottery winnings. But it’s<br />

expected that Wentworth will eliminate<br />

any remaining overlaps between<br />

Peachtree’s securitization staff and its<br />

own, which produces two or three deals<br />

per year.<br />

TO SUBSCRIBE<br />

YES! Sign me up for a one-year subscription to <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong> at a<br />

cost of $3,297. I understand I can cancel at any time and receive a full<br />

refund for the unused portion of my 46-issue license.<br />

DELIVERY (check one): q E-mail. q Mail.<br />

PAYMENT (check one): q Check enclosed, payable to <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong>.<br />

q Bill me. q American Express. q Mastercard. q Visa.<br />

Account #:<br />

Exp. date:<br />

Name:<br />

Company:<br />

Address:<br />

City/ST/Zip:<br />

Phone:<br />

E-mail:<br />

Signature:<br />

MAIL TO: <strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong><br />

www.AB<strong>Alert</strong>.com<br />

5 Marine View Plaza #400 FAX: 201-659-4141<br />

Hoboken NJ 07030-5795 CALL: 201-659-1700<br />

ASSET-BACKED ALERT<br />

www.AB<strong>Alert</strong>.com<br />

Telephone: 201-659-1700 Fax: 201-659-4141 E-mail: info@hspnews.com<br />

Joseph Nadilo Managing Editor 201-234-3984 jnadilo@hspnews.com<br />

Matt Birkbeck Senior Writer 201-234-3991 mbirkbeck@hspnews.com<br />

Steve Chambers Senior Writer 201-234-3990 schambers@hspnews.com<br />

James A. Quirk Senior Writer 201-234-3992 jquirk@hspnews.com<br />

Andrew Albert Publisher 201-234-3960 andy@hspnews.com<br />

Daniel Cowles General Manager 201-234-3963 dcowles@hspnews.com<br />

Thomas J. Ferris Editor 201-234-3972 tferris@hspnews.com<br />

T.J. Foderaro Deputy Editor 201-234-3979 tjfoderaro@hspnews.com<br />

Ben Lebowitz Deputy Editor 201-234-3961 blebowitz@hspnews.com<br />

Dan Murphy Deputy Editor 201-234-3975 dmurphy@hspnews.com<br />

Michelle Lebowitz Operations Director 201-234-3977 mlebowitz@hspnews.com<br />

Evan Grauer Database Director 201-234-3987 egrauer@hspnews.com<br />

Kevin Pugliese Database Manager 201-234-3983 kpugliese@hspnews.com<br />

Mary E. Romano Advertising Director 201-234-3968 mromano@hspnews.com<br />

Josh Albert Advertising Manager 201-234-3999 josh@hspnews.com<br />

Joy Renee Selnick Layout Editor 201-234-3962 jselnick@hspnews.com<br />

Barbara Eannace Marketing Director 201-234-3981 barbara@hspnews.com<br />

JoAnn Tassie Customer Service 201-659-1700 jtassie@hspnews.com<br />

<strong>Asset</strong>-<strong>Backed</strong> <strong>Alert</strong> (ISSN: 1520-3700), Copyright 2013, is published weekly by Harrison<br />

Scott Publications Inc., 5 Marine View Plaza, Suite 400, Hoboken, NJ 07030-5795. It is<br />

a violation of federal law to photocopy or distribute any part of this publication (either<br />

inside or outside your company) without first obtaining permission from <strong>Asset</strong>-<strong>Backed</strong><br />

<strong>Alert</strong>. We routinely monitor forwarding of the publication by employing email-tracking<br />

technology such as ReadNotify.com. Subscription rate: $3,297 per year. Information<br />

on advertising and group-license options is available upon request.