Chapter Nine- Activity-Based Costing

Chapter Nine- Activity-Based Costing

Chapter Nine- Activity-Based Costing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

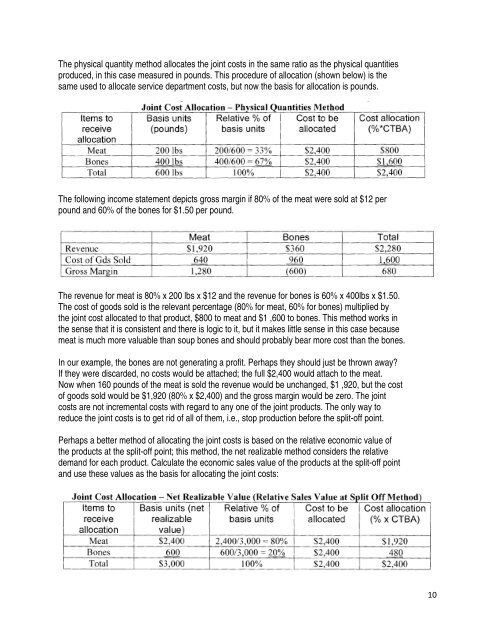

The physical quantity method allocates the joint costs in the same ratio as the physical quantities<br />

produced, in this case measured in pounds. This procedure of allocation (shown below) is the<br />

same used to allocate service department costs, but now the basis for allocation is pounds.<br />

The following income statement depicts gross margin if 80% of the meat were sold at $12 per<br />

pound and 60% of the bones for $1.50 per pound.<br />

The revenue for meat is 80% x 200 lbs x $12 and the revenue for bones is 60% x 400lbs x $1.50.<br />

The cost of goods sold is the relevant percentage (80% for meat, 60% for bones) multiplied by<br />

the joint cost allocated to that product, $800 to meat and $1 ,600 to bones. This method works in<br />

the sense that it is consistent and there is logic to it, but it makes little sense in this case because<br />

meat is much more valuable than soup bones and should probably bear more cost than the bones.<br />

In our example, the bones are not generating a profit. Perhaps they should just be thrown away?<br />

If they were discarded, no costs would be attached; the full $2,400 would attach to the meat.<br />

Now when 160 pounds of the meat is sold the revenue would be unchanged, $1 ,920, but the cost<br />

of goods sold would be $1,920 (80% x $2,400) and the gross margin would be zero. The joint<br />

costs are not incremental costs with regard to any one of the joint products. The only way to<br />

reduce the joint costs is to get rid of all of them, i.e., stop production before the split-off point.<br />

Perhaps a better method of allocating the joint costs is based on the relative economic value of<br />

the products at the split-off point; this method, the net realizable method considers the relative<br />

demand for each product. Calculate the economic sales value of the products at the split-off point<br />

and use these values as the basis for allocating the joint costs:<br />

10