Chapter Nine- Activity-Based Costing

Chapter Nine- Activity-Based Costing

Chapter Nine- Activity-Based Costing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

compensation is not usually directly linked to a performance measure; an example is that of a<br />

salaried employee. Contingent compensation is based on measured performance, an example is a<br />

sales commission based on quantity of sales.<br />

Behavioral consequences of a compensation system may be undesirable. Assume that the sales<br />

staff in the cosmetic department receives a 25% commission on every product sold. As an<br />

accommodation, a member of the sales staff allows the customer to purchase two similar<br />

products with the suggestion that one can be returned without penalty. The salesperson helps the<br />

customer, secures a sale for the company and receives a double commission for making two<br />

sales. Good news travels fast and other customers line up for such a good deal. The health<br />

department becomes interested in what appears to be the resale of used cosmetics. The company<br />

receives negative publicity. Sales increase to the company, the sales person is motivated by the<br />

commission, but at what price!<br />

When a manager's compensation is based on departmental performance, how that perfom1ance is<br />

measured is of personal importance. Because cost allocations affect the department performance.<br />

they often become items of contention. Best practice is that a department's cost allocation should<br />

depend on that department's actions and should not be affected by another department's actions.<br />

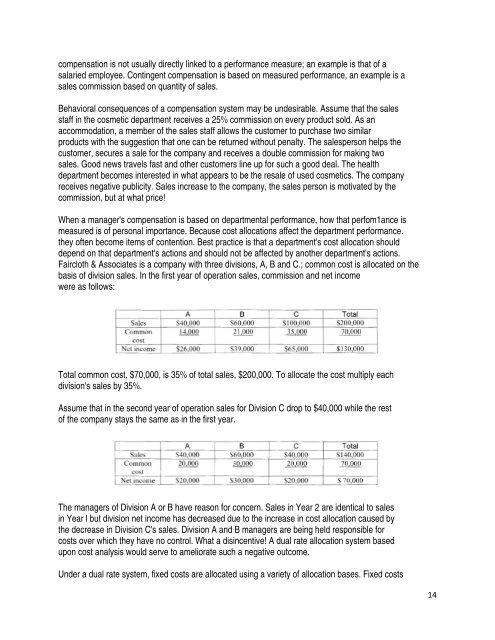

Faircloth & Associates is a company with three divisions, A, B and C.; common cost is allocated on the<br />

basis of division sales. In the first year of operation sales, commission and net income<br />

were as follows:<br />

Total common cost, $70,000, is 35% of total sales, $200,000. To allocate the cost multiply each<br />

division's sales by 35%.<br />

Assume that in the second year of operation sales for Division C drop to $40,000 while the rest<br />

of the company stays the same as in the first year.<br />

The managers of Division A or B have reason for concern. Sales in Year 2 are identical to sales<br />

in Year l but division net income has decreased due to the increase in cost allocation caused by<br />

the decrease in Division C's sales. Division A and B managers are being held responsible for<br />

costs over which they have no control. What a disincentive! A dual rate allocation system based<br />

upon cost analysis would serve to ameliorate such a negative outcome.<br />

Under a dual rate system, fixed costs are allocated using a variety of allocation bases. Fixed costs<br />

14