Chapter Nine- Activity-Based Costing

Chapter Nine- Activity-Based Costing

Chapter Nine- Activity-Based Costing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Chapter</strong> Eleven- Service Department and Joint Cost Allocation<br />

Study Tips<br />

• Service department costs increase the cost of the product and these costs should be attached<br />

to the products.<br />

• Different allocation methods are based on different assumptions: (1) direct allocation, no<br />

service department provides service to any other service department; (2) step allocation,<br />

service departments can provide service to other service departments but cannot, at the same<br />

time, receive service from other service departments; (3) reciprocal method, full reciprocity<br />

between service departments.<br />

• Judgments must be made considering the difference between the necessity of joint cost<br />

allocation for financial statements and the irrelevancy of such allocation for decision making.<br />

Summary<br />

Continuing the discussion of product cost determination, first there is a focus on service<br />

departments, why and how these costs relate to production. The remainder of the chapter is<br />

devoted to discussion of joint cost allocation.<br />

Service Department Cost Allocation<br />

The primary function of a service department is to provide service to other departments.<br />

Examples of a service department include a cafeteria, the buildings and grounds group, the<br />

computer center, and human resources. These service departments provide service to the<br />

producing departments (e.g., stamping, assembly, or finishing) and to non-producing<br />

departments (e.g., all the other service departments). The service department is a cost used by the<br />

production department; all costs of production should be attached to the products.<br />

Because there is usually no direct, traceable relationship to the products being manufactured, the<br />

service cost attachment process must be an indirect one. Relevant service department costs are<br />

allocated to the producing departments, which increases that department's overhead. This in turn<br />

will increase the producing department's overhead rate which, when applied to the products, will<br />

attach a portion of the service department's costs to each product.<br />

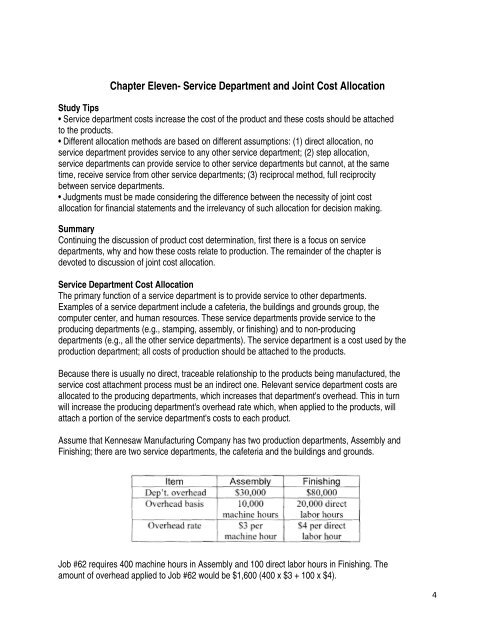

Assume that Kennesaw Manufacturing Company has two production departments, Assembly and<br />

Finishing; there are two service departments, the cafeteria and the buildings and grounds.<br />

Job #62 requires 400 machine hours in Assembly and 100 direct labor hours in Finishing. The<br />

amount of overhead applied to Job #62 would be $1,600 (400 x $3 + 100 x $4).<br />

4