An Analysis of Government Revenue and Expenditure in ... - TARA

An Analysis of Government Revenue and Expenditure in ... - TARA

An Analysis of Government Revenue and Expenditure in ... - TARA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

165<br />

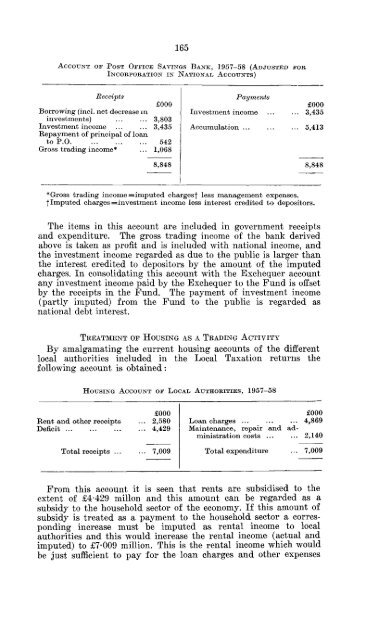

ACCOUNT OF POST OFFICE SAVINGS BANK, 1957-58 (ADJUSTED FOR<br />

INCORPORATION IN NATIONAL ACCOUNTS)<br />

Receipts<br />

Borrow<strong>in</strong>g (<strong>in</strong>cl. net decrease <strong>in</strong><br />

<strong>in</strong>vestments)<br />

Investment <strong>in</strong>come<br />

Repayment <strong>of</strong> pr<strong>in</strong>cipal <strong>of</strong> loan<br />

to P.O<br />

Gross trad<strong>in</strong>g <strong>in</strong>come*<br />

£000<br />

3,803<br />

3,435<br />

542<br />

1,068<br />

8,848<br />

Payments<br />

Investment <strong>in</strong>come<br />

Accumulation ...<br />

£000<br />

... 3,435<br />

... 5,413<br />

8,848<br />

*Gross trad<strong>in</strong>g <strong>in</strong>come = imputed chargesf less management expenses.<br />

•[•Imputed charges = <strong>in</strong>vestment <strong>in</strong>come less <strong>in</strong>terest credited to depositors.<br />

The items <strong>in</strong> this account are <strong>in</strong>cluded <strong>in</strong> government receipts<br />

<strong>and</strong> expenditure. The gross trad<strong>in</strong>g <strong>in</strong>come <strong>of</strong> the bank derived<br />

above is taken as pr<strong>of</strong>it <strong>and</strong> is <strong>in</strong>cluded with national <strong>in</strong>come, <strong>and</strong><br />

the <strong>in</strong>vestment <strong>in</strong>come regarded as due to the public is larger than<br />

the <strong>in</strong>terest credited to depositors by the amount <strong>of</strong> the imputed<br />

charges. In consolidat<strong>in</strong>g this account with the Exchequer account<br />

any <strong>in</strong>vestment <strong>in</strong>come paid by the Exchequer to the Fund is <strong>of</strong>fset<br />

by the receipts <strong>in</strong> the Fund. The payment <strong>of</strong> <strong>in</strong>vestment <strong>in</strong>come<br />

(partly imputed) from the Fund to the public is regarded as<br />

national debt <strong>in</strong>terest.<br />

TREATMENT OF HOUSING AS A TRADING ACTIVITY<br />

By amalgamat<strong>in</strong>g the current hous<strong>in</strong>g accounts <strong>of</strong> the different<br />

local authorities <strong>in</strong>cluded <strong>in</strong> the Local Taxation returns the<br />

follow<strong>in</strong>g account is obta<strong>in</strong>ed:<br />

HOUSING ACCOUNT OF LOCAL AUTHORITIES, 1957-58<br />

Rent <strong>and</strong> other receipts<br />

Deficit<br />

Total receipts<br />

£000<br />

2,580<br />

4,429<br />

7,009<br />

£000<br />

Loan charges ... ... ... 4,869<br />

Ma<strong>in</strong>tenance, repair <strong>and</strong> adm<strong>in</strong>istration<br />

costs ... ... 2,140<br />

Total expenditure 7,009<br />

From this account it is seen that rents are subsidised to the<br />

extent <strong>of</strong> £4429 millon <strong>and</strong> this amount can be regarded as a<br />

subsidy to the household sector <strong>of</strong> the economy. If this amount <strong>of</strong><br />

subsidy is treated as a payment to the household sector a correspond<strong>in</strong>g<br />

<strong>in</strong>crease must be imputed as rental <strong>in</strong>come to local<br />

authorities <strong>and</strong> this would <strong>in</strong>crease the rental <strong>in</strong>come (actual <strong>and</strong><br />

imputed) to £7-009 million. This is the rental <strong>in</strong>come which would<br />

be just sufficient to pay for the loan charges <strong>and</strong> other expenses