From vision to decision Pharma 2020 - pwc

From vision to decision Pharma 2020 - pwc

From vision to decision Pharma 2020 - pwc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

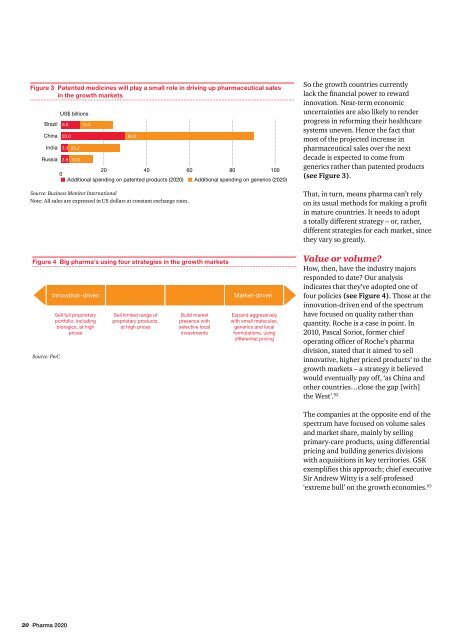

Figure 3 Patented medicines will play a small role in driving up pharmaceutical sales<br />

in the growth markets<br />

Brazil<br />

China<br />

India<br />

Russia<br />

US$ billions<br />

8.8 15.3<br />

30.0 60.2<br />

3.3 24.2<br />

3.9 10.9<br />

20 40 60 80 100<br />

0<br />

Additional spending on patented products (<strong>2020</strong>) Additional spending on generics (<strong>2020</strong>)<br />

Source: Business Moni<strong>to</strong>r International<br />

Note: All sales are expressed in US dollars at constant exchange rates.<br />

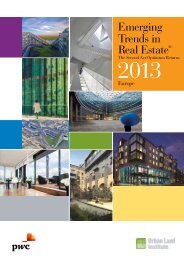

Figure 4 Big pharma’s using four strategies in the growth markets<br />

Source: PwC<br />

Innovation-driven<br />

Sell full proprietary<br />

portfolio, including<br />

biologics, at high<br />

prices<br />

Sell limited range of<br />

proprietary products,<br />

at high prices<br />

Build market<br />

presence with<br />

selective local<br />

investments<br />

Market-driven<br />

Expand aggressively<br />

with small molecules,<br />

generics and local<br />

formulations, using<br />

differential pricing<br />

So the growth countries currently<br />

lack the financial power <strong>to</strong> reward<br />

innovation. Near-term economic<br />

uncertainties are also likely <strong>to</strong> render<br />

progress in reforming their healthcare<br />

systems uneven. Hence the fact that<br />

most of the projected increase in<br />

pharmaceutical sales over the next<br />

decade is expected <strong>to</strong> come from<br />

generics rather than patented products<br />

(see Figure 3).<br />

That, in turn, means pharma can’t rely<br />

on its usual methods for making a profit<br />

in mature countries. It needs <strong>to</strong> adopt<br />

a <strong>to</strong>tally different strategy – or, rather,<br />

different strategies for each market, since<br />

they vary so greatly.<br />

Value or volume?<br />

How, then, have the industry majors<br />

responded <strong>to</strong> date? Our analysis<br />

indicates that they’ve adopted one of<br />

four policies (see Figure 4). Those at the<br />

innovation-driven end of the spectrum<br />

have focused on quality rather than<br />

quantity. Roche is a case in point. In<br />

2010, Pascal Soriot, former chief<br />

operating officer of Roche’s pharma<br />

di<strong>vision</strong>, stated that it aimed ‘<strong>to</strong> sell<br />

innovative, higher priced products’ <strong>to</strong> the<br />

growth markets – a strategy it believed<br />

would eventually pay off, ‘as China and<br />

other countries…close the gap [with]<br />

the West’. 92<br />

The companies at the opposite end of the<br />

spectrum have focused on volume sales<br />

and market share, mainly by selling<br />

primary-care products, using differential<br />

pricing and building generics di<strong>vision</strong>s<br />

with acquisitions in key terri<strong>to</strong>ries. GSK<br />

exemplifies this approach; chief executive<br />

Sir Andrew Witty is a self-professed<br />

‘extreme bull’ on the growth economies. 93<br />

20 <strong>Pharma</strong> <strong>2020</strong>