From vision to decision Pharma 2020 - pwc

From vision to decision Pharma 2020 - pwc

From vision to decision Pharma 2020 - pwc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Portfolio management:<br />

Choosing the best jam<br />

“If you must play, decide on three things at the start: the<br />

rules of the game, the stakes and when it’s time <strong>to</strong> quit.”<br />

Chinese proverb<br />

Flummoxed by all<br />

the flavours<br />

In 1995, social scientist Sheena Iyengar<br />

set up a tasting booth in a US food s<strong>to</strong>re<br />

and pretended <strong>to</strong> be a supplier of<br />

gourmet jams. Every few hours, she<br />

switched between a selection of six<br />

flavours and 24. On average, cus<strong>to</strong>mers<br />

tasted two flavours, regardless of the<br />

size of the assortment.<br />

Now here’s the nub. Only 40% of<br />

cus<strong>to</strong>mers were drawn <strong>to</strong> the small<br />

selection, whereas 60% s<strong>to</strong>pped by the<br />

large one. But 30% of those who’d been<br />

given a choice of six flavours purchased<br />

a jar of jam, while only 3% of those<br />

who’d been given a choice of 24 flavours<br />

did so. Confronted with two dozen<br />

samples, most people were paralysed<br />

by in<strong>decision</strong>. 170<br />

Choosing which drug candidates <strong>to</strong><br />

progress through the pipeline is far more<br />

difficult than choosing which kind of<br />

jam <strong>to</strong> buy, and a lot more rests on the<br />

choice. Yet many pharma companies are<br />

behaving like the cus<strong>to</strong>mers in that food<br />

s<strong>to</strong>re – with one major difference. Rather<br />

than walking away without purchasing<br />

anything, they’re buying a jar of jam in<br />

every flavour.<br />

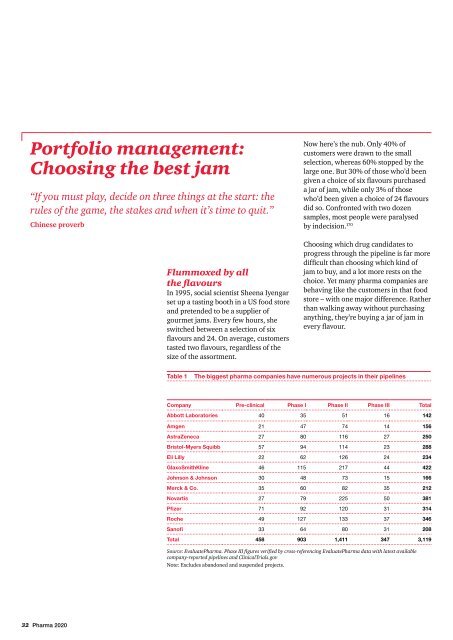

Table 1<br />

The biggest pharma companies have numerous projects in their pipelines<br />

Company Pre-clinical Phase I Phase II Phase III Total<br />

Abbott Labora<strong>to</strong>ries 40 35 51 16 142<br />

Amgen 21 47 74 14 156<br />

AstraZeneca 27 80 116 27 250<br />

Bris<strong>to</strong>l-Myers Squibb 57 94 114 23 288<br />

Eli Lilly 22 62 126 24 234<br />

GlaxoSmithKline 46 115 217 44 422<br />

Johnson & Johnson 30 48 73 15 166<br />

Merck & Co. 35 60 82 35 212<br />

Novartis 27 79 225 50 381<br />

Pfizer 71 92 120 31 314<br />

Roche 49 127 133 37 346<br />

Sanofi 33 64 80 31 208<br />

Total 458 903 1,411 347 3,119<br />

Source: Evaluate<strong>Pharma</strong>. Phase III figures verified by cross-referencing Evaluate<strong>Pharma</strong> data with latest available<br />

company-reported pipelines and ClinicalTrials.gov<br />

Note: Excludes abandoned and suspended projects.<br />

32 <strong>Pharma</strong> <strong>2020</strong>