- Page 1: World Oil Outlook 2010 Organization

- Page 4 and 5: 4 The data, analysis and any other

- Page 6 and 7: Acknowledgements Director, Research

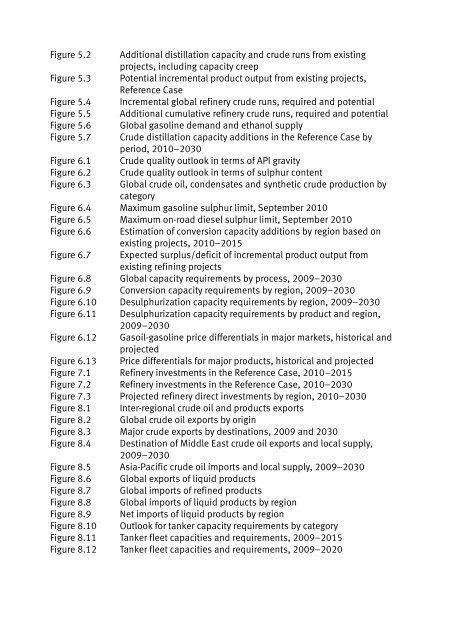

- Page 8 and 9: Section One Oil supply and demand o

- Page 10 and 11: L i s t o f b oxe s Box 1.1 The eme

- Page 14 and 15: Foreword

- Page 16 and 17: 2 Moreover, it is important not to

- Page 18 and 19: Executive summary

- Page 20 and 21: 6 expectations, with a pervasive re

- Page 22 and 23: 8 to exploit. However, the melding

- Page 24 and 25: 10 term implications for the offsho

- Page 26 and 27: 12 a combination of an ethanol supp

- Page 28 and 29: 14 production will be required, but

- Page 30 and 31: 16 addressed by OPEC Member Countri

- Page 32 and 33: Section One

- Page 35 and 36: Chapter 1 W o r l d e n e r g y t r

- Page 37 and 38: feasible, whether they are non-conv

- Page 39 and 40: Futures and options contracts outst

- Page 41 and 42: the publishing of aggregate positio

- Page 43 and 44: led to a profound debt burden for m

- Page 45 and 46: Meanwhile, domestic consumption in

- Page 47 and 48: egions. Moreover, the evolving age

- Page 49 and 50: Compounding the effect of lower bir

- Page 51 and 52: OPEC Middle East & Africa of the si

- Page 53 and 54: ising protectionism implies real th

- Page 55 and 56: Figure Figure 1.6 1.6 Real Real GDP

- Page 57 and 58: and 2.1 mb/d by 2030. This was incl

- Page 59 and 60: In looking at the issue of energy s

- Page 61 and 62: Figure 1.7 Energy use per capita bo

- Page 63 and 64:

Figure 1.8 Figure 1.7 World supply

- Page 65 and 66:

Table 1.6 Coal and gas demand growt

- Page 67 and 68:

America. Over the past year or so t

- Page 69 and 70:

natural gas (LNG) was generally pro

- Page 71 and 72:

construction in 13 countries, with

- Page 73 and 74:

US New Figure 1.13 (29.9.10) In rec

- Page 75 and 76:

Figure 1.16 Annual growth of oil de

- Page 77 and 78:

modifications to the assumptions fo

- Page 79 and 80:

Figure 70 1.20 Oil use per capita i

- Page 81 and 82:

Figure 1.24 Annual growth in oil de

- Page 83 and 84:

The initial focus is upon the prosp

- Page 85 and 86:

linked to what is realistically fea

- Page 87 and 88:

- e e EC 8 6 Figure 1.28 Figure 1.2

- Page 89 and 90:

Figure 1.32 Non-OPEC oil supply, tr

- Page 91 and 92:

2009 2011 2013 2015 2017 2019 2021

- Page 93:

Looking long-term there is a consid

- Page 96 and 97:

82 Figure 2.1 Oil demand by sector

- Page 98 and 99:

84 Table 2.1 (continued) Vehicle an

- Page 100 and 101:

lation (millions) 7,000 6,000 5,000

- Page 102 and 103:

88 Figure 2.6 Increase in number of

- Page 104 and 105:

90 Figure 2.7 Increase in volume of

- Page 106 and 107:

92 Second generation fuels and biom

- Page 108 and 109:

94 in developing Asia. By 2025, dev

- Page 110 and 111:

96 7.6 barrels of oil equivalent (b

- Page 112 and 113:

98 Table 2.6 Oil demand in domestic

- Page 114 and 115:

100 8 7 6 petrochemical sector grew

- Page 116 and 117:

102 Figure 2.12 Petroleum product f

- Page 118 and 119:

104 Other industry sectors Oil use

- Page 120 and 121:

106 Figure 2.14 Oil demand in other

- Page 122 and 123:

108 Figure 2.15 The evolution of oi

- Page 124 and 125:

15 110 Figure 2.16 Average annual p

- Page 126 and 127:

112 Demand by product The key findi

- Page 128 and 129:

114 Figure 2.17 Global product dema

- Page 130 and 131:

116 lubricants, waxes and solvents

- Page 132 and 133:

118 By 2014, non-OPEC crude plus NG

- Page 134 and 135:

120 Norwegian production fell to 2.

- Page 136 and 137:

122 Crude oil and NGLs in non-OPEC

- Page 138 and 139:

124 Box 3.1 Oil supply: lessons fro

- Page 140 and 141:

126 prices had remained that low, t

- Page 142 and 143:

128 In the coming years, advances i

- Page 144 and 145:

130 postponed until at least 2011,

- Page 146 and 147:

132 Nordaland and the Barents Sea,

- Page 148 and 149:

134 Table 3.4 Medium-term non-OPEC

- Page 150 and 151:

136 Biofuels With the recent oil pr

- Page 152 and 153:

138 OPEC upstream investment activi

- Page 154 and 155:

140 Figure 5.1 (6.10.10) Figure 4.1

- Page 156 and 157:

142 fundamentally affect the prospe

- Page 158 and 159:

144 Table 4.2 OPEC crude and non-OP

- Page 160 and 161:

146 oil as a financial asset traded

- Page 162 and 163:

148 over the past few years regardi

- Page 164 and 165:

150 It is critical that the UN MDGs

- Page 166 and 167:

Section Two

- Page 169 and 170:

Chapter 5 D i s t i l l a t i o n c

- Page 171 and 172:

With demand growing in the 1990s, t

- Page 173 and 174:

In respect to projects where no fir

- Page 175 and 176:

From other sources highlighted, onl

- Page 177 and 178:

on stream in September 2010. These

- Page 179 and 180:

the project. There is less certaint

- Page 181 and 182:

Figure 5.2 presents the yearly incr

- Page 183 and 184:

Table 5.1 Estimation of secondary p

- Page 185 and 186:

levels. In line with the expected d

- Page 187 and 188:

Figure 5.3 Figure 5.5 puts the same

- Page 189 and 190:

With utilization rates of at least

- Page 191 and 192:

upgrading capacity as a percentage

- Page 193 and 194:

Table 5.2 shows that cumulative ref

- Page 195 and 196:

Figure 5.6 Figure 5.6 Global gasoli

- Page 197 and 198:

elatively low in complexity and low

- Page 199 and 200:

Chapter 6 C o n v e r s i o n a n d

- Page 201 and 202:

Figure 6.2 Crude quality outlook in

- Page 203 and 204:

East, Latin America and Russia. Pro

- Page 205 and 206:

gallon cap and a 30 ppm annual aver

- Page 207 and 208:

It is diesel sulphur that presents

- Page 209 and 210:

y 20%, increase renewable energies

- Page 211 and 212:

for processing Mayan heavy crude, a

- Page 213 and 214:

that these processes can attain ove

- Page 215 and 216:

Long-term outlook Requirements for

- Page 217 and 218:

10 0 Figure 6.9 presents the region

- Page 219 and 220:

Figure 6.10 Desulphurization capaci

- Page 221 and 222:

There are several other factors tha

- Page 223 and 224:

Figure Figure 7.12 7.12 Figure 6.12

- Page 225 and 226:

Chapter 7 D o w n s t r e a m i n v

- Page 227 and 228:

Figure 8.1 than $10 billion will be

- Page 229 and 230:

Chapter 8 O i l m o v e m e n t s T

- Page 231 and 232:

growth in the global crude oil trad

- Page 233 and 234:

mb/d 50 decline in its crude export

- Page 235 and 236:

gasoline and diesel imbalance in th

- Page 237 and 238:

face the problem of a gasoline surp

- Page 239 and 240:

Figure 8.9 Net imports of liquid pr

- Page 241 and 242:

ica ada fic st Figure 8.10 Figure 9

- Page 243 and 244:

America pe a Canada -Pacific le Eas

- Page 245 and 246:

Chapter 9 D o w n s t r e a m c h a

- Page 247 and 248:

strongly in international markets,

- Page 249 and 250:

The overall conclusion is that the

- Page 251 and 252:

there is still the question about w

- Page 253 and 254:

equired GHG inventory and reporting

- Page 255 and 256:

Canada signalled a shift towards a

- Page 257 and 258:

• The impact will also be felt on

- Page 259 and 260:

245 Chapter 9

- Page 261 and 262:

1. http://www.ief.org/Events/Docume

- Page 263 and 264:

39. Gasoline desulphurization repor

- Page 265:

Abbreviations

- Page 268 and 269:

254 EUROPIA European Petroleum Indu

- Page 270 and 271:

256 UN MDGs United Nations Millenni

- Page 272 and 273:

Annex B

- Page 275 and 276:

OECD North America Canada Puerto Ri

- Page 277 and 278:

Equatorial Guinea Seychelles Eritre

- Page 279 and 280:

Tajikistan Uzbekistan The Former Yu

- Page 281:

World Oil Refining Logistics and De

- Page 284 and 285:

270 Brazil Uruguay Chile Africa Nor

- Page 286 and 287:

272 Croatia Slovakia Czech Republic

- Page 288 and 289:

Annex D

- Page 290 and 291:

276

- Page 292 and 293:

278 Global Subsidies Initiative (GS

- Page 294 and 295:

280 Society of Petroleum Engineers

- Page 296:

Organization of the Petroleum Expor