Chapter Two - Wiley

Chapter Two - Wiley

Chapter Two - Wiley

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8956d_ch02_082 8/20/03 12:56 PM Page 82 mac76 mac76:385_reb:<br />

82 CHAPTER 2 A Further Look at Financial Statements<br />

5. Describe the two constraints inherent in the presentation<br />

of accounting information.<br />

6. Your roommate believes that international accounting<br />

standards are uniform throughout the world. Is<br />

your roommate correct? Explain.<br />

7. What is meant by the term operating cycle?<br />

8. Define current assets. What basis is used for ordering<br />

individual items within the current assets section?<br />

9. Distinguish between long-term investments and property,<br />

plant, and equipment.<br />

10. How do current liabilities differ from long-term liabilities?<br />

11. Identify the two parts of stockholders’ equity in a corporation<br />

and indicate the purpose of each.<br />

12.<br />

(a) Ruth Weber believes that the analysis of<br />

financial statements is directed at two<br />

characteristics of a company: liquidity and<br />

profitability. Is Ruth correct? Explain.<br />

(b) Are short-term creditors, long-term creditors,<br />

and stockholders primarily interested in the<br />

same characteristics of a company? Explain.<br />

13. Name ratios useful in assessing (a) liquidity,<br />

(b) solvency, and (c) profitability.<br />

14. David Rose is puzzled. His company had<br />

a price-earnings ratio of 25 in 2005. He feels that this<br />

is an indication that the company is doing well. Julie<br />

Bast, his accountant, says that more information is<br />

needed to determine the firm’s financial well-being.<br />

Who is correct? Why?<br />

15. What do these classes of ratios measure?<br />

(a) Liquidity ratios.<br />

(b) Profitability ratios.<br />

(c) Solvency ratios.<br />

16. Holding all other factors constant, indicate<br />

whether each of the following signals generally good<br />

or bad news about a company.<br />

(a) Increase in earnings per share.<br />

(b) Increase in the current ratio.<br />

(c) Increase in the debt to total assets ratio.<br />

(d) Decrease in the cash debt coverage ratio.<br />

17. Which ratio or ratios from this chapter do<br />

you think should be of greatest interest to:<br />

(a) a pension fund considering investing in a<br />

corporation’s 20-year bonds?<br />

(b) a bank contemplating a short-term loan?<br />

(c) an investor in common stock?<br />

Brief Exercises<br />

Recognize generally accepted<br />

accounting principles.<br />

(SO 1)<br />

Identify qualitative<br />

characteristics.<br />

(SO 2)<br />

BE2-1 Indicate whether each statement is true or false.<br />

(a) GAAP is a set of rules and practices established by accounting standard-setting<br />

bodies to serve as a general guide for financial reporting purposes.<br />

(b) Substantial authoritative support for GAAP usually comes from two standardssetting<br />

bodies: the FASB and the IRS.<br />

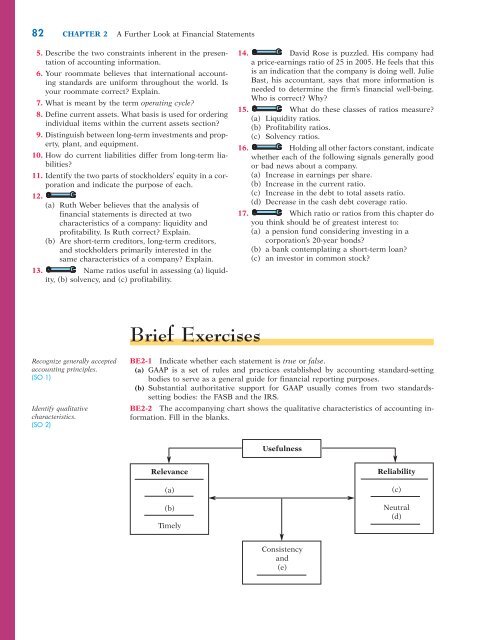

BE2-2 The accompanying chart shows the qualitative characteristics of accounting information.<br />

Fill in the blanks.<br />

Usefulness<br />

Relevance<br />

(a)<br />

(b)<br />

Timely<br />

Reliability<br />

(c)<br />

Neutral<br />

(d)<br />

Consistency<br />

and<br />

(e)