Chapter Two - Wiley

Chapter Two - Wiley

Chapter Two - Wiley

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8956d_ch02.qxd 7/17/03 2:41 PM Page 96 mac34 Mac34: kec_420:<br />

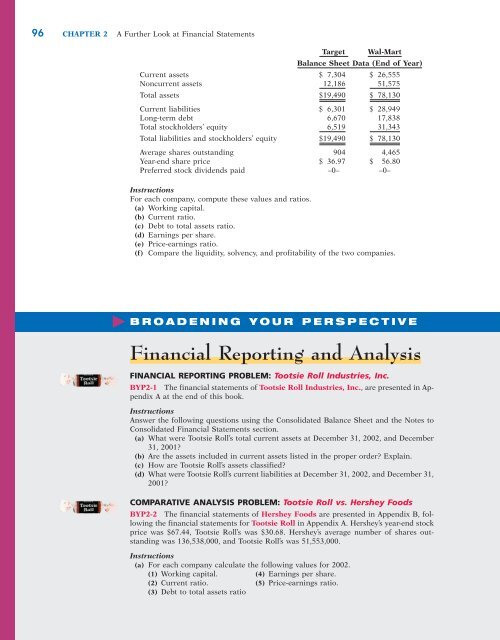

96 CHAPTER 2 A Further Look at Financial Statements<br />

Target Wal-Mart<br />

Balance Sheet Data (End of Year)<br />

Current assets $ 7,304 $ 26,555<br />

Noncurrent assets 12,186 51,575<br />

Total assets $19,490 $ 78,130<br />

Current liabilities $ 6,301 $ 28,949<br />

Long-term debt 6,670 17,838<br />

Total stockholders’ equity 6,519 31,343<br />

Total liabilities and stockholders’ equity $19,490 $ 78,130<br />

Average shares outstanding 904 4,465<br />

Year-end share price $ 36.97 $ 56.80<br />

Preferred stock dividends paid –0– –0–<br />

Instructions<br />

For each company, compute these values and ratios.<br />

(a) Working capital.<br />

(b) Current ratio.<br />

(c) Debt to total assets ratio.<br />

(d) Earnings per share.<br />

(e) Price-earnings ratio.<br />

(f) Compare the liquidity, solvency, and profitability of the two companies.<br />

BROADENING YOUR PERSPECTIVE<br />

Financial Reporting and Analysis<br />

FINANCIAL REPORTING PROBLEM: Tootsie Roll Industries, Inc.<br />

BYP2-1 The financial statements of Tootsie Roll Industries, Inc., are presented in Appendix<br />

A at the end of this book.<br />

Instructions<br />

Answer the following questions using the Consolidated Balance Sheet and the Notes to<br />

Consolidated Financial Statements section.<br />

(a) What were Tootsie Roll’s total current assets at December 31, 2002, and December<br />

31, 2001?<br />

(b) Are the assets included in current assets listed in the proper order? Explain.<br />

(c) How are Tootsie Roll’s assets classified?<br />

(d) What were Tootsie Roll’s current liabilities at December 31, 2002, and December 31,<br />

2001?<br />

COMPARATIVE ANALYSIS PROBLEM: Tootsie Roll vs. Hershey Foods<br />

BYP2-2 The financial statements of Hershey Foods are presented in Appendix B, following<br />

the financial statements for Tootsie Roll in Appendix A. Hershey’s year-end stock<br />

price was $67.44, Tootsie Roll’s was $30.68. Hershey’s average number of shares outstanding<br />

was 136,538,000, and Tootsie Roll’s was 51,553,000.<br />

Instructions<br />

(a) For each company calculate the following values for 2002.<br />

(1) Working capital. (4) Earnings per share.<br />

(2) Current ratio. (5) Price-earnings ratio.<br />

(3) Debt to total assets ratio