BENEFITS LINE FOR RETIREES - City of St. Petersburg

BENEFITS LINE FOR RETIREES - City of St. Petersburg

BENEFITS LINE FOR RETIREES - City of St. Petersburg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

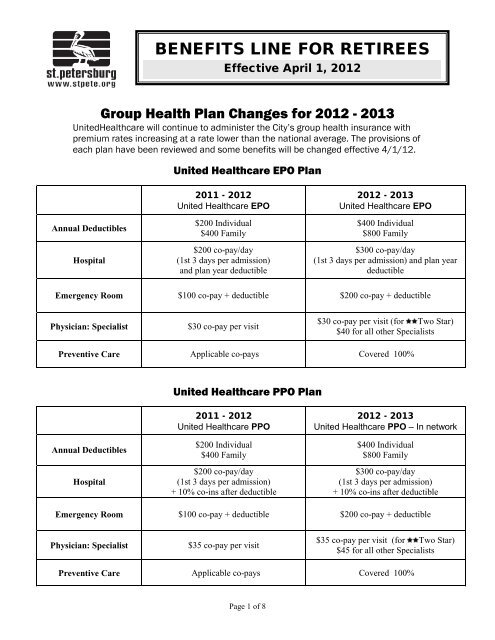

<strong>BENEFITS</strong> <strong>LINE</strong> <strong>FOR</strong> <strong>RETIREES</strong><br />

Effective April 1, 2012<br />

Group Health Plan Changes for 2012 - 2013<br />

UnitedHealthcare will continue to administer the <strong>City</strong>’s group health insurance with<br />

premium rates increasing at a rate lower than the national average. The provisions <strong>of</strong><br />

each plan have been reviewed and some benefits will be changed effective 4/1/12.<br />

United Healthcare EPO Plan<br />

Annual Deductibles<br />

Hospital<br />

2011 - 2012<br />

United Healthcare EPO<br />

$200 Individual<br />

$400 Family<br />

$200 co-pay/day<br />

(1st 3 days per admission)<br />

and plan year deductible<br />

2012 - 2013<br />

United Healthcare EPO<br />

$400 Individual<br />

$800 Family<br />

$300 co-pay/day<br />

(1st 3 days per admission) and plan year<br />

deductible<br />

Emergency Room $100 co-pay + deductible $200 co-pay + deductible<br />

Physician: Specialist<br />

$30 co-pay per visit<br />

$30 co-pay per visit (for Two <strong>St</strong>ar)<br />

$40 for all other Specialists<br />

Preventive Care Applicable co-pays Covered 100%<br />

United Healthcare PPO Plan<br />

Annual Deductibles<br />

Hospital<br />

2011 - 2012<br />

United Healthcare PPO<br />

$200 Individual<br />

$400 Family<br />

$200 co-pay/day<br />

(1st 3 days per admission)<br />

+ 10% co-ins after deductible<br />

2012 - 2013<br />

United Healthcare PPO – In network<br />

$400 Individual<br />

$800 Family<br />

$300 co-pay/day<br />

(1st 3 days per admission)<br />

+ 10% co-ins after deductible<br />

Emergency Room $100 co-pay + deductible $200 co-pay + deductible<br />

Physician: Specialist<br />

$35 co-pay per visit<br />

$35 co-pay per visit (for Two <strong>St</strong>ar)<br />

$45 for all other Specialists<br />

Preventive Care Applicable co-pays Covered 100%<br />

Page 1 <strong>of</strong> 8

Section 1: HUMANA Comp Benefits<br />

Dental and Vision Plans and Retiree Rates<br />

No changes in Carriers, Coverage or Rates 2012 - 2013<br />

Monthly Cost Dental DHMO Dental PPO Vision Basic Vision High Option<br />

Single $15.25 $22.31 $ .95 $ 5.92<br />

Two person $26.59 $47.30 $1.43 $11.80<br />

Family $37.11 $73.01 $2.38 $15.78<br />

Refer to your Benefit Summary for more complete information and for out <strong>of</strong> network benefit provisions.<br />

Section 2: Basic Life - <strong>St</strong>andard Life Insurance Company<br />

Life Insurance is <strong>of</strong>fered by The <strong>St</strong>andard Life Insurance Company. There is no change<br />

in the rate for basic life insurance in 2012- 2013 it remains at $4.58 per thousand dollars<br />

<strong>of</strong> coverage. Your coverage was determined at the time you retired. Your beneficiary<br />

designation can be changed at any time.<br />

It is recommended retirees contact the benefit <strong>of</strong>fice<br />

prior to making changes in their benefits.<br />

Page 2 <strong>of</strong> 8

Section 3: Retiree Questions and Answers<br />

General information<br />

• Changes in coverage become effective the first <strong>of</strong><br />

the month following the change.<br />

• Medicare Part A & B coverage is required in<br />

order to be eligible for the <strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong><br />

UHC Base Option Plan, Humana HMO or Humana<br />

PPO plans.<br />

• Medicare Part D is not needed when retiree is<br />

covered by the UHC or Humana plans since the<br />

<strong>City</strong>’s coverage is equal to or better than Part D.<br />

• Insurance companies will not pay what<br />

Medicare would have. Once a retiree is Medicare<br />

eligible, Medicare becomes the primary payor and<br />

the <strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong> plans become secondary<br />

payors.<br />

• If you become eligible for Social Security<br />

disability, enroll in Medicare Parts A & B coverage.<br />

Once you have both Medicare Parts A & B submit a<br />

copy <strong>of</strong> your card to the Benefits division as you will<br />

be eligible for the UHC Base Option Plan, Humana<br />

HMO or Humana PPO plans.<br />

Spouses who are covered<br />

under the retiree health insurance<br />

when the retiree dies<br />

are eligible for<br />

health insurance benefits<br />

as follows:<br />

o Retired prior to March 1 1978 - until the end<br />

<strong>of</strong> the period for which the spouse receives<br />

pension benefits, with the <strong>City</strong>'s contribution to<br />

the premium.<br />

o Retired from March 1, 1978 - March 31, 1988<br />

- the earlier <strong>of</strong> 12 months or the end <strong>of</strong> the<br />

pension benefit period with the <strong>City</strong>'s<br />

contribution. COBRA coverage is available for<br />

the balance <strong>of</strong> a 36 month period.<br />

o Retired after April 1, 1988 - COBRA<br />

coverage for up to 36 months at the full cost <strong>of</strong><br />

the premium plus a 2% administrative fee.<br />

Frequently asked Questions<br />

What are the Retiree Benefit Options? Changes<br />

to your benefits are available when you or your<br />

spouse experience a qualifying life event or you<br />

want to decrease your coverage. Once you elect to<br />

decrease or drop your coverage you will NOT have<br />

the option to re-enroll in that coverage again.<br />

What is a qualifying life event? Qualifying life<br />

events are: turning age 65, approved social security<br />

disability, marriage, birth <strong>of</strong> a child, adoption,<br />

divorce, spouse’s loss <strong>of</strong> insurance coverage, death.<br />

How long does a retiree have to report a<br />

qualifying life event to the Benefits <strong>of</strong>fice?<br />

Retirees have only 31 days from the qualifying life<br />

event effective date to contact the <strong>City</strong> <strong>of</strong> <strong>St</strong>.<br />

<strong>Petersburg</strong> Benefits <strong>of</strong>fice and complete the<br />

required forms and provide certified documentation.<br />

What happens if a retiree signs up for an outside<br />

supplemental Medicare plan while enrolled in a<br />

Humana plan <strong>of</strong>fered by the <strong>City</strong>? Your Humana<br />

plan with the <strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong> will be cancelled<br />

by your new carrier and you will not have the option<br />

<strong>of</strong> going back on the <strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong> plan.<br />

How long does someone turning 65 have to<br />

change to a Medicare plan with the <strong>City</strong> <strong>of</strong> <strong>St</strong><br />

<strong>Petersburg</strong>? Retirees can make this selection <strong>of</strong><br />

benefit at any time. Retirees must be enrolled in<br />

Medicare Parts A & B. Enrollment is not retroactive.<br />

Can a life insurance/AD&D beneficiary be<br />

changed? Retirees are allowed to change their life<br />

insurance/AD&D beneficiary at any time.<br />

What is the difference between the UHC PPO<br />

and UHC Base PPO Option? As a Medicare<br />

supplement plan UHC Base Option Plan has a<br />

lifetime maximum benefit <strong>of</strong> $100,000. UHC PPO<br />

has no lifetime max.<br />

What happens if a retiree is traveling and has an<br />

emergency? All plans cover emergency services.<br />

Contact your insurance provider as soon as<br />

possible.<br />

What happens if I move out <strong>of</strong> the service area<br />

and am on a Humana Plan? You will not be able to<br />

remain on the plan. A onetime only opportunity to<br />

transfer to the UHC Base Option plan will be <strong>of</strong>fered<br />

to you.<br />

Page 3 <strong>of</strong> 8

Section 4: Group Health Plans and Rates for Retirees<br />

Healthcare plans for Retirees under the age <strong>of</strong> 65 and those still employed:<br />

• UnitedHealthcare Choice Plan (EPO) – Open Access network plan<br />

• UnitedHealthcare Choice Plus Plan (PPO) – Open Access network and out <strong>of</strong> network services<br />

Healthcare plans for Retirees 65 years and older:<br />

• UnitedHealthcare Choice Plan (EPO) – Open Access network plan<br />

• UnitedHealthcare Choice Plus Plan (PPO) – Open Access network and out <strong>of</strong> network services<br />

• UnitedHealthcare Choice Plus Plan (PPO) – Base Option<br />

(Medicare is primary and UHC Choice Plus plan base option is secondary)<br />

• Humana Gold (HMO) – In-Network plan<br />

• Humana Choice (PPO) – In and Out <strong>of</strong> Network plan<br />

2012 - 2013 RETIREE GROUP HEALTH PLAN COMPARISON<br />

Plan<br />

UHC Choice<br />

(EPO)<br />

In-network<br />

UHC Choice<br />

Plus (PPO)<br />

In-network<br />

UHC Choice<br />

Plus Base<br />

(PPO)<br />

In-network<br />

Humana Gold<br />

(HMO)<br />

Humana<br />

Choice (PPO)<br />

In-network<br />

Annual<br />

Deductibles<br />

$400<br />

Individual<br />

$800 Family<br />

$400<br />

Individual<br />

$800 Family<br />

$400<br />

Individual<br />

$800 Family<br />

N/A<br />

N/A<br />

Hospital<br />

$300 copay/day<br />

(1st 3<br />

days per<br />

admission) and<br />

plan year<br />

deductible<br />

$300 copay/day<br />

(1st 3<br />

days per<br />

admission) +<br />

10% co-ins<br />

after<br />

deductible<br />

$300 copay/day<br />

(1st 3<br />

days per<br />

admission) +<br />

10% co-ins<br />

after<br />

deductible<br />

$250 copay/day<br />

(1st 5<br />

days per<br />

admission then<br />

100% coverage<br />

$150 copay/day<br />

(1st 5<br />

days per<br />

admission then<br />

100% coverage<br />

Emergency<br />

Room<br />

$200 co-pay<br />

plus deductible<br />

$200 co-pay<br />

plus deductible<br />

$200 co-pay<br />

plus deductible<br />

$65 co-pay per<br />

visit<br />

$65 co-pay per<br />

visit<br />

Ambulance<br />

Deductible<br />

does not apply<br />

10% co-ins<br />

after<br />

deductible<br />

10% co-ins<br />

after<br />

deductible<br />

$75 co-pay per<br />

date <strong>of</strong> service<br />

$50 co-pay per<br />

date <strong>of</strong> service<br />

Physician:<br />

Primary<br />

$20 co-pay per<br />

visit<br />

$25 co-pay per<br />

visit<br />

$25 co-pay per<br />

visit<br />

$10 co-pay per<br />

visit<br />

$10 co-pay per<br />

visit<br />

Physician:<br />

Specialist<br />

$30-$40 copay<br />

per visit<br />

$35-$45 copay<br />

per visit<br />

$35-$45 copay<br />

per visit<br />

$25 co-pay per<br />

visit<br />

$20 co-pay per<br />

visit<br />

Urgent Care<br />

Center<br />

$50 after<br />

deductible<br />

$50 after<br />

deductible<br />

$50 after<br />

deductible<br />

$25 co-pay per<br />

visit<br />

$20 co-pay per<br />

visit<br />

Preventative<br />

Care<br />

100%<br />

Coverage<br />

100%<br />

Coverage<br />

100%<br />

Coverage<br />

100%<br />

Coverage<br />

100%<br />

Coverage<br />

Page 4 <strong>of</strong> 8

Plan<br />

UHC Choice<br />

(EPO)<br />

In-network<br />

UHC Choice<br />

Plus (PPO)<br />

In-network<br />

UHC Choice<br />

Plus Base<br />

(PPO)<br />

In-network<br />

Humana Gold<br />

(HMO)<br />

Humana<br />

Choice (PPO)<br />

In-network<br />

Skilled nursing<br />

facility<br />

100% coverage<br />

after<br />

deductible<br />

(Limited to 60<br />

days per plan<br />

year)<br />

10%<br />

co-ins after<br />

deductible<br />

(Limited to 60<br />

days per plan<br />

year)<br />

10%<br />

co-ins after<br />

deductible<br />

(Limited to 60<br />

days per plan<br />

year)<br />

100% coverage<br />

days 1 - 20.<br />

$75 co-pay per<br />

day (days 21-<br />

100 per benefit<br />

period)<br />

100% coverage<br />

days 1 - 20.<br />

$75 co-pay per<br />

day (days 21-<br />

100 per benefit<br />

period)<br />

Rehabilitation<br />

Services<br />

$30 co-pay per<br />

visit (limit 60<br />

visits each type<br />

<strong>of</strong> service,<br />

multiple visits<br />

per day)<br />

$35 co-pay per<br />

visit (limit 60<br />

visits each type<br />

<strong>of</strong> service,<br />

multiple visits<br />

per day)<br />

$35 co-pay per<br />

visit (limit 60<br />

visits each type<br />

<strong>of</strong> service,<br />

multiple visits<br />

per day)<br />

$25 - $100 copay<br />

based on<br />

services<br />

received<br />

$20 co-pay per<br />

visit<br />

Outpatient<br />

Surgery -<br />

hospital<br />

100% coverage<br />

after<br />

deductible<br />

10% co-ins<br />

after<br />

deductible<br />

10% co-ins<br />

after<br />

deductible<br />

$200 co-pay<br />

per visit<br />

$50 co-pay per<br />

visit<br />

Annual Out <strong>of</strong><br />

Pocket Limit<br />

Lifetime<br />

Maximum<br />

Benefit<br />

Generic<br />

Prescriptions<br />

(Tier 1)<br />

Preferred<br />

Brand<br />

(Tier 2)<br />

Non-preferred<br />

Brand<br />

(Tier 3)<br />

Specialty<br />

(Tier 4)<br />

$2,000<br />

individual,<br />

$4,000 Family;<br />

excludes<br />

deductible,<br />

co-pays<br />

No lifetime<br />

maximum<br />

benefit<br />

$1,000<br />

individual,<br />

$2,000 Family;<br />

excludes<br />

deductible,<br />

co-pays<br />

No lifetime<br />

maximum<br />

benefit<br />

$1,000<br />

individual,<br />

$2,000 Family;<br />

excludes<br />

deductible,<br />

co-pays<br />

Combined<br />

Network and<br />

Non-network<br />

maximum <strong>of</strong><br />

$100,000 per<br />

covered<br />

person.<br />

$2,500 per<br />

plan year<br />

Benefits apply<br />

to Medicare<br />

covered<br />

services.<br />

$4,000 per<br />

plan year<br />

Benefits apply<br />

to Medicare<br />

covered<br />

services.<br />

$15.00 $15.00 $15.00 $4.00 $4.00<br />

$30.00 $30.00 $30.00 $25.00 $25.00<br />

$45.00 $45.00 $45.00 $40.00 $40.00<br />

N/A N/A N/A 33% 33%<br />

NOTE: This is general information only. Benefit plan provisions are governed by the<br />

applicable plan agreement. All questions and concerns regarding specific coverage and<br />

benefits should be directed to the insurance company.<br />

Page 5 <strong>of</strong> 8

Group Health Insurance Rates - Retirees<br />

Effective April 1, 2012<br />

TOTAL<br />

COST<br />

CITY<br />

CONTRIBUTION<br />

RETIREE<br />

COST<br />

Benefit Plan Monthly Monthly Monthly<br />

UnitedHealthcare CHOICE (EPO)<br />

Single $466.79 $204.74 $262.05<br />

Two person $1,003.62 $413.55 $590.07<br />

Family $1,321.04 $573.23 $747.81<br />

UnitedHealthcare CHOICE PLUS (PPO)<br />

Single $560.24 $204.74 $355.50<br />

Two person $1,131.72 $413.55 $718.17<br />

Family $1,568.73 $573.23 $995.50<br />

UnitedHealthcare CHOICE PLUS - BASE OPTION (PPO)<br />

Single $272.98 $204.74 $68.24<br />

Two person $551.40 $413.55 $137.85<br />

Family $764.31 $573.23 $191.08<br />

HUMANA GOLD (HMO) * effective 1/1/2012<br />

Single $49.00 $49.00 0<br />

Two Person $98.00 $98.00 0<br />

HUMANA CHOICE (PPO) *effective 1/1/2012<br />

Single $149.00 $149.00 0<br />

Two Person $298.00 $298.00 0<br />

Page 6 <strong>of</strong> 8

INSURANCE COVERAGE<br />

<strong>FOR</strong> CHILDREN AGE 19 OR OVER<br />

I. HEALTH INSURANCE<br />

Under Florida <strong>St</strong>ate Law, retirees covered by one <strong>of</strong> the <strong>City</strong>’s health insurance plans have the<br />

option <strong>of</strong> covering children (who meet the requirements for eligibility) up to age 30.<br />

The <strong>City</strong> requires that each employee electing to continue coverage or add coverage for<br />

a child age 19 or over complete the ‘Children age 19 or over – Verification for Coverage’<br />

form. The completed form must be returned to the <strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong> – Benefits Division<br />

Office by March 17, 2012.<br />

The payment <strong>of</strong> insurance premiums for children age 19 or over will continue to be deducted<br />

from the monthly Retiree Pension check (or included on monthly invoices.)<br />

From calendar year after child attains age 26 through end <strong>of</strong> calendar year in which child<br />

attains age 30 – Child may be covered for Health Insurance only if the child is:<br />

a) Unmarried,<br />

b) Has no dependents <strong>of</strong> his/her own,<br />

c) Is a resident <strong>of</strong> Florida,<br />

d) Is not covered or <strong>of</strong>fered coverage under any other health plan or under Title<br />

XVIII <strong>of</strong> the Social Security Act;<br />

OR IS:<br />

a) Unmarried,<br />

b) Has no dependents <strong>of</strong> his/her own,<br />

c) Is a full or part-time student,<br />

d) Is not covered or <strong>of</strong>fered coverage under any other health plan or under Title<br />

XVIII <strong>of</strong> the Social Security Act<br />

NOTE: The <strong>City</strong> <strong>of</strong> <strong>St</strong> <strong>Petersburg</strong> reserves the right to require additional documentation to<br />

confirm eligibility <strong>of</strong> a child age 19 or over at any time.<br />

II. DENTAL AND VISION INSURANCE<br />

Children are eligible for dental and vision insurance coverage until the attainment <strong>of</strong> age 19. If<br />

the child is a full time student, coverage may be continued until age 25. In order to initially cover<br />

or continue dental and vision coverage for a child age 19 and over, you must complete the form<br />

‘Children age 19 or over – Verification for Coverage’ and return the completed form to the<br />

<strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong> – Benefits Division Office by March 17, 2012.<br />

Page 7 <strong>of</strong> 8

<strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong> Retiree Benefits 727-893-7819 benefits@stpete.org<br />

UnitedHealthcare on site representative 727-893-7911 lauren_gibson@uhc.com<br />

UnitedHealthcare customer service 1-800-377-5154 www.myuhc.com<br />

com<br />

Humana on site representative (Fridays 1:00pm to 4:00pm)<br />

727-793-2116 jpaolillo@humana.com<br />

Humana customer service 1-866-396-8810 www.humana.com<br />

compbenefits.com<br />

Humana CompBenefits (Dental) 1-800-342-5209 www.compbenefits.com<br />

Humana CompBenefits (Vision) 1-800-865-3676 www.compbenefits.com<br />

http://www.sunshinecenterfriends.org<br />

<strong>St</strong>. <strong>Petersburg</strong> Parks & Recreation Sunshine Center<br />

A Community Center for Active Adults<br />

Subscribe to the monthly newsletter<br />

http://www.stpete.org/mailing.asp<br />

ST. PETERSBURG E-NEWS<br />

SUBSCRIPTIONS<br />

Get Informed about the Who, What,<br />

When, Where and Why <strong>of</strong> <strong>St</strong>. <strong>Petersburg</strong><br />

Page 8 <strong>of</strong> 8