An introduction to the European Post-Trade Market - Clearstream

An introduction to the European Post-Trade Market - Clearstream

An introduction to the European Post-Trade Market - Clearstream

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.3 Providers of post-trade services<br />

THE EUROPEAN POST-TRADE MARKET<br />

Overview of <strong>the</strong> <strong>Post</strong>-<strong>Trade</strong> <strong>Market</strong><br />

The previous section explained <strong>the</strong> five post-trade functions. This section takes an institutional view<br />

and describes <strong>the</strong> providers of post-trade services.<br />

The main types of institutions active in <strong>the</strong> post-trade market are: agent banks/cus<strong>to</strong>dians (such as<br />

Citibank, Bank of New York, JP Morgan Chase, BNP Paribas, Dexia, etc.), <strong>the</strong> international central<br />

securities deposi<strong>to</strong>ries (“ICSDs”, such as <strong>Clearstream</strong> Banking Luxembourg and Euroclear Bank),<br />

central securities deposi<strong>to</strong>ries (“CSDs”, such as Euroclear France, Monte Ti<strong>to</strong>li, <strong>Clearstream</strong> Banking<br />

Frankfurt, etc.), common deposi<strong>to</strong>ries (such as Deutsche Bank, HSBC, etc.) and registrars (such as<br />

Capita Registrars, Lloyds TSB, etc.).<br />

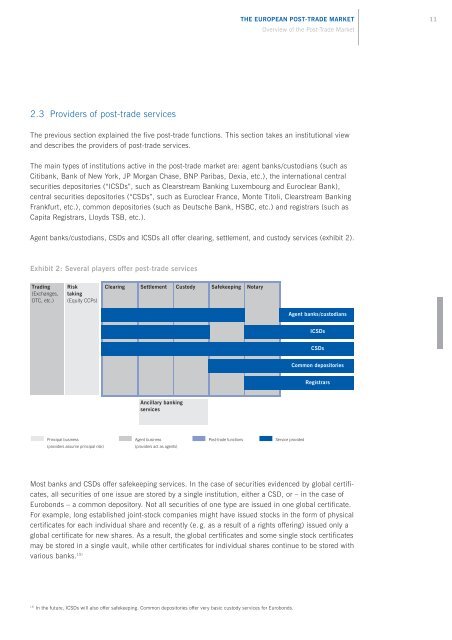

Agent banks/cus<strong>to</strong>dians, CSDs and ICSDs all offer clearing, settlement, and cus<strong>to</strong>dy services (exhibit 2).<br />

Exhibit 2: Several players offer post-trade services<br />

Trading<br />

(Exchanges,<br />

OTC, etc.)<br />

Risk<br />

taking<br />

(Equity CCPs)<br />

Clearing Settlement Cus<strong>to</strong>dy Safekeeping Notary<br />

<strong>An</strong>cillary banking<br />

services<br />

Principal business Agent business <strong>Post</strong>-trade functions Service provided<br />

(providers assume principal risk) (providers act as agents)<br />

Most banks and CSDs offer safekeeping services. In <strong>the</strong> case of securities evidenced by global certificates,<br />

all securities of one issue are s<strong>to</strong>red by a single institution, ei<strong>the</strong>r a CSD, or – in <strong>the</strong> case of<br />

Eurobonds – a common deposi<strong>to</strong>ry. Not all securities of one type are issued in one global certificate.<br />

For example, long established joint-s<strong>to</strong>ck companies might have issued s<strong>to</strong>cks in <strong>the</strong> form of physical<br />

certificates for each individual share and recently (e. g. as a result of a rights offering) issued only a<br />

global certificate for new shares. As a result, <strong>the</strong> global certificates and some single s<strong>to</strong>ck certificates<br />

may be s<strong>to</strong>red in a single vault, while o<strong>the</strong>r certificates for individual shares continue <strong>to</strong> be s<strong>to</strong>red with<br />

various banks. 15)<br />

15) In <strong>the</strong> future, ICSDs will also offer safekeeping. Common deposi<strong>to</strong>ries offer very basic cus<strong>to</strong>dy services for Eurobonds.<br />

Agent banks/cus<strong>to</strong>dians<br />

ICSDs<br />

CSDs<br />

Common deposi<strong>to</strong>ries<br />

Registrars<br />

11