Q&A - Alfi

Q&A - Alfi

Q&A - Alfi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

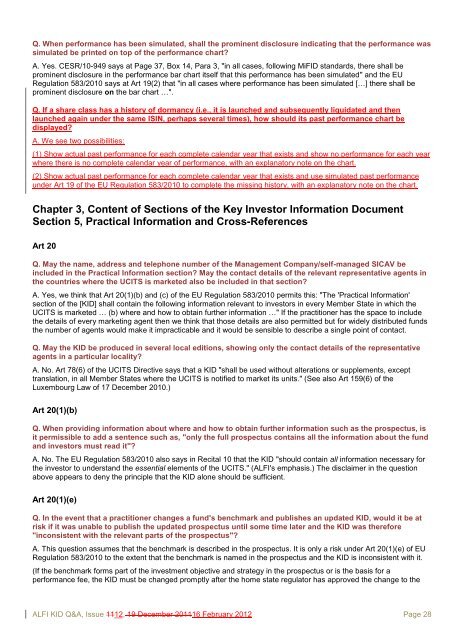

Q. When performance has been simulated, shall the prominent disclosure indicating that the performance was<br />

simulated be printed on top of the performance chart?<br />

A. Yes. CESR/10-949 says at Page 37, Box 14, Para 3, "in all cases, following MiFID standards, there shall be<br />

prominent disclosure in the performance bar chart itself that this performance has been simulated" and the EU<br />

Regulation 583/2010 says at Art 19(2) that "in all cases where performance has been simulated […] there shall be<br />

prominent disclosure on the bar chart …".<br />

Q. If a share class has a history of dormancy (i.e., it is launched and subsequently liquidated and then<br />

launched again under the same ISIN, perhaps several times), how should its past performance chart be<br />

displayed?<br />

A. We see two possibilities:<br />

(1) Show actual past performance for each complete calendar year that exists and show no performance for each year<br />

where there is no complete calendar year of performance, with an explanatory note on the chart.<br />

(2) Show actual past performance for each complete calendar year that exists and use simulated past performance<br />

under Art 19 of the EU Regulation 583/2010 to complete the missing history, with an explanatory note on the chart.<br />

Chapter 3, Content of Sections of the Key Investor Information Document<br />

Section 5, Practical Information and Cross-References<br />

Art 20<br />

Q. May the name, address and telephone number of the Management Company/self-managed SICAV be<br />

included in the Practical Information section? May the contact details of the relevant representative agents in<br />

the countries where the UCITS is marketed also be included in that section?<br />

A. Yes, we think that Art 20(1)(b) and (c) of the EU Regulation 583/2010 permits this: "The 'Practical Information'<br />

section of the [KID] shall contain the following information relevant to investors in every Member State in which the<br />

UCITS is marketed … (b) where and how to obtain further information …" If the practitioner has the space to include<br />

the details of every marketing agent then we think that those details are also permitted but for widely distributed funds<br />

the number of agents would make it impracticable and it would be sensible to describe a single point of contact.<br />

Q. May the KID be produced in several local editions, showing only the contact details of the representative<br />

agents in a particular locality?<br />

A. No. Art 78(6) of the UCITS Directive says that a KID "shall be used without alterations or supplements, except<br />

translation, in all Member States where the UCITS is notified to market its units." (See also Art 159(6) of the<br />

Luxembourg Law of 17 December 2010.)<br />

Art 20(1)(b)<br />

Q. When providing information about where and how to obtain further information such as the prospectus, is<br />

it permissible to add a sentence such as, "only the full prospectus contains all the information about the fund<br />

and investors must read it"?<br />

A. No. The EU Regulation 583/2010 also says in Recital 10 that the KID "should contain all information necessary for<br />

the investor to understand the essential elements of the UCITS." (ALFI's emphasis.) The disclaimer in the question<br />

above appears to deny the principle that the KID alone should be sufficient.<br />

Art 20(1)(e)<br />

Q. In the event that a practitioner changes a fund's benchmark and publishes an updated KID, would it be at<br />

risk if it was unable to publish the updated prospectus until some time later and the KID was therefore<br />

"inconsistent with the relevant parts of the prospectus"?<br />

A. This question assumes that the benchmark is described in the prospectus. It is only a risk under Art 20(1)(e) of EU<br />

Regulation 583/2010 to the extent that the benchmark is named in the prospectus and the KID is inconsistent with it.<br />

(If the benchmark forms part of the investment objective and strategy in the prospectus or is the basis for a<br />

performance fee, the KID must be changed promptly after the home state regulator has approved the change to the<br />

ALFI KID Q&A, Issue 1112, 19 December 201116 February 2012 Page 28