Q&A - Alfi

Q&A - Alfi

Q&A - Alfi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

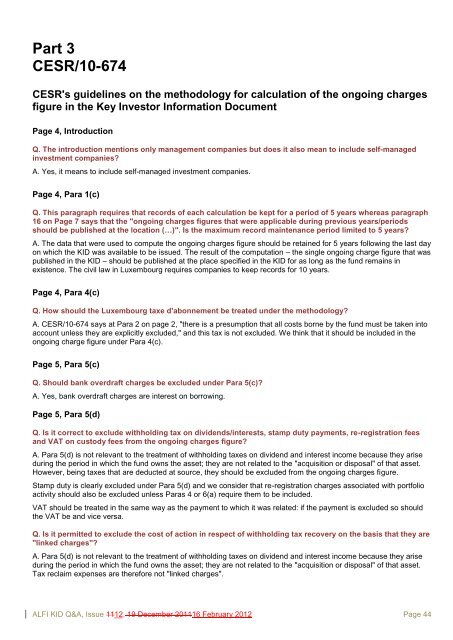

Part 3<br />

CESR/10-674<br />

CESR's guidelines on the methodology for calculation of the ongoing charges<br />

figure in the Key Investor Information Document<br />

Page 4, Introduction<br />

Q. The introduction mentions only management companies but does it also mean to include self-managed<br />

investment companies?<br />

A. Yes, it means to include self-managed investment companies.<br />

Page 4, Para 1(c)<br />

Q. This paragraph requires that records of each calculation be kept for a period of 5 years whereas paragraph<br />

16 on Page 7 says that the "ongoing charges figures that were applicable during previous years/periods<br />

should be published at the location (…)". Is the maximum record maintenance period limited to 5 years?<br />

A. The data that were used to compute the ongoing charges figure should be retained for 5 years following the last day<br />

on which the KID was available to be issued. The result of the computation – the single ongoing charge figure that was<br />

published in the KID – should be published at the place specified in the KID for as long as the fund remains in<br />

existence. The civil law in Luxembourg requires companies to keep records for 10 years.<br />

Page 4, Para 4(c)<br />

Q. How should the Luxembourg taxe d'abonnement be treated under the methodology?<br />

A. CESR/10-674 says at Para 2 on page 2, "there is a presumption that all costs borne by the fund must be taken into<br />

account unless they are explicitly excluded," and this tax is not excluded. We think that it should be included in the<br />

ongoing charge figure under Para 4(c).<br />

Page 5, Para 5(c)<br />

Q. Should bank overdraft charges be excluded under Para 5(c)?<br />

A. Yes, bank overdraft charges are interest on borrowing.<br />

Page 5, Para 5(d)<br />

Q. Is it correct to exclude withholding tax on dividends/interests, stamp duty payments, re-registration fees<br />

and VAT on custody fees from the ongoing charges figure?<br />

A. Para 5(d) is not relevant to the treatment of withholding taxes on dividend and interest income because they arise<br />

during the period in which the fund owns the asset; they are not related to the "acquisition or disposal" of that asset.<br />

However, being taxes that are deducted at source, they should be excluded from the ongoing charges figure.<br />

Stamp duty is clearly excluded under Para 5(d) and we consider that re-registration charges associated with portfolio<br />

activity should also be excluded unless Paras 4 or 6(a) require them to be included.<br />

VAT should be treated in the same way as the payment to which it was related: if the payment is excluded so should<br />

the VAT be and vice versa.<br />

Q. Is it permitted to exclude the cost of action in respect of withholding tax recovery on the basis that they are<br />

"linked charges"?<br />

A. Para 5(d) is not relevant to the treatment of withholding taxes on dividend and interest income because they arise<br />

during the period in which the fund owns the asset; they are not related to the "acquisition or disposal" of that asset.<br />

Tax reclaim expenses are therefore not "linked charges".<br />

ALFI KID Q&A, Issue 1112, 19 December 201116 February 2012 Page 44