Q&A - Alfi

Q&A - Alfi

Q&A - Alfi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

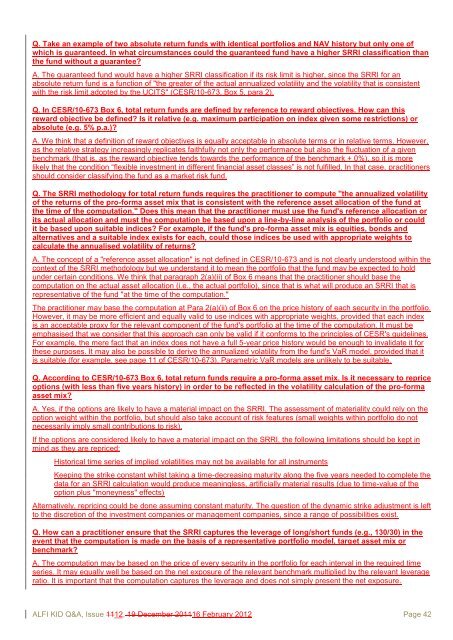

Q. Take an example of two absolute return funds with identical portfolios and NAV history but only one of<br />

which is guaranteed. In what circumstances could the guaranteed fund have a higher SRRI classification than<br />

the fund without a guarantee?<br />

A. The guaranteed fund would have a higher SRRI classification if its risk limit is higher, since the SRRI for an<br />

absolute return fund is a function of "the greater of the actual annualized volatility and the volatility that is consistent<br />

with the risk limit adopted by the UCITS" (CESR/10-673, Box 5, para 2).<br />

Q. In CESR/10-673 Box 6, total return funds are defined by reference to reward objectives. How can this<br />

reward objective be defined? Is it relative (e.g. maximum participation on index given some restrictions) or<br />

absolute (e.g. 5% p.a.)?<br />

A. We think that a definition of reward objectives is equally acceptable in absolute terms or in relative terms. However,<br />

as the relative strategy increasingly replicates faithfully not only the performance but also the fluctuation of a given<br />

benchmark (that is, as the reward objective tends towards the performance of the benchmark + 0%), so it is more<br />

likely that the condition “flexible investment in different financial asset classes” is not fulfilled. In that case, practitioners<br />

should consider classifying the fund as a market risk fund.<br />

Q. The SRRI methodology for total return funds requires the practitioner to compute "the annualized volatility<br />

of the returns of the pro-forma asset mix that is consistent with the reference asset allocation of the fund at<br />

the time of the computation." Does this mean that the practitioner must use the fund's reference allocation or<br />

its actual allocation and must the computation be based upon a line-by-line analysis of the portfolio or could<br />

it be based upon suitable indices? For example, if the fund's pro-forma asset mix is equities, bonds and<br />

alternatives and a suitable index exists for each, could those indices be used with appropriate weights to<br />

calculate the annualised volatility of returns?<br />

A. The concept of a "reference asset allocation" is not defined in CESR/10-673 and is not clearly understood within the<br />

context of the SRRI methodology but we understand it to mean the portfolio that the fund may be expected to hold<br />

under certain conditions. We think that paragraph 2(a)(ii) of Box 6 means that the practitioner should base the<br />

computation on the actual asset allocation (i.e., the actual portfolio), since that is what will produce an SRRI that is<br />

representative of the fund "at the time of the computation."<br />

The practitioner may base the computation at Para 2(a)(ii) of Box 6 on the price history of each security in the portfolio.<br />

However, it may be more efficient and equally valid to use indices with appropriate weights, provided that each index<br />

is an acceptable proxy for the relevant component of the fund's portfolio at the time of the computation. It must be<br />

emphasised that we consider that this approach can only be valid if it conforms to the principles of CESR's guidelines.<br />

For example, the mere fact that an index does not have a full 5-year price history would be enough to invalidate it for<br />

these purposes. It may also be possible to derive the annualized volatility from the fund's VaR model, provided that it<br />

is suitable (for example, see page 11 of CESR/10-673). Parametric VaR models are unlikely to be suitable.<br />

Q. According to CESR/10-673 Box 6, total return funds require a pro-forma asset mix. Is it necessary to reprice<br />

options (with less than five years history) in order to be reflected in the volatility calculation of the pro-forma<br />

asset mix?<br />

A. Yes, if the options are likely to have a material impact on the SRRI. The assessment of materiality could rely on the<br />

option weight within the portfolio, but should also take account of risk features (small weights within portfolio do not<br />

necessarily imply small contributions to risk).<br />

If the options are considered likely to have a material impact on the SRRI, the following limitations should be kept in<br />

mind as they are repriced:<br />

Historical time series of implied volatilities may not be available for all instruments<br />

Keeping the strike constant whilst taking a time-decreasing maturity along the five years needed to complete the<br />

data for an SRRI calculation would produce meaningless, artificially material results (due to time-value of the<br />

option plus "moneyness" effects)<br />

Alternatively, repricing could be done assuming constant maturity. The question of the dynamic strike adjustment is left<br />

to the discretion of the investment companies or management companies, since a range of possibilities exist.<br />

Q. How can a practitioner ensure that the SRRI captures the leverage of long/short funds (e.g., 130/30) in the<br />

event that the computation is made on the basis of a representative portfolio model, target asset mix or<br />

benchmark?<br />

A. The computation may be based on the price of every security in the portfolio for each interval in the required time<br />

series. It may equally well be based on the net exposure of the relevant benchmark multiplied by the relevant leverage<br />

ratio. It is important that the computation captures the leverage and does not simply present the net exposure.<br />

ALFI KID Q&A, Issue 1112, 19 December 201116 February 2012 Page 42