GST: A Guide on Exports (Eleventh Edition) - IRAS

GST: A Guide on Exports (Eleventh Edition) - IRAS

GST: A Guide on Exports (Eleventh Edition) - IRAS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A GUIDE ON EXPORT – INDIRECT EXPORT<br />

6.2 Local buyer instructs local supplier to deliver goods out of Singapore. Local<br />

buyer invoices its overseas customers.<br />

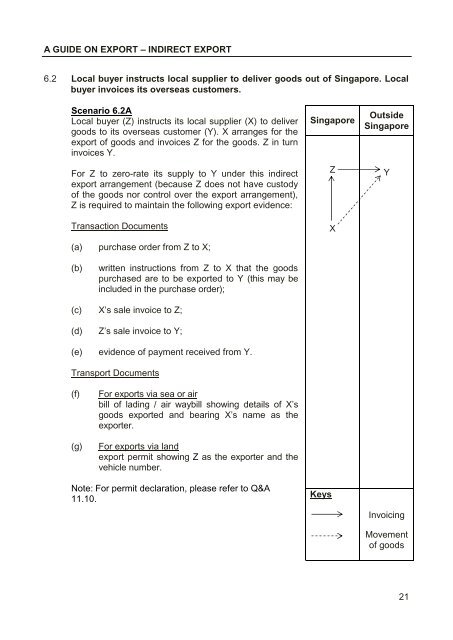

Scenario 6.2A<br />

Local buyer (Z) instructs its local supplier (X) to deliver<br />

goods to its overseas customer (Y). X arranges for the<br />

export of goods and invoices Z for the goods. Z in turn<br />

invoices Y.<br />

For Z to zero-rate its supply to Y under this indirect<br />

export arrangement (because Z does not have custody<br />

of the goods nor c<strong>on</strong>trol over the export arrangement),<br />

Z is required to maintain the following export evidence:<br />

Transacti<strong>on</strong> Documents<br />

(a) purchase order from Z to X;<br />

Singapore<br />

Z<br />

X<br />

Outside<br />

Singapore<br />

Y<br />

(b)<br />

written instructi<strong>on</strong>s from Z to X that the goods<br />

purchased are to be exported to Y (this may be<br />

included in the purchase order);<br />

(c) X’s sale invoice to Z;<br />

(d) Z’s sale invoice to Y;<br />

(e) evidence of payment received from Y.<br />

Transport Documents<br />

(f)<br />

(g)<br />

For exports via sea or air<br />

bill of lading / air waybill showing details of X’s<br />

goods exported and bearing X’s name as the<br />

exporter.<br />

For exports via land<br />

export permit showing Z as the exporter and the<br />

vehicle number.<br />

Note: For permit declarati<strong>on</strong>, please refer to Q&A<br />

11.10.<br />

Keys<br />

Invoicing<br />

Movement<br />

of goods<br />

21